The DP-3T contact tracing app has been tested initially with members of the Swiss army (Keystone / Laurent Gillieron) A Swiss smartphone app that uses Apple-Google technology to help trace coronavirus infections has widespread support among the population, a new survey shows. Around 70% of Swiss residents welcome the introduction of the decentralised contact tracing application DP-3T, according to a poll published on Monday by the research consultancy Sotomoexternal...

Read More »The Folly of “Ask What You Can Do for Your Country”

Recently, I was reminded of John F. Kennedy’s most famous line, “Ask not what your country can do for you; ask what you can do for your country,” when I heard it among several famous sound bites leading into a radio show segment. It also reminded me that we will hear it more soon, as we are approaching JFK’s May 29 birthday. However, it is worth reconsidering what it means. Of particular importance is Milton Friedman’s response that “Ask not” was “at odds with the...

Read More »When Is a Capital Gain Capital Consumption? Market Report, 25 May

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals. Gold Basis and Co-basis and the Dollar Price Here is the graph of the gold basis. The basis has come in quite a bit—but it is still 3.6% annualized. We do not believe that this as a “true” reading. It is a sign of...

Read More »Crypto Soundbites 3 – Jeff Snider, Defiance and Lyn Alden

3 clips this week, Defiance takes a big look at how you money gets diluted. Jeff Snider takes on the Fed and Nathaniel Whitmore talks to Lyn Alden about how the potential for Inflation vs Deflation. Links to the episodes below. What the Fed with Jeff Snider https://youtu.be/E2gCKaejiso Lyn Alden https://www.youtube.com/watch?v=fEhDdWJZ3HI Defiance https://www.defiance.news/podcast/the-money-game-cheaters-edition

Read More »Coronavirus: drop in revenue could leave Swiss hospitals with 3 billion loss

© Francisco Javier Zea Lara | Dreamstime.com In Switzerland, the finances of hospitals are similar to those of a business. If revenues fall, as they did during the coronavirus pandemic, profits can turn into losses. During the recent phase of the pandemic, non-urgent operations were postponed to free up hospital capacity to care for serious Covid-19 cases. Postponing these operations has left a large hole in hospital revenue. Fears of infection have kept others away...

Read More »The Federal Counterfeiter

Suppose you wanted to run an enterprise the right way (we know, we know, this is pretty far-out fiction, but bear with us). And, your enterprise has a $1 million dollar piece of equipment that wears out after 10 years. You must set aside $100,000 a year, so that you have $1 million at the end of 10 years when the equipment needs replacing. There’s a word, now archaic, to describe the account in which you set aside this money. From Wikipedia: “A sinking fund is a...

Read More »Narrative Economics: How Stories Go Viral and Drive Major Economic Events

Narrative Economics: How Stories Go Viral and Drive Major Economic EventsRobert J. Shiller Princeton: Princeton University Press, 2019xxi + 377 pp. Abstract: Much of Shiller’s new book is about how economic narratives form, spread, and fade. Drawing on medical evidence about the spread of infectious disease, Shiller argues that “economic fluctuations are substantially driven by contagion of oversimplified and easily transmitted variants of economic narratives.” But...

Read More »The Pandemic Gives Us Permission To Get What We Always Wanted

Dear Corporate America: maybe you remember the old Johnny Paycheck tune? Let me refresh your memory: take this job and shove it. Put yourself in the shoes of a single parent waiting tables in a working-class cafe with lousy tips, a worker stuck with high rent and a soul-deadening commute–one of the tens of millions of America’s working poor who have seen their wages stagnate and their income becoming increasingly precarious / uncertain while the cost of living has...

Read More »The Japanese Love of Keynesian Economics Might Finally Be Coming to an End

Even those fortunate enough to have escaped infection by the Wuhan coronavirus will by now have noticed one of the virus’ many secondary effects: the disruption of the supply chain. Sick workers at meat plants, closed restaurants, hoarding, and the sudden spike in demand for things like ventilators, masks, and comestibles with long shelf lives have thrown the global flow of goods and services into disarray. Shelves are empty, crops are rotting in the fields—supply...

Read More »Why an Economy Can’t Work without Market Prices

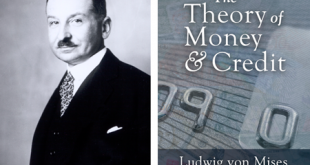

It has been a full century since Mises dropped the economic calculation bomb, but the argument apparently still haunts socialists. It should, since Mises managed to show that a socialist economy is not an economy at all but calculational chaos. Yet it is curious that it does, since most have (incorrectly) concluded that Mises’s argument, after decades of debate, was debunked. Why does a presumably debunked argument still, drive even non-Austrian critics to pen new...

Read More » SNB & CHF

SNB & CHF