But the underlying pick-up in inflation in January was not as severe as it seems.January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further...

Read More »US chart of the week – Tax base

Some northern US states face the challenge of a shrinking tax base.A worry persists about many US states and municipalities’ finances, especially due to rising pension costs. The recent volatility in financial markets has raised fears the situation might worsen. The need to add to the pension pot is also affecting states and municipalities’ ability to fund infrastructure investment, or even basic maintenance.A shrinking tax base is aggravating the problem in some areas. A good proxy for the...

Read More »Switzerland: inflation edged lower in January

Core inflation fell back to the same level as last October. Our scenario for monetary policy remains unchanged.Headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation fell from 0.7% y-o-y in December to 0.5% y-o-y in January.Our inflation outlook remains unchanged. We expect headline inflation to firm up gradually as 2018 progresses, averaging 1.0% in 2018, but with risks tilted...

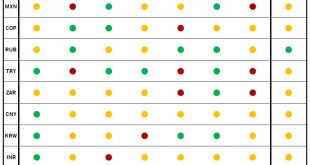

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic...

Read More »Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

This year is all about the Phillips curve: the extent to which wage growth and inflation respond to falling unemployment will shape the ECB’s monetary tightening cycle.We agree with the ECB that the euro area Phillips curve is alive, albeit “flatter and non-linear”. In particular, structural changes in the labour market have resulted in larger slack than implied by standard unemployment figures, including a large number of workers marginally attached to the labour force.Our analysis confirms...

Read More »Equity markets in a new regime

The recent ‘flash crash’ in equities was unusual by several measures. After ‘goldilocks’, equity markets have entered a new regime.The global equity market sell-off of late January and early February was rather unusual in a number of respects.Equity and bond prices declined simultaneously in the recent market sell-off, a pattern that has only occurred in a quarter of the last 25 equity market sell-offs.The recent sell-off is far above the levels seen in the past two years, because the...

Read More »Europe chart of the week – Italian productivity

Among the main challenges facing Italy, stagnant labour productivity is one of the most important.With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard.Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history....

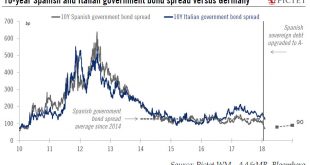

Read More »Robust outlook supports low Spanish sovereign bond spreads

Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.The...

Read More »US chart of the week – Low macro vol

Volatility in US payroll data has remained low lately. We see limited signs of imminent overheating or slowing in the US.Volatility has picked up significantly on US equity markets lately. But does it reflect higher volatility in US macroeconomic data?So far, not really. Take US payroll data. If one looks at the one-year rolling standard deviation of the monthly data, one can see volatility is still subdued: it now stands at 68,000 (new payrolls/month), which is close to the average since...

Read More »Volatility presents opportunities

[embedded content] A pick-up in inflation fears contributed to the recent spike in bond yields that spilled over into equities. But while inflation remains a risk, Cesar Perez Ruiz, CIO at Pictet Wealth Management, remains sanguine about the global economy and risk assets and sees volatility as an opportunity for tactical positioning.

Read More » Perspectives Pictet

Perspectives Pictet