The Chinese government’s work report for 2018 presents its priorities for growth and employment and lays down the roadmap for monetary and fiscal policy this year.China’s National People’s Congress (NPC) meetings are being held during March 5-20. On the first day, Premier Li Keqiang delivered the government work report, in which he outlined the major achievements of the past five years and laid out the key objectives and initiatives for 2018. The contents of the report are largely in line...

Read More »US trade policy: steel-ing the show

We believe the announcement of new US import tariffs will have little macroeconomic effect, but there are real risks of an escalation in trade tensions.US President Trump wants to impose trade tariffs of 25% on imports of steel and 10% on aluminium, although the formal announcement and the exact details are yet to be released. The basis for this move is officially ‘national security’, although it is clear that there are also internal political considerations at play. Still, our base case is...

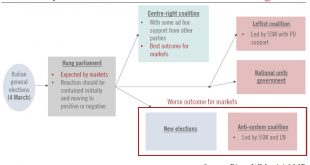

Read More »Italy: Political fragmentation leads to a hung parliament

The election result means the risk of an anti-system coalition has risen, but remains relatively low.Italian voters have shifted significantly to the right and towards populist parties in Sunday’s election, with a huge split between the North and the South. More than 50% of the votes went to Eurosceptic parties (Five Star Movement and the Northern League). As no single party or coalition won an absolute majority, negotiations to form a new government will start after parliament reconvenes on...

Read More »SNB confirms record profit for 2017

The SNB made a record high profit in 2017, mainly due to its foreign currency positions.The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn.The CHF2bn profit the SNB made on its Swiss franc...

Read More »Europe – ECB preview

We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again.The ECB remains on a cautious exit path. At the 8 March meeting, we expect the ECB to drop its commitment to increase QE in terms of its size and/or duration, if needed – a change that is long overdue, in our view, against a very favourable economic background and given that constraints linked to bond scarcity make it all but impossible to increase QE anyway. Ideally, this...

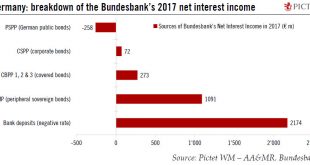

Read More »ECB policy is boosting the Bundesbank’s profits

The Bundesbank made a net profit from ECB QE last year, while the combination of all unconventional measures boosted the central bank’s net profit by EUR 3.4bn.This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end...

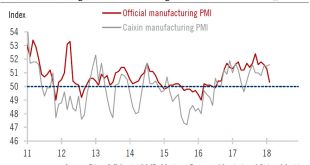

Read More »China: February PMIs point to deceleration in industrial activity

Although latest data may reflect impact of temporary environmental measures and seasonal distortions, we expect Chinese growth to moderate in 2018.China’s official manufacturing Purchasing Manager Index (PMI) for February came in at 50.3, down from 51.3 in January and 51.6 in December 2017. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month.Due to the floating date of the Lunar New Year (LNY), Chinese data in January...

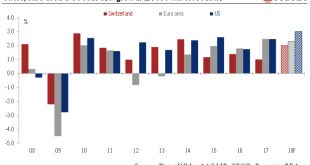

Read More »Switzerland: So far so good

The Swiss economy is gaining momentum, with growth becoming more broad based at the end of the year.Switzerland lagged the US and the euro area in terms of annual GDP growth for the third consecutive year in 2017, but today’s data confirm that the Swiss economy is continuing its recovery. Economic prospects for this year look promising. We expect growth in the Swiss economy to accelerate from 1.0% in 2017 to 2.0% in 2018, reducing the gap with other economies.According to the State...

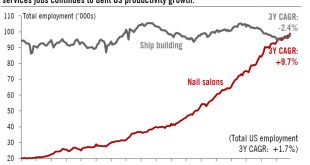

Read More »US chart of the week – Not nailing it

The US economy is creating a lot of low-skilled and low-productivity jobs.Productivity is a crucial missing link in US growth. Q4-2017 productivity data was again disappointing: labour productivity was up just 1.1% year-on-year (y-o-y). It averaged only 1.3% in 2017 as a whole, while the five-year average is a lacklustre 0.8% (versus more than 3% in the early 2000s).Low productivity growth remains a front-and-centre worry of Federal Reserve officials. Before lawmakers on 27 February, the new...

Read More »Fed update-Jerome Powell’s testimony to Congress

The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).Reading between the lines, it remains clear that the Powell Fed will not...

Read More » Perspectives Pictet

Perspectives Pictet