Source: cnbc.com - Click to enlarge I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday. There has not been much follow through today, though the euro broke below $1.08 in late-Asia and is maintaining the break in early...

Read More »Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum. European Council President Tusk is expected formally to respond for the EU before the...

Read More »Price Inflation – The Ultimate Contrarian Bet

Unanimity Syndrome If there is one thing apparently no-one believes to be possible, it is a resurgence of consumer price inflation. Actually, we are not expecting it to happen either. If one compares various “inflation” data published by the government, it seems clear that the recent surge in headline inflation was largely an effect of the rally in oil prices from their early 2016 low. Since the rally in oil prices...

Read More »India: The next Pakistan?

India’s Rapid Degradation This is Part XI of a series of articles (the most recent of which is linked here) in which I have provided regular updates on what started as the demonetization of 86% of India’s currency. The story of demonetization and the ensuing developments were merely a vehicle for me to explore Indian institutions, culture and society. Tribal cultures face an inherent contradiction. They create poison...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week March 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Llst weeks: The EUR/CHF suddenly appreciated with the ECB...

Read More »FX Daily, March 28: Prospects for Turnaround Tuesday?

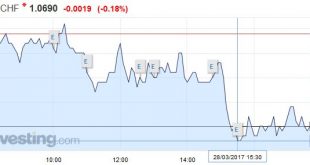

Swiss Franc EUR/CHF - Euro Swiss Franc, March 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc continues to hold the higher ground as global uncertainty continues to dominate the markets. UBS Consumption Indicator is released tomorrow morning which should give some further clues to as the health of the Swiss economy. The numbers are important as the consumption is the most important...

Read More »Weekly Speculative Positions: Continued reduction of Euro Shorts

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world’s largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump. Yesterday. in the latest expression of his building anti-Trumpian sentiment, Bridgewater released a...

Read More »Putting Pennies in the Fuse Box – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Careening from Crisis to Crisis Back in the old days, homes had fuse boxes. Today, of course, any new house is built with a circuit breaker panel and many older homes have been upgraded at one time or another. However, the fuse is a much more interesting analogy for the monetary system. When a fuse burned out, it was...

Read More »Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More » SNB & CHF

SNB & CHF