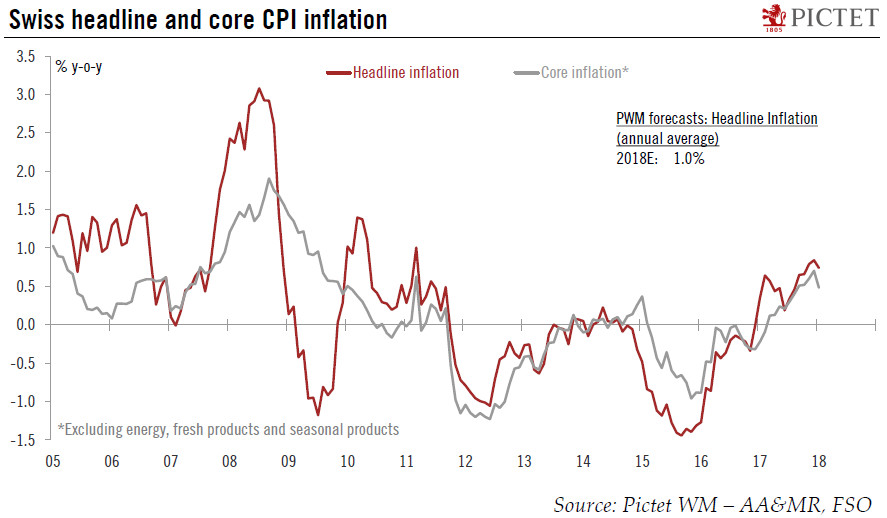

Core inflation fell back to the same level as last October. Our scenario for monetary policy remains unchanged.Headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation fell from 0.7% y-o-y in December to 0.5% y-o-y in January.Our inflation outlook remains unchanged. We expect headline inflation to firm up gradually as 2018 progresses, averaging 1.0% in 2018, but with risks tilted to the downside.Given the outlook for inflation is still contained, the Swiss National Bank is likely to remain cautious and true to its current ‘two-pillar’ strategy. Our best guess is that there will be a first rate hike of 25bp in December 2018.Read full report here

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss headline inflation, Swiss inflation outlook

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Core inflation fell back to the same level as last October. Our scenario for monetary policy remains unchanged.

Headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation fell from 0.7% y-o-y in December to 0.5% y-o-y in January.

Our inflation outlook remains unchanged. We expect headline inflation to firm up gradually as 2018 progresses, averaging 1.0% in 2018, but with risks tilted to the downside.

Given the outlook for inflation is still contained, the Swiss National Bank is likely to remain cautious and true to its current ‘two-pillar’ strategy. Our best guess is that there will be a first rate hike of 25bp in December 2018.