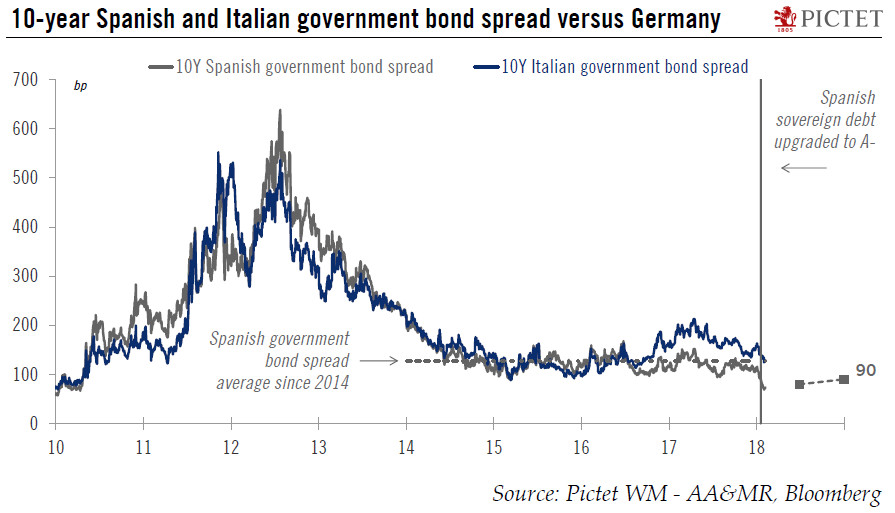

Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.The compression in Spanish spreads is even more impressive in light of the enduring political uncertainty in Catalonia, the forthcoming Italian general elections, and the gradual unwinding ECB stimulus. With the improved macroeconomic environment, peripheral euro area countries in general seem more robust than

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Euro periphery bonds, European bond market forecast, European bond spreads, Macroview, Spanish bonds

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.

Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.

The compression in Spanish spreads is even more impressive in light of the enduring political uncertainty in Catalonia, the forthcoming Italian general elections, and the gradual unwinding ECB stimulus. With the improved macroeconomic environment, peripheral euro area countries in general seem more robust than they were before the ECB launched quantitative easing (QE) at the beginning of 2015.

We have revised our Spanish bond spread and yield forecasts to take account of recent developments. In our baseline scenario, we now expect the 10-year Spanish sovereign bond spread over its German counterpart to widen from 73bp (on February 6, 2018) to 90bp at the end of 2018, lower than the 130bp we expected previously. Building on our forecast of a rise of the 10-year German Bund yield to 0.9% at end-2018, we expect the 10-year Spanish sovereign bond yield to rise from 1.4% to 1.8% (our previous forecast was 2.2% for the end of this year).