This year is all about the Phillips curve: the extent to which wage growth and inflation respond to falling unemployment will shape the ECB’s monetary tightening cycle.We agree with the ECB that the euro area Phillips curve is alive, albeit “flatter and non-linear”. In particular, structural changes in the labour market have resulted in larger slack than implied by standard unemployment figures, including a large number of workers marginally attached to the labour force.Our analysis confirms that such increase in labour underutilisation helps improve the explanatory power of traditional Phillips curve model. The rapid decline in U6 rates would be consistent with a rebound in core inflation, to around 1.5% in the next 12-18 months. That said, there are other measures of hysteresis that may

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

This year is all about the Phillips curve: the extent to which wage growth and inflation respond to falling unemployment will shape the ECB’s monetary tightening cycle.

We agree with the ECB that the euro area Phillips curve is alive, albeit “flatter and non-linear”. In particular, structural changes in the labour market have resulted in larger slack than implied by standard unemployment figures, including a large number of workers marginally attached to the labour force.

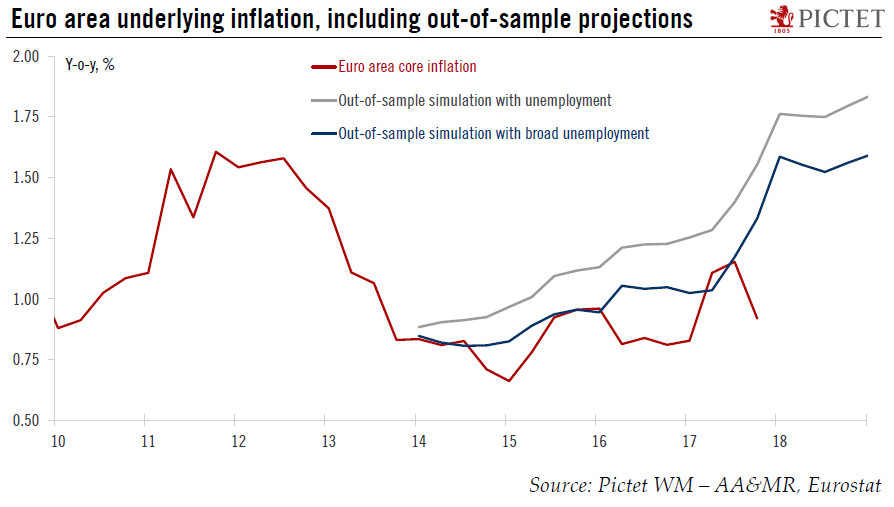

Our analysis confirms that such increase in labour underutilisation helps improve the explanatory power of traditional Phillips curve model. The rapid decline in U6 rates would be consistent with a rebound in core inflation, to around 1.5% in the next 12-18 months. That said, there are other measures of hysteresis that may be equally helpful, and other drivers for a flatter Phillips curve which the ECB needs to factor in as well.

We find evidence of significant heterogeneity across countries, possibly amplified by structural reforms and competitiveness pressure. More than ever, a patient ECB should wait until it sees the ‘whites of the eyes’ of core inflation.