Overview In the second quarter of 2016, the current account surplus amounted to CHF 17 billion. This was CHF 3 billion less than in the year-back quarter, mainly due to a decline in the receipts surplus in primary income (labour and investment income). The receipts surplus in primary income was CHF 1 billion, compared to CHF 7 billion in the year-back quarter. By contrast, the second-quarter surplus of receipts from...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM initially benefitted from the FOMC decision, but softened into the weekend. One culprit was lower oil prices, as reports suggest an output deal is unlikely at the OPEC meeting this week in Algeria. But it wasn’t just EM, as the greenback closed firmer against the majors as well. We still believe that risk and EM should do fine over the next few weeks, as the Fed basically set a two-month window of...

Read More »Great Causes, a Sea of Debt and the 2017 Recession

Great Cause NORMANDY, FRANCE – We continue our work with the bomb squad. Myth disposal is dangerous work: People love their myths more than they love life itself. They may kill for money. But they die for their religions, their governments, their clans… and their ideas. Some people think that even an idea as abstract as “freedom of speech” is worth dying for. It was Voltaire who said: “I disapprove of what you say,...

Read More »Juncker eyes Swiss-specific EU immigration deal despite Brexit

European Commission President Jean-Claude Juncker said he was aiming to solve a two-year-old dispute with Switzerland over immigration in a country-specific manner even in the wake of Brexit. © Mykhaylo Palinchak | Dreamstime.com The Swiss government has been at pains to implement restrictions on European Union newcomers decided upon in a 2014 referendum without annulling an economically important set of treaties with...

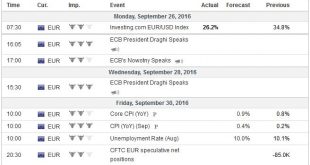

Read More »FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s...

Read More »European mobile roaming charges to be axed. Pity the Swiss (who just have a Swiss phone)

Yesterday the European Commission announced that EU residents should soon be able to make calls and use data without any additional charges while travelling in another EU country. Countries outside the EU, but within the European Economic Area (EEA), including Norway, Iceland, and Switzerland’s neighbour Liechtenstein, will be included in the deal. © Quintanilla | Dreamstime.com Günther H. Oettinger, EU Commissioner...

Read More »Don’t Bet on Deflation Lasting Forever

More Mumbo-Jumbo OUZILLY, France – Imagine the poor economist without a sense of humor. How he must suffer! This week was to be dominated by central banks. Two big ones – the Bank of Japan (BoJ) and the Fed – were to make important policy announcements. The BoJ’s chief lunatic Haruhiko Kuroda with one of his famous diagrams. How can this not work? It looks so neat! Photo credit: Yuya Shino / Reuters The speculators...

Read More »U.S. Imports Record Amount Of Gold From Switzerland In July

U.S. Gold Imports from Switzerland Monthly It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3...

Read More »Emerging Markets: What has Changed

Summary The Hungarian central bank capped the amount commercial banks can keep at its 3-month deposit facility. S&P upgraded Hungary from BB+ to BBB- with stable outlook. Bank of Israel will move to 8 meetings per year starting in 2017, down from 12 currently. S&P raise the outlook on Russia’s BB+ rating from negative to stable. The South African Reserve Bank signaled a potential end of the tightening...

Read More »Un-Becoming American – One Man’s Painful Journey To Renouncing Citizenship

Submitted by ‘Kevnice’ via ForeignByNature.com, In April 2012, I returned to Switzerland – my country of birth – to commence a new phase of my adult life. Naturally, one of the first steps to undertake when establishing oneself in a new country is to open a bank account. I went down to the local Raiffeisen bank branch in the village of Aesch, Luzern, where my relatives and ancestors had lived and worked as farmers for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org