Read More »

Stress rises among Swiss workers

© Luis Pablo Escoto Hernandez | Dreamstime - Click to enlarge A recent report by Travail.Suisse shows around 40% of Swiss workers report feeling often or very often stressed by their work.Stress and emotional exhaustion is a daily reality for many says Travail.Suisse. Between 2015 and 2017, the percentage suffering work related stress or emotional exhaustion has risen from 38% to 48%. A key issue appears to be loss...

Read More »Richest get richer – Switzerland’s top 300

The wealthiest people in one of the world’s wealthiest nations – Switzerland, have increased their assets by CHF60 billion over the past year. According to the latest edition of the German-language business magazine, Bilanz, the 300 richest residents of the country have assets totalling CHF674 billion. + Read why Switzerland is attractive to wealthy foreigners The richest family on the list remains IKEA’s...

Read More »Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

– Geopolitical risk highest “in four decades” should push gold higher – Citi – Elections, political and macroeconomic crises and war lead to gold investment – Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank– “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank – Reduce counter party risk:...

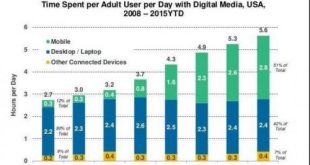

Read More »Addictions: Social Media & Mobile Phones Fall From Grace

Identifying social media and mobile phones as addictive is only the first step in a much more complex investigation. For everyone who remembers the Early Days of social media and mobile phones, it’s been quite a ride from My Space and awkward texting on tiny screens to the current alarm over the addictive nature of social media and mobile telephony. The emergence of withering criticism of Facebook and Google is a new...

Read More »Lessons from Squanto

Standing In Your Way Governments across the planet will go to any length to meddle in the lives and private affairs of their citizens. This is what our experiences and observations have shown. What gives? For one, politicians have an aversion to freedom and liberty. They want to control your behavior, choices, and decisions. What’s more, they want to use your money to do so. As this by now famous cartoon...

Read More »[ Jeffrey Snider ] Evolution of Eurodollars, Money as interbank liabilities

Jeffrey Snider: Eurodollar University Part 1 -- How Dollar becomes 'Dollar' -- Bankers' Acceptances -- The Evolution of Eurodollars -- Where do Eurodollars . [ Jeffrey Snider ] -- Evolution of Eurodollars, Money as interbank liabilities - update 2017. Jeffrey Snider: Eurodollar University Part 1 -- How Dollar becomes . Jeffrey Snider: Eurodollar University Part 1 -- How Dollar becomes 'Dollar' -- Bankers' Acceptances -- The Evolution of Eurodollars -- Where do Eurodollars . Jeffrey...

Read More »Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

Summary The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro’s drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s. The head and shoulders pattern in technical analysis is most commonly seen as a reversal pattern. As this Great...

Read More »Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve.

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales! - Click to enlarge Cette entrée a été publiée dans Autres articles. Bookmarquez ce permalien. [embedded content] Related...

Read More »Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve. Vidéo Thinkerview

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales! - Click to enlarge Cette entrée a été publiée dans Autres articles. Bookmarquez ce permalien. [embedded content] Related...

Read More » SNB & CHF

SNB & CHF