Summary Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee. Stock Markets In the EM equity space as measured by MSCI, the Philippines (+2.4%), UAE (+2.3%), and Singapore (+2.1%) have outperformed this week, while Russia (-4.3%), Turkey (-1.8%), and Qatar (-1.6%) have underperformed. To put this in better context, MSCI EM fell -0.4% this week while MSCI DM rose 0.7%. In the EM local currency bond space, Czech Republic (10-year yield -10 bp), Hungary (-5 bp), and India (-5 bp) have outperformed this week, while Russia (10-year yield +18 bp), Argentina (+16 bp), and Colombia (+8 bp) have underperformed. To put this in better context, the 10-year UST yield rose 8 bp to 2.36%. In the EM FX space, ILS (+0.7% vs. USD), ARS (+0.5% vs. USD), and HUF (+0.4% vs. EUR) have outperformed this week, while RUB (-2.7% vs. USD), ZAR (-1.7% vs. USD), and PEN (-1.3% vs. USD) have underperformed. Stock Markets Emerging Markets, May 06 Source: economist.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

Stock MarketsIn the EM equity space as measured by MSCI, the Philippines (+2.4%), UAE (+2.3%), and Singapore (+2.1%) have outperformed this week, while Russia (-4.3%), Turkey (-1.8%), and Qatar (-1.6%) have underperformed. To put this in better context, MSCI EM fell -0.4% this week while MSCI DM rose 0.7%.

In the EM local currency bond space, Czech Republic (10-year yield -10 bp), Hungary (-5 bp), and India (-5 bp) have outperformed this week, while Russia (10-year yield +18 bp), Argentina (+16 bp), and Colombia (+8 bp) have underperformed. To put this in better context, the 10-year UST yield rose 8 bp to 2.36%. In the EM FX space, ILS (+0.7% vs. USD), ARS (+0.5% vs. USD), and HUF (+0.4% vs. EUR) have outperformed this week, while RUB (-2.7% vs. USD), ZAR (-1.7% vs. USD), and PEN (-1.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets, May 06 Source: economist.com - Click to enlarge |

China and North KoreaRelations between China and North Korea appear to be worsening. Pyongyang issued a rare criticism of China by saying “reckless remarks” on North Korea’s nuclear program are testing its patience, which in turn could trigger “grave” consequences. This comes after China suspended imports of North Korean coal earlier this year.

South KoreaThe US Terminal High Altitude Area Defense (THAAD) missile shield has been deployed earlier than expected in South Korea. Despite China’s objections, THAAD is reportedly ready for operations even as tensions grow over North Korea’s nuclear program. South Korea’s Defense Ministry had previously said that it expected the system to be fully operational by year-end.

IndiaAn amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Among other things, it allows the RBI to order banks to initiate insolvency proceedings against defaulters and to create committees to advise banks on recovering or writing down non-performing loans. The government stated that so-called stressed assets in the banking system have reached “unacceptably high levels” that require urgent measures to resolve them. Czech Republic

Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. This comes just six months before the two are likely to face off in general elections, in which polls show Babis’ ANO leading Sobotka’s Social Democrats by wide margins. Sobotka originally said he’ll submit his government’s resignation to President Zeman this week, but has since delayed and now withdrawn it. BrazilBrazil pension reform bill was passed 23-14 in the lower house special committee. However, lawmakers still need to finish voting on amendments to the bill as protesters forced them to suspend the session. The committee will resume voting on Tuesday, as the proposed changes need to be accepted or rejected before the bill goes to a vote by the entire lower house. Some lawmakers admit that there are currently not enough votes to pass it.

|

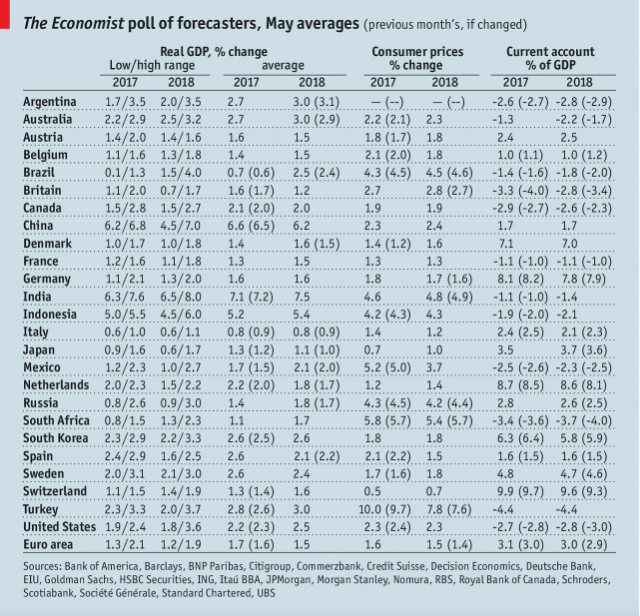

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin