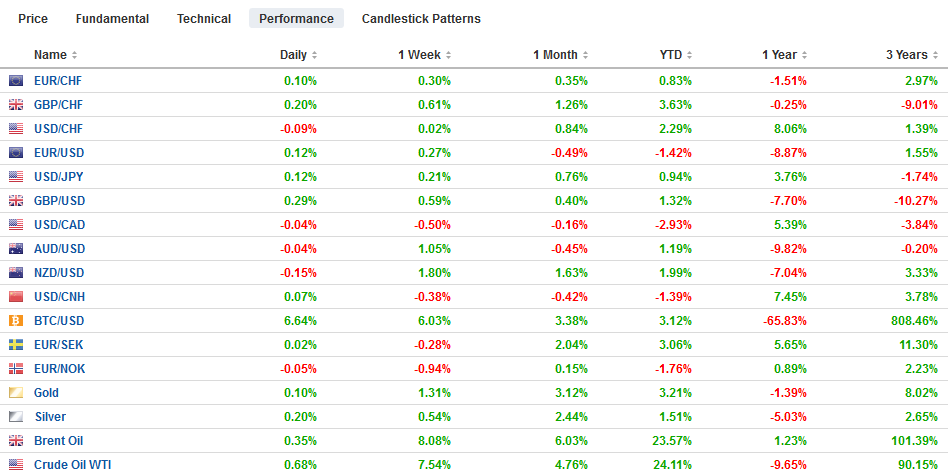

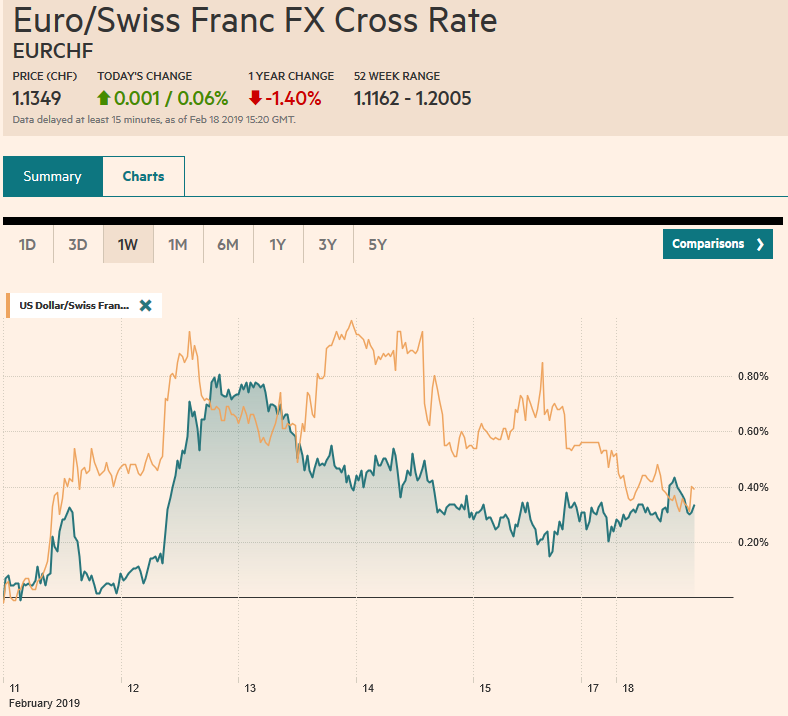

Swiss Franc The Euro has risen by 0.06% at 1.1349 EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In quiet turnover, the US dollar slipped lower against most of the major currencies to start the new week. The news stream is light and the US markets are closed today. The MSCI Asia Pacific Index was up five of the past six weeks and extended its gains today. Nearly all the equity markets in the region rose but India. European markets are narrowly mixed in the morning trade. Bond yields firmed in the Asia Pacific region, while benchmark yields in Europe were mostly softer. FX Performance, February 18 - Click to

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, SPX, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.06% at 1.1349 |

EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: In quiet turnover, the US dollar slipped lower against most of the major currencies to start the new week. The news stream is light and the US markets are closed today. The MSCI Asia Pacific Index was up five of the past six weeks and extended its gains today. Nearly all the equity markets in the region rose but India. European markets are narrowly mixed in the morning trade. Bond yields firmed in the Asia Pacific region, while benchmark yields in Europe were mostly softer. |

FX Performance, February 18 |

Asia Pacific

Shares in Shanghai rose 2.7% while the Shenzhen Composite rose 3.7% on heavy volume. Both indices are now up more than 10% for the year. Optimism on trade talk with the US and stimulative domestic measures were cited as factors behind the advance. At the same time, the wholesale auto sales slumped 17.7% in January, accelerating the losses seen since the middle of last year, while retail sales fell for the eighth consecutive month. Note that Europe reported declining auto sales for five months through January. US auto sales matched a five-month low in January.

As an entrepot, Singapore economic performance, especially trade, is seen as a reflection of regional trends. News that its non-oil exports fell 10.1% in January (year-over-year), the most in a couple of years and three times more than expected is an ominous sign. Volatility around the Lunar New Year is not unusual, but it was the third monthly decline.

The dollar has been confined to around 10 ticks on either side of JPY110.50 thus far today. Several expiring options are in play, including $465 mln at JPY110.60 and $360 mln at JPY110.25. There are $2.4 bln struck at JPY110.00 that will be cut today. The intraday technicals favor a range extension to the upside. The Australian dollar extended its gains from the end of last week and it testing the 20-day moving average (~$0.7150) for the first time in a couple of weeks. Resistance is pegged in the $0.7175-$0.7200 range. Meanwhile, the dollar is trapped in a CNY6.75-CNY6.80 trading-range.

Europe

There are two main issues demanding investors’ attention in Europe: The first is the state of the slowdown in both depth and duration, which seems to be the key to the policy response. This week’s flash PMI will offer fresh insight. The second is Brexit. Cameron’s idea that a referendum would allow the Tory Party to close ranks has proved wide of the mark. The fissures with the Tory Party are as acute as ever. Indeed, May’s strategy appears to be shaped by the desire to minimize the risk of a formal break. News today has focused on the possibility that as many as seven members of the Labour Party resign over the handling of Brexit and anti-semitism.

US and Europe are coming to loggerheads on a number of issues. There are tensions over the US unilateral withdrawal from the treaty with Iran. The US exemptions for several of Iranian’s largest oil customers is set to expire in April. Europe, including the UK, may not follow the US in banning Huawei. Reports suggest other controls may be implemented. The US Commerce Dept submitted its report into the security implications of imports. No details have been provided yet, but European brands are seen as particularly vulnerable.

Spain is headed for the polls on April 28. A minority government was headed by the Socialists. It needed Catalonia’s support for its budget, but this left it vulnerable to criticism of working with the separatists. The polls show the Socialists will likely do well, but support for its ally, Podemos, is waning, and offsetting part of ist gain. A center-right coalition (PP, Ciudadanos, and Vox) could give a center-left coalition a run for its money.

The euro has extended its recovery from last week’s low near $1.1235. It reached a three-day high in Europe of $1.1325. A gain above $1.1340 would help lift the tone. Sterling is also extending its pre-weekend recovery. Resistance is pegged by $1.2940 and then $1.30. There are GBP1.1 bln in options expiring today struck between $1.2895 and $1.2915. The intraday technical indicators are stretched, suggesting that the holiday-markets in North America may struggle to significantly extend the euro and sterling’s gains from here.

America

The economic calendar is light today, and US markets are closed for the Presidents Day holiday. The US drama is four-fold--the legal challenges to the President’s declaration of an emergency to shift some funding for the wall on the Mexican border, the Commerce Department’s report on auto imports, the ongoing investigation into Russia attempt to influence the 2016 presidential election, and trade talks with China that continue this week.

Last week, the US reported poor retail sales and industrial production figures that prompted economists to revise down Q4 growth forecasts. The Atlanta Fed’s GDPNow sees the economy having grown only 1.5% down from 2.7% previously. The NY Fed’s GDP tracker cut its Q1 19 growth estimate in half to 1.1%.

The US dollar is trading a touch heavier against the Canadian dollar. Last week’s low was a little below CAD1.3200. The two-year interest rate differential has widened in the US favor by about 10-12 bp since the start of the year but appears to be stalling in front of Q4 18 highs near 72 bp. Initial resistance is pegged around CAD1.3260. The dollar tested MXN19.50, the high for the year, in the second half of last week. Trendline support is seen by MXN19.12.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$JPY,EUR/CHF,Featured,FX Daily,MXN,newsletter,SPX,USD/CHF