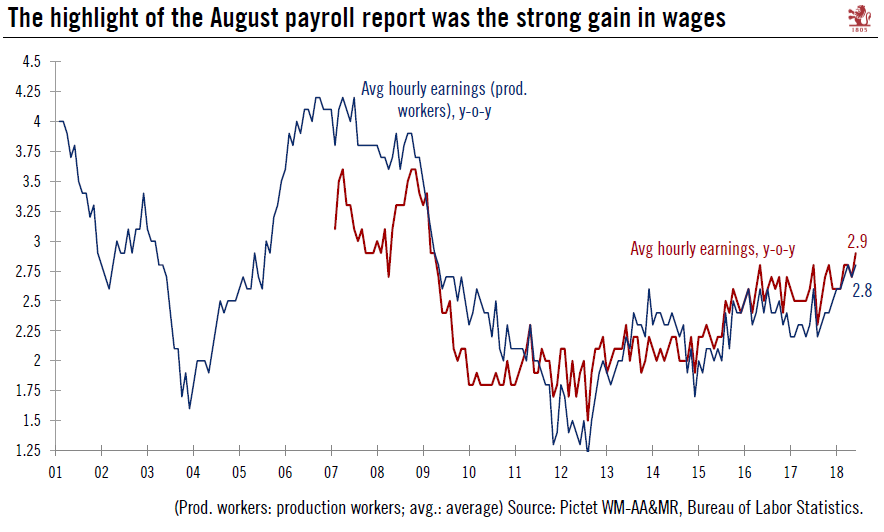

Wage growth and business cycle indicators are good news for current expansion.The August employment report confirmed that the US economy remains strong, still relatively isolated from the vagaries in global growth, and little affected by the ongoing trade tensions. This echoes recent data, such as the ISM manufacturing survey, which rose to the highest level since 2004. The unemployment rate was unchanged at 3.9%, just below the important 4% threshold. The highlight of the August report was the notable jump in wage growth (average hourly earnings) as the month-on-month was twice as strong as expected, and the year-on-year reading rose to its highest rate since mid-2009. We continue to think that wage growth will continue to inch up gradually in coming months.The strong gains in wage

Topics:

Thomas Costerg considers the following as important: Macroview, US jobs

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Wage growth and business cycle indicators are good news for current expansion.

The August employment report confirmed that the US economy remains strong, still relatively isolated from the vagaries in global growth, and little affected by the ongoing trade tensions. This echoes recent data, such as the ISM manufacturing survey, which rose to the highest level since 2004. The unemployment rate was unchanged at 3.9%, just below the important 4% threshold. The highlight of the August report was the notable jump in wage growth (average hourly earnings) as the month-on-month was twice as strong as expected, and the year-on-year reading rose to its highest rate since mid-2009. We continue to think that wage growth will continue to inch up gradually in coming months.

The strong gains in wage growth, combined with healthy job creation, will likely encourage the Federal Reserve to keep its tightening bias, and buttress the current tightening autopilot (1 rate hike per quarter).

We continue to see two more Fed rate hikes this year and two in 2019. The Fed is likely to signal four annual hikes this year and three next year (above current market pricing). On the flip side of recent wage gains is the increased risk of a business cycle slowdown. This is because, according to our metrics, stronger wage gains have a historic tendency to hamper US expansions. The ongoing low unemployment rate is another factor to watch, from a macro risk perspective.

However, most other business cycle related indicators continue to flash green and we particularly emphasise the ongoing gains in temporary help employment and the ongoing strong gains in cyclical sectors such as construction and manufacturing. The bottom line is that the risk of a US slowdown remains quite low overall, despite the ageing US business cycle. On the other hand, we still do not think the labour market is at risk of imminent ‘overheating’ since we still think there is a surplus of workers still waiting to be absorbed back into the labour force. This view is reinforced by the fact that the rate of men between 25 and 54 out of the labour force remains at abnormally elevated levels compared with the pre-crisis period.