The CIO office’s view of the week ahead.Politics and related events around the world continued to dominate headlines, distracting markets. In the US, clarity around the next tranche of tariffs on USD 200bn worth of Chinese imports failed to materialise as the Trump administration became preoccupied by a White House insider’s New York Times op-ed, which coincided with the imminent release of the latest tell-all book by journalist Bob Woodward. Meanwhile, in the run-up to Brazil’s potentially...

Read More »US employment data confirms strength of economy

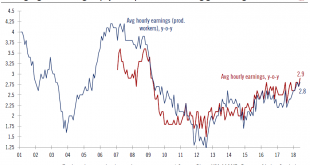

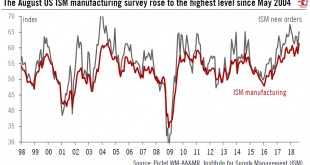

Wage growth and business cycle indicators are good news for current expansion.The August employment report confirmed that the US economy remains strong, still relatively isolated from the vagaries in global growth, and little affected by the ongoing trade tensions. This echoes recent data, such as the ISM manufacturing survey, which rose to the highest level since 2004. The unemployment rate was unchanged at 3.9%, just below the important 4% threshold. The highlight of the August report was...

Read More »Mixed signals from Chinese PMIs

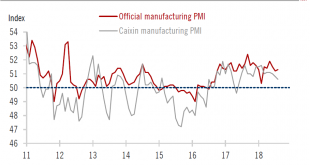

Latest data suggests continued growth moderation in Q3. Our 2018 Chinese GDP forecast remains unchanged, but we see potential downside risk.In August, Purchasing Manager Indices (PMIs) sent mixed messages about the Chinese economy. Official PMIs compiled by the national bureau of Statistics and the China Federation of Logistics and Purchasing showed the market picking up slightly in August, while the Markit PMIs (also known as the Caixin PMIs) indicated further growth deceleration. Taking...

Read More »Italian surveys show worrying weakness

Declining manufacturing and services PMIs suggest negative GDP prospects.In addition to ongoing discussions around the 2019 Italian budget, GDP growth is one of the key variables to watch given its importance to debt dynamics. Recent surveys point to quite worrying signals. The Italian manufacturing PMI slipped to 50.1 in August from 51.5 in July, posting its second consecutive fall. The main driver of this decrease was new orders (-1.4 points to 48.7) and output (-0.9 points to 49.4). Both...

Read More »DONG Chen 2013

DONG Chen 2013

Oil prices close to fair value

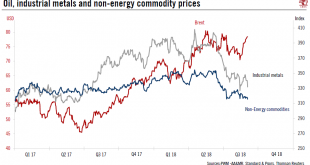

Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by...

Read More »ISM business survey rises to highest level since 2004

August’s US ISM manufacturing survey rise confirms that economic momentum is strong.The flagship ISM manufacturing survey, a series released by the Institute for Supply Management, with data going back to 1948, rose to 61.3 in August, its highest level since May 2004. Details of the survey were strong, for instance ‘new orders’ rose to 65.1, from 60.2 in July. The ISM index is a diffusion index, with any reading above 50 indicating expansion in activity.These healthy data are another...

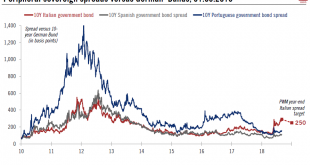

Read More »Fiscal battle looms over Italian bonds

Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27....

Read More »Dong Chen, Sales Manager, Afore New Energy

Dong Chen, Sales Manager, Afore New Energy

Read More » Perspectives Pictet

Perspectives Pictet