The nation is failing as a direct consequence of these four catastrophic policies. It’s admittedly a tough task to select the four most disastrous presidential policies of the past 60 years, given the great multitude to choose from. Here are my top choices and the reasons why I selected these from a wealth of policy disasters. 1. President Johnson’s expansion of the Vietnam War, which set the stage for President Nixon’s...

Read More »When Does This Travesty of a Mockery of a Sham Finally End?

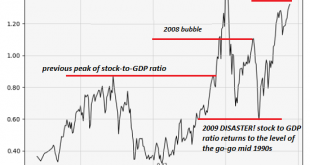

Credit bubbles are not engines of sustainable employment, they are only engines of malinvestment and wealth destruction on a grand scale. We all know the Status Quo’s response to the global financial meltdown of 2008 has been a travesty of a mockery of a sham–smoke and mirrors, flimsy facades of “recovery,” simulacrum “reforms,” serial bubble-blowing and politically expedient can-kicking, all based on borrowing and...

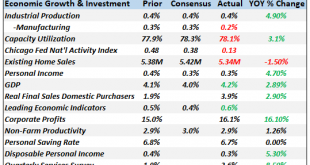

Read More »Monthly Macro Monitor – September

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about...

Read More »We’re All Speculators Now

When the herd thunders off the cliff, most participants are trapped in the stampede.. One of the most perverse consequences of the central banks “saving the world” (i.e. saving banks and the super-wealthy) is the destruction of low-risk investments: we’re all speculators now, whether we know it or acknowledge it. The problem is very few of us have the expertise and experience to be successful speculators, i.e....

Read More »Massive Deficit Spending Greenlights Waste, Fraud, Profiteering and Dysfunction

America’s problem isn’t a lack of deficit spending/consumption. America’s problems are profoundly structural. The nice thing about free to me money from any source is the recipients don’t have to change anything. Free money is the ultimate free-pass from consequence and adaptation: instead of having to make difficult trade-offs or suffer the consequences of profligacy, the recipients of free money are saved: they can...

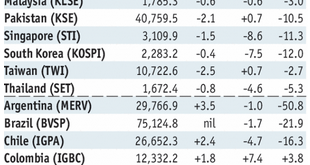

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

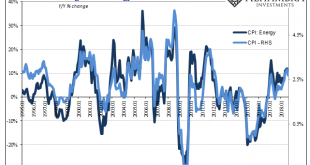

Read More »Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains. Yet, the CPI headline retreated a little further than expected. After reaching the highest since December 2011 the month before,...

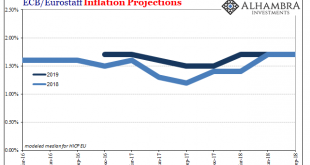

Read More »ECB (Data) Independence

Mario Draghi doesn’t have a whole lot going for him, but he is at least consistent – at times (yes, inconsistent consistency). Bloomberg helpfully reported yesterday how the ECB’s staff committee that produces the econometric projections has recommended the central bank’s Governing Council change the official outlook. Since last year, risks have been “balanced” in their collective opinion. Given what’s happened this...

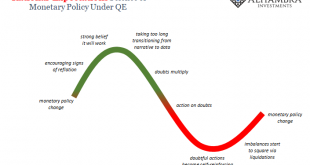

Read More »Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy. The problem has been that officials mistake reflation for what it is. Each time they believe it...

Read More »The Next Financial Crisis Is Right on Schedule (2019)

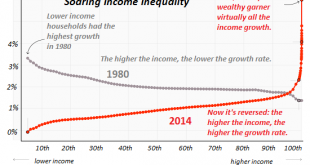

Neither small business nor the bottom 90% of households can afford this “best economy ever.” After 10 years of unprecedented goosing, some of the real economy is finally overheating: costs are heating up, unemployment is at historic lows, small business optimism is high, and so on–all classic indicators that the top of this cycle is in. Financial assets have been goosed to record highs in the everything bubble.Buy the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org