We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy. The problem has been that officials mistake reflation for what it is. Each time they believe it is the only requirement. If the economy reaches reflation, policymakers seem to think, then it is only a matter of time before complete recovery. It’s this false impression that leaves us with “unexpected” downturns, as well as no serious investigation into the lack of recovery. Reflation, relatively

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, currencies, curve inversion, downturn, ECB, economy, eurodollar futures, eurodollar futures curve, Europe, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

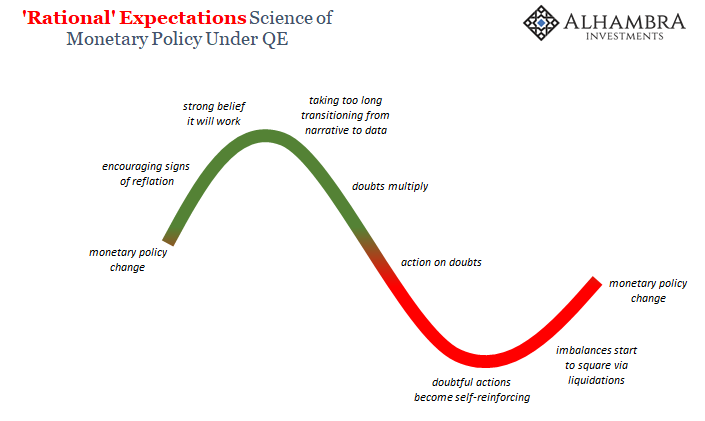

The problem has been that officials mistake reflation for what it is. Each time they believe it is the only requirement. If the economy reaches reflation, policymakers seem to think, then it is only a matter of time before complete recovery. It’s this false impression that leaves us with “unexpected” downturns, as well as no serious investigation into the lack of recovery.

| Reflation, relatively speaking, is easy. The eurodollar world at the end of its downswing cycle stops being such a negative force. For whatever reasons, liquidations, optimism, whatever, global banks cease withdrawing capacity. A few then offer a little expansion followed by others so long as no reversal (downside risk) appears imminent. The natural inclination is in the direction of reflation.

But that’s just not enough. Eventually those who take risks need them to pay off; or, more accurately, they need the plausible path for the payoff to remain, well, plausible. If instead things start to look like they’re tilting back toward the downside, dealers become nervous and then nervousness is transformed into a full-blown monetary pull-back. At some point, it can develop into self-reinforcing processes; the monetary system “tightens”, the economy slows, increasing perceptions of downside risks; leading to more tightness and economic slowing; and so on. |

Dollar Cycles General, June 2018 |

One key marker along the way in that progression is, ironically, central bankers’ projections. Not for the reasons they expect or might hope, of course. Rather, these perpetual optimists are forced time and again off their straight-line extrapolations toward nothing but full recovery. When these hardened idealists begin to waver, it confirms trouble ahead.

The ECB’s Governing Council can always choose to ignore reality, it’s almost their default position by and large. The rest of us don’t have the same luxury. |

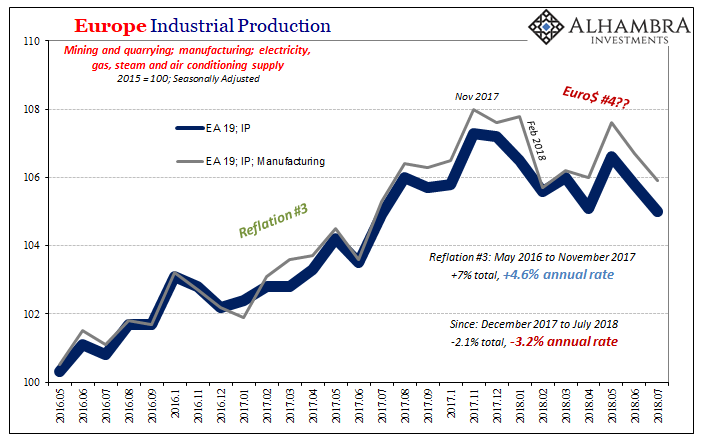

Europe Industrial Production 2016-2018 |

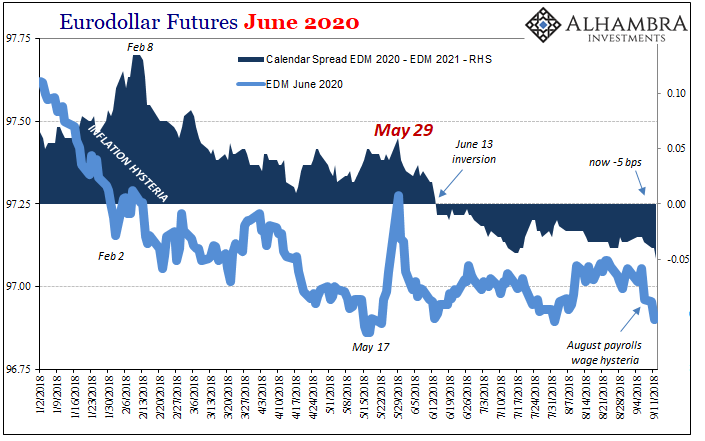

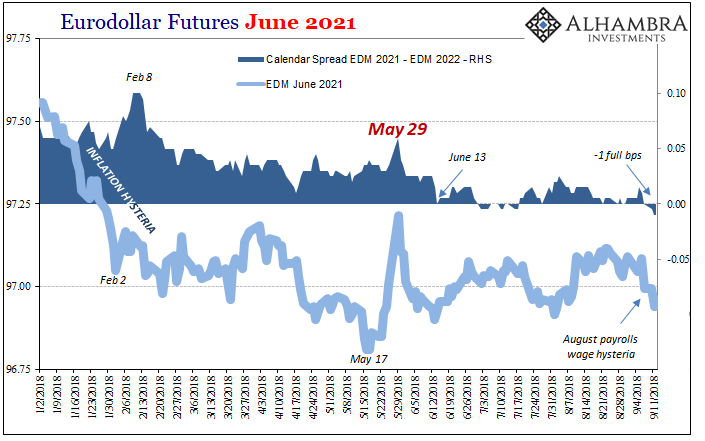

| This is why, as noted yesterday, US markets in particular may be caught up in a little wage hysteria of late but only on the surface. Eurodollar futures, in particular, continue to protest the boom despite their mild selloff. Nominally, contract prices have come down. That’s just the market figuring Jay Powell will continue on his “rate hike” course by taking wage data for what it isn’t. |

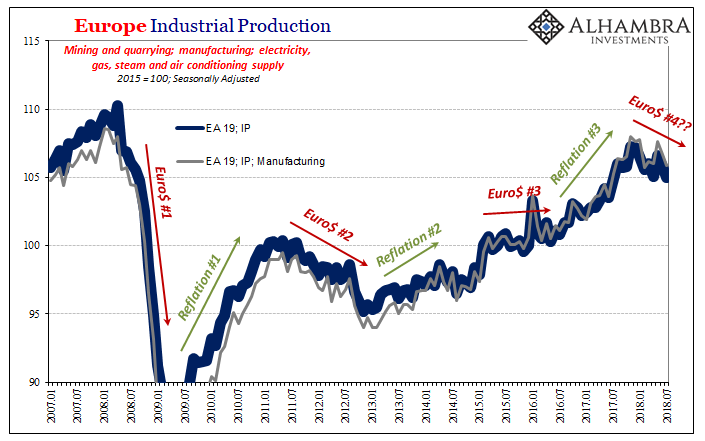

Europe Industrial Production 2007-2018 |

| At some point, the market believes, reality will rudely intrude and the Fed in the not-too-distant future will have its own ECB sort of moment (recognizing more clearly these same downside risks). The curve inversion has today deepened and been extended further on.

In the 2020-2021 contract range, the inversion hit 5 bps for the first time. In addition, the 2021-2022 inversion became unofficially official (reaching a full bps). That’s two full years inverted. This isn’t the direction for economic acceleration; quite the opposite. |

Eurodollar Futures June 2020(see more posts on EUR/USD, ) |

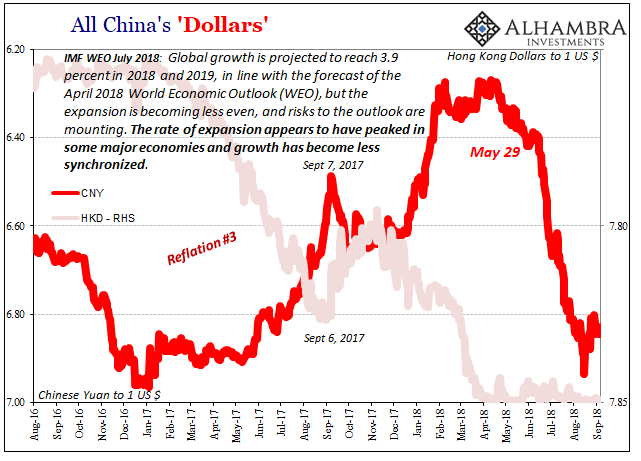

| If the US economy is booming, then the eurodollar market is betting that like with Europe it may not be for much longer. Then again, with the curve still stuck where it is nominally and has been, it really wasn’t ever a boom to begin with. It’s more and more likely Reflation #3 was at its best only ever tepid reflation and now it may be gone. This market, and this is no small niche, is increasingly projecting Eurodollar Event #4 on the horizon, very real risks the Fed is trying its best to downplay if not ignore using hollow rhetoric about wages (fastest since 2009!) to do it. |

Eurodollar Futures June 2021 |

| Though the Europe’s central bankers wouldn’t agree with the cause, they unlike their US counterparts may no longer be ruling out the possibly serious negative effects. What a difference a few months make. What a different a dollar makes. |

All China's Dollars 2016-2018 |

All China's Dollars 2016-2018 |

Tags: currencies,curve inversion,downturn,ECB,economy,eurodollar futures,eurodollar futures curve,Europe,Featured,Federal Reserve/Monetary Policy,Markets,newsletter