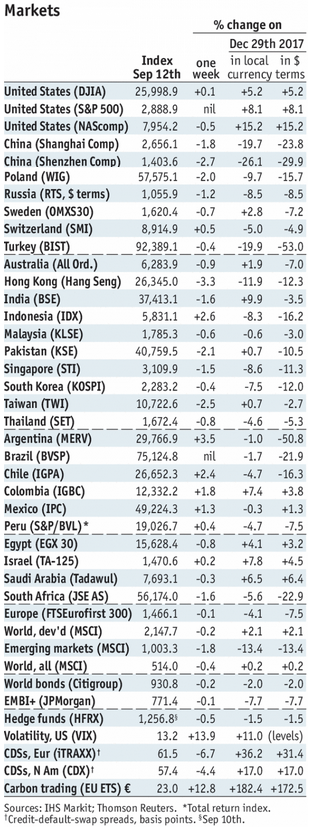

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on 0 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the backdrop for EM remains negative. Stock Markets Emerging Markets, September 12 - Click to enlarge Singapore Singapore reports August trade Monday. Non-oil Domestic Exports (NODX) are expected to rise 5.3% y/y vs. 11.8% in July. The economy remains somewhat sluggish, while CPI rose only 0.6% y/y

Topics:

Win Thin considers the following as important: 5) Global Macro, Argentina, Brazil, emerging markets, Featured, Hungary, Israel, Malaysia, newsletter, Poland, Singapore, South Africa, Taiwan, Thailand, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the backdrop for EM remains negative. |

Stock Markets Emerging Markets, September 12 |

SingaporeSingapore reports August trade Monday. Non-oil Domestic Exports (NODX) are expected to rise 5.3% y/y vs. 11.8% in July. The economy remains somewhat sluggish, while CPI rose only 0.6% y/y in July. The MAS does not have an explicit inflation target, but low price pressures should allow it to remain on hold at its semi-annual policy meeting in October. TurkeyTurkey reports July IP Monday, which is expected to rise 1.2% y/y vs. 3.2% in June. The economy slowed sharply in Q2 and data in Q3 should show an even deeper slowdown. Indeed, with rates hiked again last week and likely to head higher, we think a recession is becoming much more likely. Next policy meeting is October 25, and we suspect the bank would prefer to stand pat. Much will depend on the lira. IsraelIsrael reports August trade and Q2 current account data Monday. Early Sunday, it reported Q2 GDP growth at 1.8% SAAR vs. 2.0% in Q1. CPI rose 1.2% y/y in August, near the bottom of the 1-3% target range. With the economy still fairly robust, inflation is likely to continue moving towards the 2% target. No change is expected at the next policy meeting October 8. However, we think a hike is possible at the next meeting on November 26. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.9%. CPI rose 3.4% y/y in both July and August. While this is the highest since January 2013, inflation remains within the 2-4% target range. As long as the forint remains relatively firm, the central bank is likely to retain its ultra-dovish stance. MalaysiaMalaysia reports August CPI Wednesday, which is expected to rise 0.5% y/y vs. 0.9% in July. Bank Negara does not have an explicit inflation target, but low price pressures should allow it to remain on hold well into 2019. Next policy meeting is November 8 and rates are likely to be kept steady at 3.25%. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. However, a couple of analysts see a 25 bp hike to 1.75%. CPI rose 1.6% y/y in August. While this is the highest since September 2014, inflation remains below the 2.5% target and in the bottom half of the 1-4% target range. We do not see a tightening cycle until well into 2019. PolandPoland reports August industrial and construction output and PPI Wednesday. Data are expected to show modest slowing from July. Central bank minutes will be released Thursday and are likely to underscore its ultra-dovish stance. August real retail sales will be reported Friday, which are expected to rise 7.0% y/y vs. 7.1% in July. South AfricaSouth Africa reports August CPI Wednesday, which is expected to rise 5.2% y/y vs. 5.1% in July. If so, it would be the highest since May 2017 and moves closer to the top of the 3-6% target range. The central bank then meets Thursday and is expected to keep rates steady at 6.5%. One analyst sees a 25 bp hike to 6.75%. SARB typically does not hike rates to defend the rand, particularly since the economy remains slow sluggish. Next and last meeting of the year is November 22, and much will depend on the rand. ArgentinaArgentina reports Q2 GDP Wednesday, which is expected to contract -4.2% y/y vs. +3.6% y/y in Q1. With rates likely to stay at 60% until at least December, we expect the economy to continue contracting in both Q3 and Q4. We also cannot rule out further tightening if the peso remains under significant pressure. BrazilBrazil COPOM meets Wednesday and is expected to keep rates steady at 6.5%. The analysts are virtually unanimous in seeing no change (one sees a 25 bp hike), but the CDI market is pricing in some chance of a 25 bp hike. However, the CDI market has more conviction for a 50 bp hike on October 31. Mid-September IPCA inflation will be reported Friday, which is expected to rise 4.37% y/y vs. 4.30% in mid-August. TaiwanTaiwan reports August export orders Thursday, which are expected to rise 7.6% y/y vs. 8.0% in July. Export growth has slowed sharply in recent months, and so stronger orders would be a welcome development. CPI rose 1.5% y/y. The central bank does not have an explicit inflation target, but low price pressures should allow it to keep rates at 1.375% at its next quarterly policy meeting September 27. |

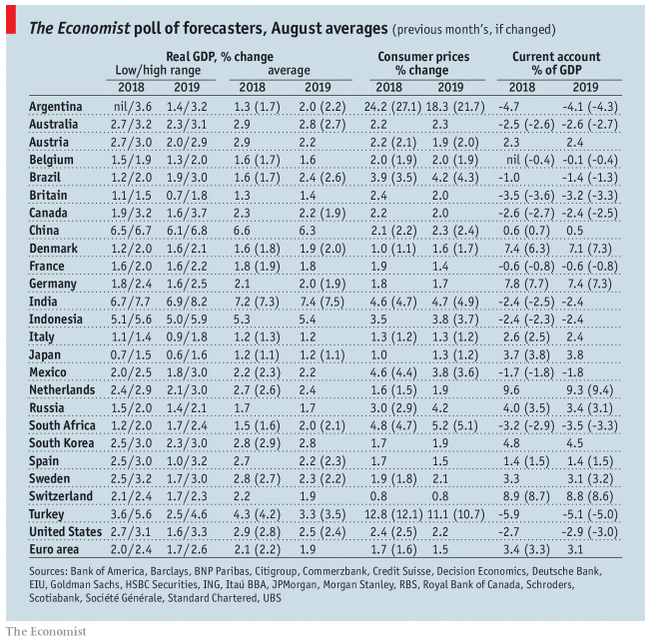

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2018 Source: economist.com - Click to enlarge |

Tags: Argentina,Brazil,Emerging Markets,Featured,Hungary,Israel,Malaysia,newsletter,Poland,Singapore,South Africa,Taiwan,Thailand,Turkey,win-thin