© Kevkhiev Yury | Dreamstime.com Le Matin. According to a recent study, employees in certain roles in Switzerland are paid around 50% more than those second-placed Luxembourg. The premium applies to recent hires, middle managers and qualified professionals, says the study conducted by Willis Tower Watson. The report, entitled Global 50 Remuneration Planning Report 2016/2017, looks at pay across 50 roles and 60 countries...

Read More »Keiser Report Interview: Peak Gold, Silver On Small Finite Planet

Peak Gold and Silver On “Small Finite Planet” With Near Infinite CurrencyPeak gold and silver and the case for peak precious metals on “our small, finite planet” was the topic for discussion on the latest episode of the the Keiser Report. (Max Keiser interview of Mark O’Byrne of GoldCore in 2nd half of show at 13 min 15 seconds) [embedded content] Topics covered in the interview – Small planet with finite resources...

Read More »Emerging Markets: Buyer Beware – An Interview with Jayant Bhandari

Jayant on Emerging Markets, Precious Metals and Mining Companies Maurice Jackson of Proven & Probable has once again interviewed one of our friends, namely Jayant Bhandari, a frequent and highly valued contributor to Acting Man. Jayant is probably best known to our readers for his strong criticism of the economic and nationalist policies implemented by prime minister Narendra Modi in India since he decreed the...

Read More »Blatant Similarities

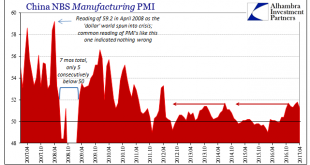

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows. While that might be erased next month as normal short run volatility, the indicators overall do seem to have stalled...

Read More »China: Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows. While that might be erased next month as normal short run volatility, the indicators overall do seem to have stalled...

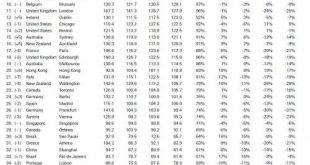

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive – and in this year’s edition, best – cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of “cheap dates” in the world’s top cities. The index consists of...

Read More »London Property Market Vulnerable To Crash

– London property market vulnerable to crash– House prices in London are falling – London property up 84% in 10 years (see chart) – House prices have risen over 450% in 20 years– Brexit tensions as seen over weekend and outlook for U.K. economy to impact property– Global property bubble fragile – Risks to global economy– Gold bullion a great hedge for property investors For the bargain price of 36 AED (£5) I can buy...

Read More »Emerging Markets: What has Changed

Summary Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee. Stock...

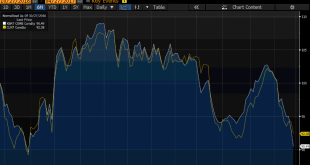

Read More »Great Graphic: Gas and Oil

Summary: Steep falls in gasoline and oil prices. Large build in gasoline inventories and record refinery work shifted some surplus from oil to the products. OPEC is expected to roll over its output cuts, but non-OPEC may find it difficult and US output continues to rise. This Great Graphic, made on Bloomberg, shows the past six months of oil and gas prices. The white line is the June gasoline futures and the...

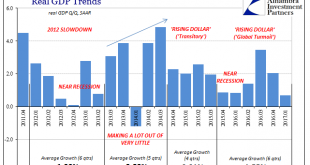

Read More »This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric. The Federal Reserve had been since 2014 itching to “raise rates” if for no other reason than to...

Read More » SNB & CHF

SNB & CHF