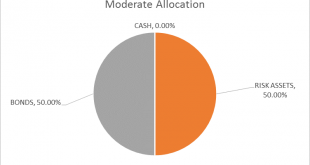

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50. Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world. I am painfully aware of the...

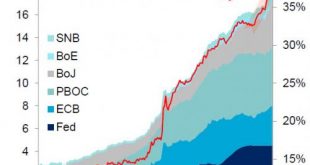

Read More »After 10 Years of “Recovery,” What Are Central Banks So Afraid Of?

If the world’s economies still need central bank life support to survive, they aren’t healthy–they’re barely clinging to life. The “recovery”/Bull Market is in its 10th year, and yet central banks are still tiptoeing around as if the tiniest misstep will cause the whole shebang to shatter: what are they so afraid of? The cognitive dissonance / crazy-making is off the charts: On the one hand, central banks are still...

Read More »The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

Currencies don’t melt down randomly. This is only the first stage of a complete re-ordering of the global financial system. Take a look at the Shanghai Stock Market (China) and tell me what you see: Shanghai Stock Exchange Composite Index - Click to enlarge A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once...

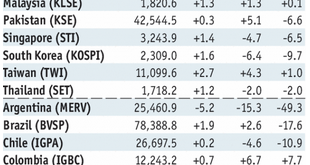

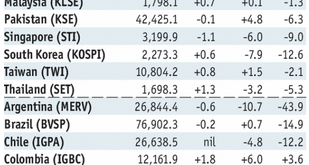

Read More »Emerging Market Week Ahead Preview

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Emerging Markets: What Changed

Summary China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned. Moody’s moved the outlook on Egypt’s B3 rating from stable to...

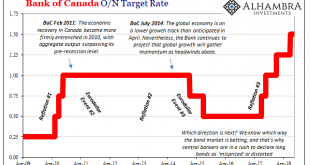

Read More »‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are. Look to our...

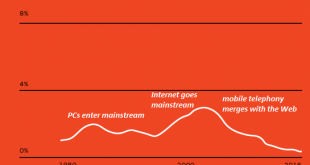

Read More »Why Is Productivity Dead in the Water?

The only possible output of this system is extortion as a way of life. As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value. One...

Read More »Here’s How We Ended Up with Predatory, Parasitic Elites

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites. How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.Following in Ancient Rome’s...

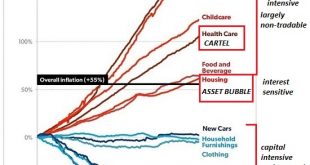

Read More »To Understand America’s Neofeudal Economy, Start with Extortion

Here is the result of America’s neofeudalism: soaring wealth and income inequality. Let’s spin the time machine back to the late Middle Ages, at the height of feudalism, and imagine we’re trying to get a boatload of goods to the nearest city to sell. As we drift down the river, we’re constantly being stopped and charged a fee for transiting one small fiefdom after another. When we finally reach the city, there’s an...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org