A Fed survey of expectations shows that the consumer mood darkens on employment and job prospects. Job Transitions This chart shows the changes in employment status of respondents who were employed four months ago. The Fed survey asks individuals currently employed (excluding self-employment) whether they are working in the same job as when they submitted their last survey. If in the past four months they have answered that they now work for a different employer,...

Read More »Heavy Metal Selling

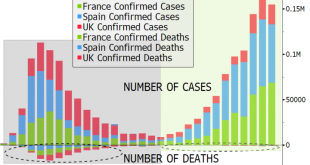

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday. Precious metals were not immune to the sell off which saw gold below $1,900 and silver off a whopping 12% during intraday trading. The following charts show the short term support that halted the rout in precious metals by the end of the day. With the negative news...

Read More »FINMA rügt Bank SYZ wegen Verstössen in der Geldwäschereibekämpfung

Die Eidgenössische Finanzmarktaufsicht FINMA hat in einem Enforcementverfahren festgestellt, dass die Bank SYZ SA gegen die Geldwäschereibestimmungen verstossen hatte. Die Verstösse erfolgten im Kontext einer sehr bedeutenden Geschäftsbeziehung mit einem Kunden aus Angola. Im Februar 2020 eröffnete die FINMA ein Enforcementverfahren gegen die Bank SYZ SA, um Hinweisen auf Verstösse gegen die Geldwäschereibestimmungen nachzugehen. Diese Hinweise betrafen eine sehr...

Read More »Swiss regulator censures Bank Syz over money laundering

FINMA described the bank’s money laundering processes as “inadequate” and reprimanded it for a breach of its duty of due diligence in relation to anti-money laundering rules. © Keystone / Gaetan Bally The Swiss financial market regulator FINMA has reprimanded Bank Syz for breaching money laundering rules involving a business relationship with an Angolan client. “FINMA found that the bank did not make sufficient efforts to investigate the substantial growth in the...

Read More »Rapid Covid-19 tests could offer a path back to normal

Some countries like India have made rapid antigen tests a key part of their strategy for containing the coronavirus. Keystone / Str Swiss pharmaceutical company Roche plans to launch a test that can detect the coronavirus in 15 minutes. Could tests like this become the norm? With no vaccine in sight for at least a few months, testing is becoming a more important part of containing the coronavirus. Antigen tests, which detect the presence of a specific viral antigen...

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part II

Interview with Robert Mark: Claudio Grass (CG): In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks? Robert Mark (RM): The patriarch of value investing, Ben Graham, once said, “In the short run the market is a voting machine, but in the long run it is a...

Read More »Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US Colombia is expected to cut...

Read More »Zak vs Neon: Best Swiss digital bank account in 2020?

(Disclosure: Some of the links below may be affiliate links) Zak and Neon are two good Swiss Digital bank accounts. They are both entirely digital and accessible through mobile applications. The great thing about these bank accounts is that they are significantly cheaper than conventional bank accounts. Their low prices are what make their success. And they have some attractive features. But which one should you choose? Which of Zak vs Neon is better for you? Let’s...

Read More »Compulsory vs. Free Education

[unable to retrieve full-text content][A selection from Education: Free and Compulsory.] The Reverend George Harris described the effects of compulsory education in imposing uniformity and enforced equality (soon after the establishment of compulsion).

Read More »28 Brent Johnson and Jeff Snider (also ‘George Gobel’)

Brent Johnson, CEO of Santiago Capital, joins Jeff Snider to discuss central banks, public relations, modern monetary theory, politically-directed investment and whether the future ahead is a bright or dark one. Also, brown shoes. ----------WHY---------- In 1969 Johnny Carson was hosting The Tonight Show and in one particular episode Bob Hope was the headliner. After Carson was finished interviewing Hope he called out his next guest, George Gobel. To everyone's surprise the person that...

Read More » SNB & CHF

SNB & CHF