© Yulan | Dreamstime.com In the seven days to 10 July 2020, the reported number of new SARS-CoV-2 infections recorded in Switzerland was 589, a similar number to the week before, when 615 new cases were recorded. Over the weeks prior to this there were 251 and 172 new cases, according to worldinfometer.com. Much of the recent rise in infections is due to clusters of infections found among people going to nightclubs and bars. Late last week Switzerland’s Covid-19...

Read More »The Sinking Titanic’s Great Pumps Finally Fail

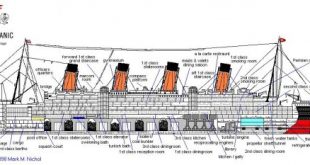

The greater fools still partying in the first-class lounge are in denial that even the greatest, most technologically advanced ship can sink. On April 14, 1912, the liner Titanic, considered unsinkable due to its watertight compartments and other features, struck a glancing blow against a massive iceberg on that moonless, weirdly calm night. In the early hours of April 15, the great ship broke in half and sank, ending the lives of the majority of its passengers and...

Read More »EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit. This comes as markets are grappling with still-rising virus numbers in the US and resurgent numbers in many other countries that call into question the durability of the economic recovery....

Read More »Game Over Spending

Coming and Going Like a Wildfire Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace. The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping...

Read More »The Great Society: A Libertarian Critique

The Great Society is the lineal descendant and the intensification of those other pretentiously named policies of twentieth-century America: the Square Deal, the New Freedom, the New Era, the New Deal, the Fair Deal, and the New Frontier. All of these assorted Deals constituted a basic and fundamental shift in American life—a shift from a relatively laissez-faire economy and minimal state to a society in which the state is unquestionably king.1 In the previous...

Read More »Jeff Snider – How Is US Labor Force Changing? (RCS Ep. 41)

Interview original date: April 25th, 2020 Labor force participation expanding. The labor force is not what it used to be. In a typical recession the labor force doesn't really change, it continue to grow, it doesn't contract. That changed in 2008, the labor force then started to contract. Discuss about the survey of labor participation.

Read More »Immigration slowdown hits Swiss rents

In 1999, Switzerland signed a deal with the EU allowing free movement of people between Switzerland and the bloc. The deal came into force in 2002. This led to a rise in immigration into Switzerland, which in turn eventually led to rising rents. © Andreaciox | Dreamstime.com However, since 2014 there has been a marked slowdown in EU immigration into Switzerland. In addition, a lot of rental homes have been built. The overall supply of rental properties now exceeds...

Read More »How Central Banks Destroy Money’s Purchasing Power

Most economists hold that a growing economy requires a growing money stock on grounds that growth gives rise to a greater demand for money that must be accommodated. Failing to do so, it is maintained, will lead to a decline in the prices of goods and services, which in turn will destabilize the economy and lead to an economic recession, or even worse, depression. Since growth in money supply is of such importance, it is not surprising that economists are...

Read More »Swiss Unemployment Falls in June 2020

The number unemployed in Switzerland at 30 June 2020, fell 5,709 in June to 159,289, according to the State Secretariat for the Economy (SECO). © Wutthichai Luemuang | Dreamstime.com Switzerland’s unemployment rate fell from 3.4% to 3.2%. However, despite improving on May 2020, the number unemployed was 53,067 (+54.6%) higher than at the end of June 2019. Switzerland’s official unemployment figures however include only those registered as unemployed, a lower...

Read More »The Simon-Ehrlich Bet Did Not Settle the Question

The bet between Julian Simon and Paul Ehrlich shows a fatal flaw in how most people think about inflation. Are you familiar with the bet? Ehrlich wrote a book titled The Population Bomb. He held a pessimistic view of the future, in which population growth would outstrip resources (essentially the same as Thomas Malthus). Simon disagreed. So in 1980, they made a famous bet. Ehrlich thought that the real cost of commodities would be higher in 10 years. Simon said they...

Read More » SNB & CHF

SNB & CHF