The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker, for example, cut its estimate to 1.5% from2.7% the previous week. The NY Nowcasting estimate for Q4 18 was shaved 0.2% to 2.2%, but Q1 19 estimate was cut in half to 1.1%. Investors also learned ahead of the weekend that although the University of Michigan’s consumer sentiment rose, the long-term

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, ECB, Featured, FOMC, newsletter, trade, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive.

United StatesThe US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker, for example, cut its estimate to 1.5% from2.7% the previous week. The NY Nowcasting estimate for Q4 18 was shaved 0.2% to 2.2%, but Q1 19 estimate was cut in half to 1.1%. Investors also learned ahead of the weekend that although the University of Michigan’s consumer sentiment rose, the long-term inflation expectations slipped to a return to the cyclical low of 2.3% (from 2.6%). The Fed’s declared patience has clearly signaled no March rate increase. What the Fed decides to do around the middle of the year, when some, like ourselves, see the window for a hike opening up, will not be swayed by the data from the end of 2018 and Q1 2019. There has been much talk from the commentary about renewed deflation. Headline CPI in January eased to 1.6% from 1.9%. Yet, digging deeper the situation is not as benign as it may seem. The Fed tends to put weight on core measure because over time, the headline rate converges to the core rate, not the other way around. In turn, many economists see the core rate being driven may wage growth. Core CPI rose 0.2% for the fourth consecutive month. The year-over-year pace was unchanged at 2.2%. Real average hourly earnings have risen 1.9% year-over-year in January, up from 1.4% in December, and is the fastest pace in more than three years. The real average weekly earnings accelerated from 1.3% to 1.7%, which is also the strongest rise since July 2016. The breakeven of 10-year TIPS has risen 20 bp since January 3 to 1.86%. At his press conference at the end of last month, Fed Chair Powell singled out actual inflation (not expectations) as an important factor in determining the extent of his patience. |

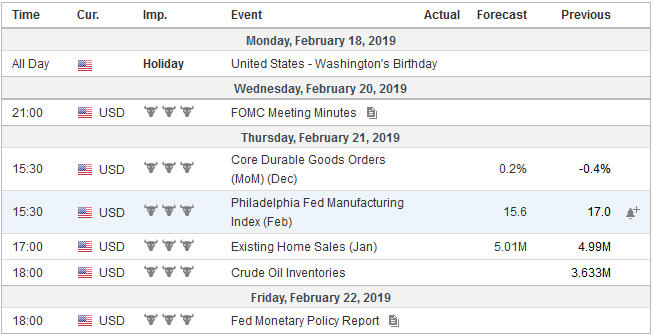

Economic Events: United States, Week February 18 |

Many observers are beginning to look for an opportunity to put on yield curve steepeners. The pessimists see the curve steepening because the two-year yield falls as the market moves to discount a Fed cut. Some optimists see the yield curve steepening as the Fed’s volte-face was premature and its patience means tolerance of the building price pressures and anticipates long-term rates increasing more than short-term rates falling. Recall that the flatness of the US curve makes hedging the dollar for international fixed income investors prohibitively expensive.

The US economic calendar is light in the week ahead, and if the unexpectedly poor retail sales and industrial output figures did not stress the dollar (though there was some profit-taking ahead of the weekend), there is little reason to expect the high-frequency economic reports until the employment report in early March to be very impactful. That said, the FOMC minutes will likely draw a great deal of attention as investors and analysts scrutinize the record with hopes of shedding light the apparent pivot and the providing more color on how it is thinking about “patience” and “flexibility,” as well as any insight into its thinking about the balance sheet.

Market participants are divided about China’s economic outlook. The pessimists think that is command system is terminal. They have exhausted their options. The situation will get increasingly worse. This assessment seems to risk under-estimating the political will of Chinese officials to avoid a hard landing.

Between tax cuts, tariff reductions, bank re-capitalization (issuance of perpetual bonds that can be swapped for PBOC bills), and the (belated) recognition of the importance of the shadow banking sector, China has had its “Draghi moment (whatever it takes). This is doubly true because of the confrontation with the US and the 70th anniversary of the 1949 Revolution.

The US-China trade talks continue in the week ahead in Washington. Reports indicate a memorandum of understanding may be struck that would signal sufficient progress is being made to extend the tariff freeze. A comparison of the statements issued by China and the US are different in tone and substance. The US statement includes Chinese commitments. China plays up the progress being made. Perhaps it hopes to deliver a fait accompli, maneuvering to make it more difficult to announce the talks have failed. If the freeze is to be extended, tactically there is no advantage to agreeing to it until the last moment to keep the pressure on negotiators. Reports suggest the Trump Administration may be receptive to a 60-day extension. There are rumors that China proposed a 90-day extension.

The rise of China was always going to be disruptive. Even as far back as Napoleon, there was some understanding of this. How China has gone about integrating into the world economy has been more disruptive than it had to be. China’s reluctance to adhere to its commitments it made when it joined the WTO in 2001 is an important source of frustration that is widely shared. Its excess capacity in numerous industries and its willingness to export its surplus makes it an economic threat to developing and developed countries.

However, many countries experience the US as another significant disruptor. We have suggested that Trump is the first post-Cold War President. He has no time for ideological conflict. He is a businessman. Economic rivalry is paramount. There are no allies. The US is demanding a greater share of the gains from globalization. Rather than retreat from the global stage as the isolationist label suggest, Trump is pressing America’s economic interests with renewed vigor.

The trade talks with China have exhausted the trade oxygen, but soon Europe and Japan will move into the cross-hairs. The US and Europe are already having disagreements about what was agreed to be negotiated. The actual document (MOU) made a reference to soybeans, not agriculture more broadly and this is what Europe is insisting. From the US side, because of EU resistance to agriculture reform (see the Common Agriculture Program or CAP), it agreed to substitute soybeans to make it more agreeable, but it was understood by EU President Juncker to represent agriculture.

The Commerce Department is expected to report on its investigation of auto imports and national security at the President’s request. Observers are treating it as a foregone conclusion that Commerce Secretary Ross will conclude that indeed reliance on foreign autos is a threat to national security and the President with a range of options, including tariffs, quotas, and/or some combination. He will have 90-days from receiving the report to make a decision. He has repeatedly threatened a 25% tariff on autos and auto part imports. China has human rights violations are abhorrent, it often acts like a bully, but there is nothing it is doing or threatening to do that is anything like this.

It would poison the well of trade talks with Japan and Europe, and retaliatory measures would ensue. Auto prices would rise, and some estimates forecast a loss of several hundred thousand jobs. The impact could very well knock the slowing economy into a recession. It is mad, as in mutually assured destruction.

There may be no surer way to secure the decline of America’s prestige and status in the world than to put a broad tariff on autos and auto imports. It would be the 21st-century version of Smoot-Hawley. It would mark the end of this attempt of globalization and American leadership. Resurgent nationalism may have also marked the end of the 19th-century globalization under the British gold standard.

Like nonconventional weapons, the power of the auto tariffs may lie in their threat rather than in their use. Of course, the threat has to be credible. The fact that the steel and aluminum tariffs on national security grounds are still in effect for Canada and Mexican imports, despite reaching a new agreement, arguably makes the threat of auto tariffs more credible.

Declaring a national emergency to take funds from military housing to build a wall on the Mexican border may be legally challenged, but the President is given a wide berth on defining national security. The courts will be reluctant to second-guess the commander-in-chief. The conflict resolution mechanism of the WTO is in disrepair because the US is blocking the appointment of judges as terms have ended so it may not be able to make a timely judgment about this little-explored defense (national security) for infringement of the best trade practices.

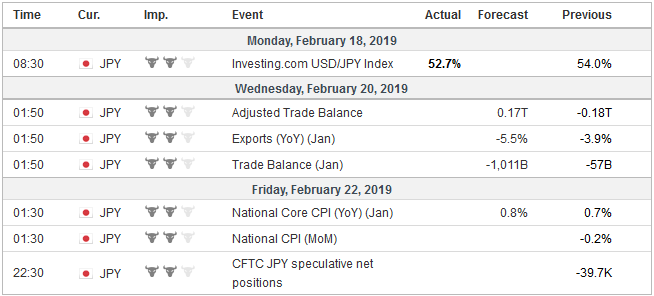

JapanJapan reports January CPI, while the UK releases the latest job figures, but the most important data point in the week ahead will be the eurozone’s flash PMI. The weakness in the eurozone has been an important part of the economic landscape for the past nine months, and the ECB has gotten increasingly concerned. The composite PMI has declined for five consecutive months to stand at 51.0 in January. |

Economic Events: Japan, Week February 18 |

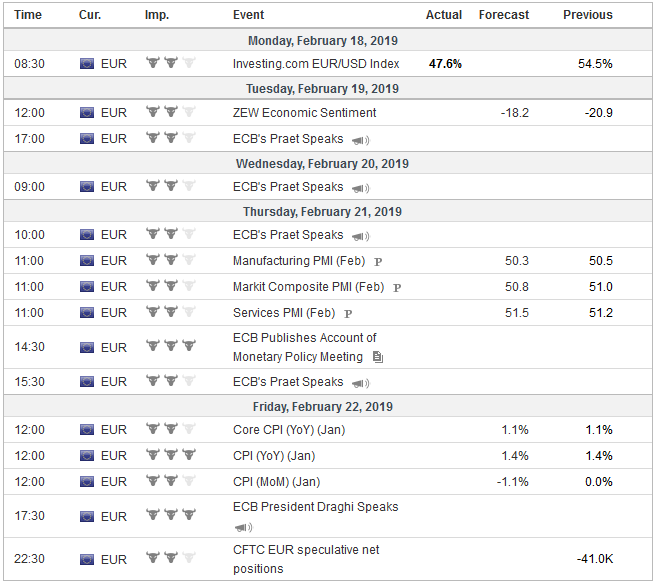

EurozoneWhile the US is enjoying what appears to record long even if unspectacular expansion, the European cycle is short. The 0.7% growth posted in each quarter of 2017 was the sprint. To Draghi’s point, there has not been the kind of structural reforms during the recovery and expansion that lifted growth potential. The combination of weak productivity growth and little workforce growth makes for poor growth impulses. Perhaps the eurozone’s flash PMI is like America’s Groundhog Day. If the PMI improves, the economic spring could be at hand. The worst may be passed. The German auto emission issue may have been worked through. The French economy is showing more resilience than expected in the face of the persistent Yellow Vest protests—some of which have turned on themselves—and Macron’s support has edged higher. Spain’s snap election announcement hardly caused a flicker in the bond market, where the benchmark 10-year yield finished half a basis point lower ahead of the weekend, the same as Italy, at 1.23% and 2.79% respectively. Although there are of course eurosceptic officials in Italy as there seems in all countries. However, League leader and Deputy Prime Minister Salvini distanced himself from his colleague’s remarks and offered as close to a full-throated endorsement of the EU (albeit in need of reforms) that can be imagined. |

Economic Events: Eurozone, Week February 18 |

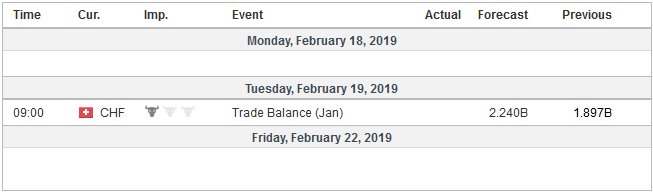

Switzerland |

Economic Events: Switzerland, Week February 18 |

Tags: China,ECB,Featured,FOMC,newsletter,Trade,US