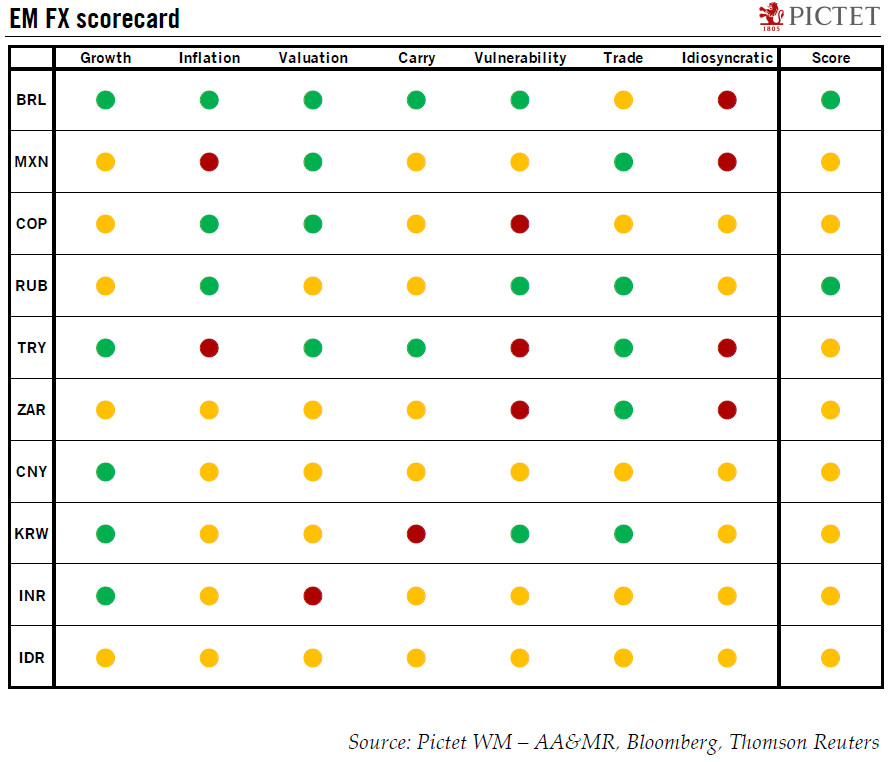

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic drivers. All criteria are rules based, with the sole exception of the idiosyncratic factor.No EM FX in our scorecard has a bad mark, highlighting improvements in the quality of growth, credible central banks (which have helped reduced the risk of high inflation) and stronger external buffers in many

Topics:

Luc Luyet considers the following as important: Brazilian real, Currency drivers, EM currencies, Macroview, Russian rouble

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic drivers. All criteria are rules based, with the sole exception of the idiosyncratic factor.

No EM FX in our scorecard has a bad mark, highlighting improvements in the quality of growth, credible central banks (which have helped reduced the risk of high inflation) and stronger external buffers in many emerging markets.

At present, our scoreboard suggests that the Brazilian real (BRL) and the Russian rouble (RUB) are the most attractive currencies among our selection of EM currencies.

The BRL scores highest on most of our metrics given improving economic activity, falling inflation, its attractive valuation, the high carry attached and strong external buffers. The main issue facing the real is politics (i.e. idiosyncratic factors) given the danger that progress on social security reform falters ahead of the October general elections.

The RUB also scores highly, mostly given its decent carry and strong external buffer. Current NAFTA negotiations represent a clear and present danger for the Mexican peso, although our view remains that an unilateral withdrawal from NAFTA by the Trump administration remains unlikely given likely opposition from a pro-trade US Congress.