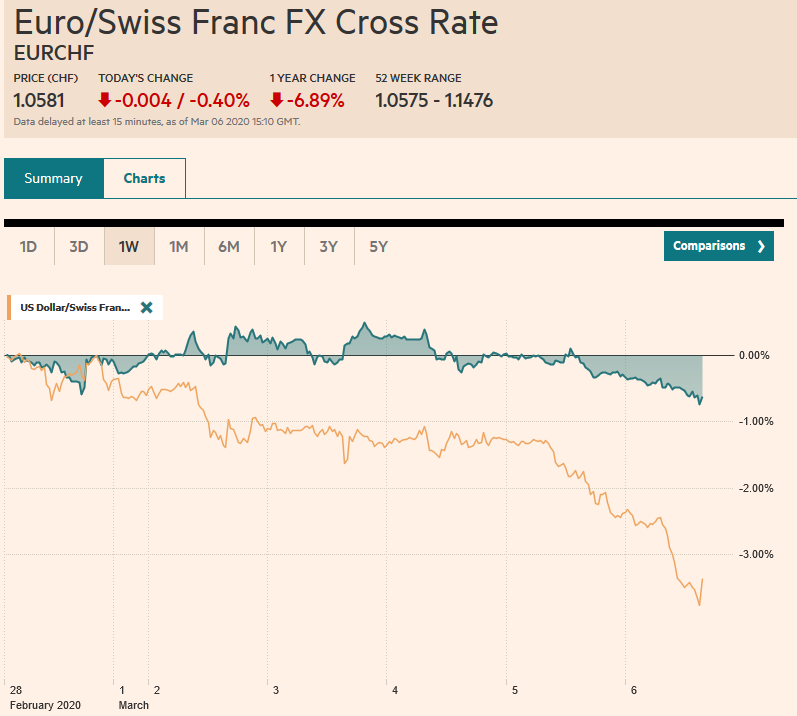

Swiss Franc The Euro has fallen by 0.40% to 1.0581 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today. The story is similar in Europe. The Dow Jones Stoxx 600 came into today’s session up about 1.3% for the week, but has given that back plus more and is now off about 1% for the week. Even after yesterday’s plunge, the S&P 500 is up nearly 2.4%

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Canada, Currency Movement, Featured, Germany, Interest rates, Japan, jobs, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.40% to 1.0581 |

EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

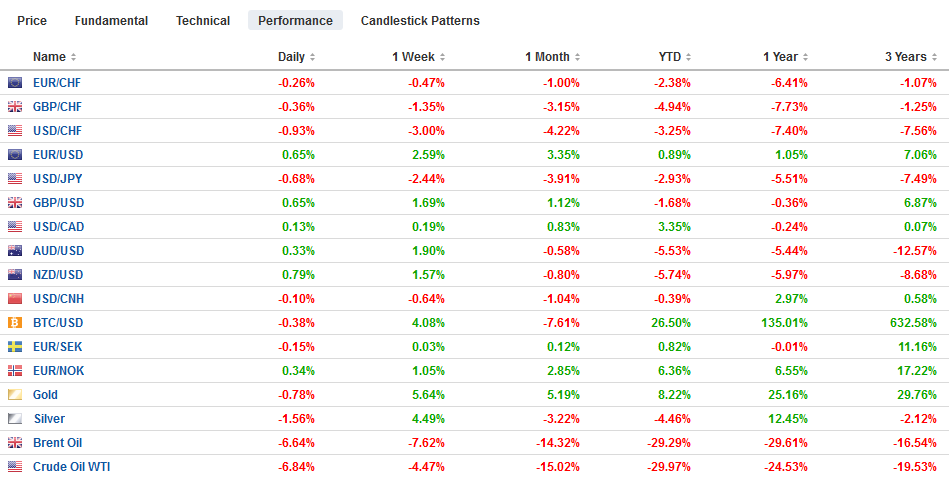

FX RatesOverview: The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today. The story is similar in Europe. The Dow Jones Stoxx 600 came into today’s session up about 1.3% for the week, but has given that back plus more and is now off about 1% for the week. Even after yesterday’s plunge, the S&P 500 is up nearly 2.4% for the week coming into today’s session. US shares are trading heavily, and the early indication is for an opening loss of more than 1%. Core bonds are on fire. The US 10-year yield is off 15 bp today to about 76 bp. It has fallen almost 40 bp this week. The 30-year yield is below 1.5%. The closest a G7 country has gotten to match such a move on the US 10-year is Canada, where its benchmark yield is off 26 bp to slip below 85 bp. The German 10-year Bund is within striking distance of its record low set last September near minus 74 bp. Peripheral European bond markets are seen as risk assets, and yields are firmer today, with Italy’s benchmark actually now a little higher on the week. The UK’s 10-year Gilt currently yields less than 25 bp. The dollar’s safe-haven status is being tarnished. It is lower against all the major currencies, and many emerging market currencies, where eastern and central European currencies lead the advancers. The JP Morgan Emerging Market Currency Index is up about 0.2% today, which pares this week’s loss to about 0.4%, its third consecutive weekly decline. After advancing 2% yesterday, gold is pushing higher still. It is approaching last week’s multiyear high, just shy of $1690. Russia appears to be spurning OPEC’s call for steep output cuts, sending oil prices reeling. April WTI is down about almost 4% today near $44 and is now off around 2% for the week after the 16% plunge last week. |

FX Performance, March 06 |

Asia Pacific

Weakness in consumption in Japan to start the year lends credence to ideas that the world’s third-largest economy is contracting for the second consecutive quarter. Household spending fell 3.9% year-over-year, nearly matching economists’ projections, after a 4.8% decline in December. It is the fourth straight decline. Durable goods have been especially hard hit, led by a 10.7% decline in January auto sales after an 11.1% decline in December. Some daily data suggest that after the school closures were announced in late February, there may have been some a surge in necessity purchases. Labor cash earnings rose 1.5% year-over-year after a 0.2% fall in December. Yet, details may not be as favorable as the optics. Base pay did accelerate, but the real juice came from the 10.2% jump in bonuses. Lastly, the January leading economic indicator fell from 91.0 to 90.3, its lowest level since 2009.

Australia’s retail sales unexpectedly fell in January by 0.3% after the 0.7% decline at the end of last year. It is the first back-to-back decline in retail sales since July-August 2017. Weak wages, the peak of the wildfires, and high household debt levels are the likely culprits. The central bank cut rates by 25 bp earlier in the week, putting the cash rate at a record-low 50 bp. Another 25 bp rate cut next month is largely discounted.

The dollar finished last week near JPY109.60 and is now threatening JPY105. Reports suggest that BOJ concerns will rise as if the dollar moves toward JPY100. It might prompt action at the March 19 policy meeting. The move is getting stretched technically, and the dollar is below the lower Bollinger Band (~JPY105.85). While there are some momentum traders jumping aboard, the key driver seems to be Japanese institutional investors who had been buying foreign bonds on an unhedged basis. The Australian dollar is firm, having built a small base near $0.6575-$0.6785 and is may close above the 200-day moving average (~$0.6635) for the first time since early January. Above there, the $0.6660 area beckons. It is the (38.2%) retracement of this year’s decline. The dollar finished the mainland session near CNY6.9330, off about 0.85% this week. It has returned to levels that prevailed before the Lunar New Year.

Europe

German factory orders jumped 5.5% in January, more than offsetting the disappointing 2.1% decline in December. The median forecast in the Bloomberg survey was for a 1.3% gain. Of note, domestic orders slipped (-1.3%) for the first time in three months. Foreign orders jumped by 10.5% (-4.9% in December) led by eurozone members (15.1% vs. -14% in December). Consistent with some survey data that suggest the world’s fourth-largest economy may have been on the mend before the virus struck.

France’s January trade figures disappointed. It reported a 5.9 bln euro trade deficit, about 20% larger than expected. Exports fell 4% on the month, while imports rose by 1.1%. Italy reported a flat retail sales report for January after a 0.5% increase in December. The 1.4% year-over-year rate is the highest since last July. The ECB meets next week, and most observers have focused on the loan facility (TLTRO) rather than a rate cut or an expansion of asset purchases.

The euro broke above $1.11 at the start of the week and is now bid above $1.13 for the first time since last July. While some momentum players pushing the move, it seems that the driver is the buying back of short hedges among corporates and asset managers. The next important chart area is near $1.1460, a retracement objective of the two-year slide. Sterling carved a shelf near $1.2725-$1.2740 ahead of the 200-day moving average (~$1.2710) earlier this week and poked above $1.30 earlier today for the first time since February 25. It is more a function of the dollar’s weakness than sterling strength. The euro is rising against sterling for the third consecutive week. The euro tested the 200-day moving average (~GBP0.8740) earlier this week before backing off. Now it seems to have a running start to try again.

America

The first Friday of the new month should be about US (and sometimes, Canada) employment data. But not today. Oh, the data will still be reported, but it is not the focus and is unlikely to have much impact on the capital markets or policy expectations. Between the census and election workers, the government’s payrolls are increasing, but are not the result of economic forces. The median forecast for private-sector hiring is for around a 160k after 206k in January. The 12-month average is near 156k, though more recently, it has averaged a little below 200k in the three months through January. The details may not be particularly interesting, though the unemployment rate could slip back to 3.5% from 3.6%. Due to the base effect, a 0.3% rise in average hourly earnings could see the year-over-year rate move to 3.0%. If all one knew was the stat of the US labor market, this week’s emergency rate cut and expectations that the Fed will return to the zero-bound would be inexplicable. Separately, the US reports the January trade balance (deficit looks about 5% smaller) and the consumer credit figures. Four Fed officials speak today at the Shadow FOMC in NY (Bullard, Williams, Evans, and George) ahead of next week’s blackout period.

Canada reports January trade figures and February employment data today. Job growth is expected to moderate after a 34.5k jump in January (full-time positions surged by 35.7k), and the unemployment rate could tick up to 5.6% from 5.5%. Wage growth may slow. The Bank of Canada delivered its first rate cut in four years earlier this week and made a decisive 50 bp move. It meets again in the middle of April, and a 25 bp cut is mostly discounted.

The US dollar continues to chop within Monday’s range against the Canadian dollar (~CAD1.3315-CAD1.3440). It finished last week a little above CAD1.34. The risk-off, weakness in commodity prices, especially oil, has been blunted by the greenback’s broad weakness and Canada’s nearly 30 bp premium over the US on two-year borrowings, the most in five years. It is the weakest of the major currencies, with its slightly better than flat performance, while the next weakest is the British pound, which has gained almost 1.4% against the greenback (at ~$1.30). The dollar is rising against the Mexican peso for the 11th session in the past 12. The dollar has fallen in only two sessions since February 14. It traded as high as MXN20.15 earlier today. Two full forces are weighing on the peso: unwinding of carry trades, for which it was a favorite, and as a proxy for other, less liquid, or accessible emerging market currencies. The next important chart point is last August’s high near MN20.26.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Canada,Currency Movement,Featured,Germany,Interest rates,Japan,jobs,newsletter