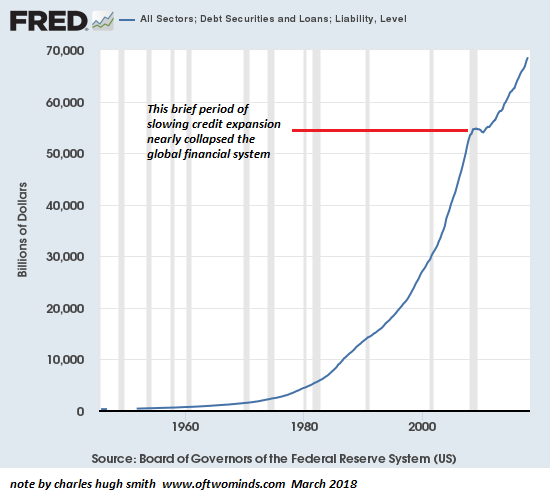

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and designed-to-implode mortgage backed securities. The central bank “solution” to institutionalized, commoditized fraud was to lower interest rates to zero and enable tens of trillions in new debt. As a result, total debt in the U.S. has soared to trillion, roughly 3.5 times GDP,

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Unfortunately, all central banks know how to do is goose liquidity to inflate asset bubbles and juice the issuance of more debt. If asset bubbles start to deflate, then central banks start buying mortgages, empty flats, stocks and bonds to prop up markets that would otherwise implode.

| Equally unfortunately, propping up asset bubbles and stimulating more debt to chase speculative gambles only increases the fragility of the asset bubbles and the economy that has come to rely on them for “growth”. A useful concept here is debt saturation: just as an absorbent material can only hold so much water, a corporation, household or economy can only support so much debt before servicing the debt reduces income and increases the risk of default.

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion: a sharp increase in defaults, a rapid decline in demand for more debt, a collapse in asset bubbles that depend on debt and a resulting drop in economic activity, a.k.a. a deep and profound recession that cannot be “fixed” by lowering interest rates or juicing the creation of more debt. |

Debt Securities and Loans 1960-2018 |

Tags: Featured,newsletter