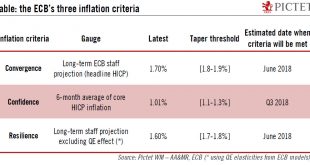

Euro area core inflation rebounded in December. We expect a more sustained adjustment in core prices to start in H2 2018, and to continue in 2019.Euro area core inflation rebounded to 1.0% in January, from 0.9% in the previous month, in line with expectations. There is no escaping the fact that the ECB remains “some distance” from meeting its inflation criteria, as Peter Praet said this week.Our inflation forecasts are consistent with a delayed normalisation in the ECB’s stance as core...

Read More »Euro area Q4 GDP growth: Strong, but not stronger

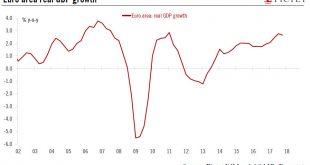

Euro area real GDP expanded in Q4, in line with expectations but marginally less than in Q3. We forecast GDP growth of 2.3% in 2018, with near-term upside risks.According to Eurostat’s preliminary estimate, euro area real GDP rose by 0.6% q-o-q in Q4 (2.3% q-o-q annualised; 2.7% y-o-y), in line with consensus expectations but slightly less than its upwardly-revised 0.7% q-o-q increase in Q3.The euro area economy expanded by 2.5% in 2017 overall, its fastest annual growth since 2007. The...

Read More »Ten-year Treasury yield has further to rise

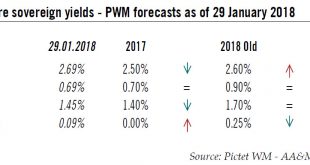

Taking into account last December’s fiscal reforms in the US, we have revised up our end-of-the year target for the 10-year Treasury yield.Given our expectations of a rebound in core inflation, accelerating growth and a faster rise in the Fed funds rate this year, we now expect the 10-year US Treasury yield to rise from 2.7% as of 29 January to 3.0% by the end of 2018 (our previous forecast for end-2018 was 2.6%). This rise is likely to be driven by both inflation expectations and TIPS...

Read More »Strong growth and Abenomics mean Japanese equities continue to provide opportunities

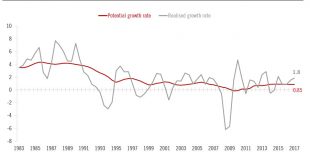

Pictet Wealth Management’s view on prospects for Japanese growth, for the yen, and for Japanese bonds and equities.Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11-year high in Q4 2017. The Japanese economy may have expanded by 1.8% in 2017, up from 0.9% in 2016. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s long-term potential. Inflation...

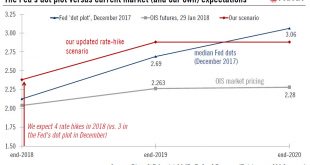

Read More »Fed to drop hints about its increased optimism

With a rate hike very unlikely to be announced at the Fed’s January 30-31 meeting, the focus will be on the post-meeting statement, which could contain some moderate hawkish hints.The Fed meets on 30-31 January, a ‘tier 2’ meeting as there will be no press conference nor new economic projections. Rates should remain on hold. Still, the Fed could drop some hints that its optimism about the US and global economy is on the rise.We think this increased optimism will pave the way for higher 2018...

Read More »Tax cuts and ‘animal spirits’ mean higher US growth in 2018

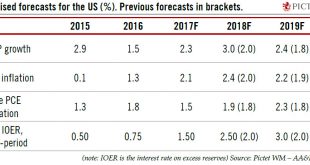

The recent US tax cuts and abundant signs of increased corporate investment have led us to raise our forecast for growth and inflation in the US this year and next.December’s US tax cuts – which saw corporate taxation sharply reduced– are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We have raised our 2018 US growth forecast to 3.0% (from a previous forecast of 2.0%), as...

Read More »After an exceptional year…

Download issue:English /Français /Deutsch /Español /Italiano2017 was an exceptional vintage for risk assets that will be hard to repeat this year. But the environment could become increasingly favourable for active management as challenges rise and volatility increases. This is one of the main messages from Pictet Wealth Management (PWM) analysts and strategists featured in the 2018 special edition of Perspectives.What might some of those challenges be? Global strategist Alexandre Tavazzi...

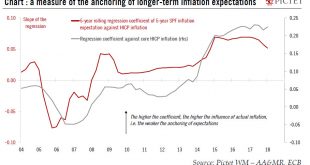

Read More »Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment.The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years, sometimes substantially. Euro area GDP is now expected to expand by 2.3% in...

Read More »China: 2018 GDP forecast revised up

China’s economy beat consensus growth forecasts in 2017 and we have revised up our own forecast for 2018.The Chinese economy ended 2017 on a strong note, rising 1.6% over the previous quarter and, growing by 6.9% in real terms over 2017 as a whole, thus beating the consensus forecast as well as our own estimate (both at 6.8%). The strong 2017 growth number marks the first full-year acceleration in the Chinese economy since 2010, and can be accredited to the synchronised global economic...

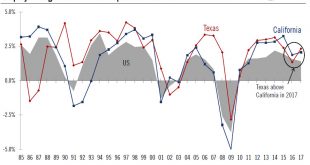

Read More »US chart of the week – Texas rebounds

Employment in Texas rose more quickly than in California in 2017 as recovering oil prices boosted the energy sector and associated industries in the Lone Star State.One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local...

Read More » Perspectives Pictet

Perspectives Pictet