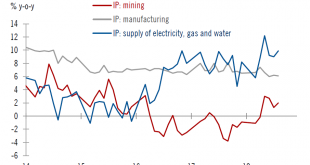

But we expect further growth moderation before a slight rebound at the end of the year.Latest data releases from China broadly point to stabilisation in activity in August after a notable deceleration in the previous months. Industrial production, retail sales and fixed-asset investment all rebounded slightly last month. While the data releases seem to show some signs of stabilisation, we think growth momentum could remain soft in the near term given a continued decline fixed-asset...

Read More »Weekly View – Ten Years On

The CIO office’s view of the week ahead.September 15 marked the 10th anniversary of Lehman Brothers’ filing for Chapter 11 bankruptcy protection. Since Lehman’s collapse has come to symbolise a massive financial crisis whose consequences continue to be felt, it is natural for this anniversary to be the occasion for speculation on when and where the next large-scale crisis might occur.Emerging markets (EM) are the weakest link in the eyes of some, even though contagion has been limited to the...

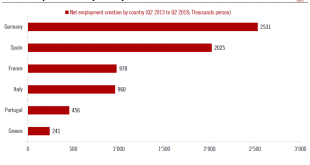

Read More »European labour market remains in rude health

But there is room for further improvement.This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area. One development of note is that employment growth has been broad, including many countries that were hard hit by the crisis. Spain and Germany...

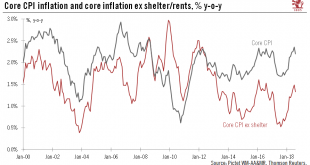

Read More »Throw the textbook away: US inflation is still modest

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still...

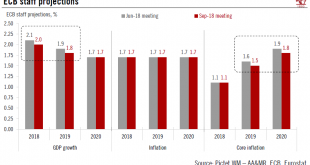

Read More »A successful bank should be boring

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were...

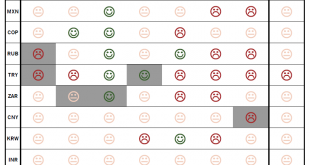

Read More »Sombre scorecard for EM currencies

A challenging global environment has sapped the appeal of all the EM currencies we track.There have been few changes in our emerging market (EM) currencies scorecard over the past month. Currently, it suggests that no EM currency at present is particularly attractive on a 12-month horizon.August was a particularly harsh month for EM currencies, with the Argentinian peso and the Turkish lira both dropping 25% against the US dollar. While these two currencies were particularly vulnerable to a...

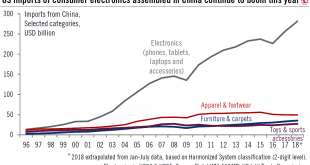

Read More »US trade deficit with China rises to fresh high

Regarding US trade, there are two key recent pieces of news and one major source of uncertainty.The first is the bilateral trade deficit with China, which rose to a new high: USD 393 billion in the twelve months to July, with imports of USD 529 billion, according to US customs data. The second is that Trump’s focus is increasingly on the imports of consumer electronics, as he has recently threatened to cover a major consumer electronics brand (and importer) with levies. Bizarrely, electronics...

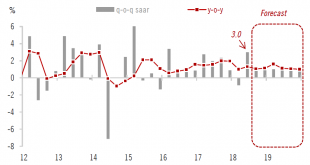

Read More »Second reading of Japanese Q2 GDP shows upward revision

The revised figures mean a slight rise in our 2018 growth forecast. However, external uncertainties remain.The second estimate of the Japanese Q2 GDP coming in at 3.0% quarter-over-quarter annualised in Q2, a significant upward revision from the first estimate of 1.9%. This is Japan’s highest growth rate in nine quarters.The biggest revision was in corporate capital expenditure, which rose by 12.8% year over year (y-o-y) in Q2, according to the latest estimate. It contributed 1.7 percentage...

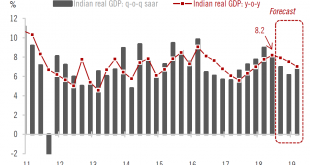

Read More »Indian growth beats expectations

Fading policy headwinds has been helping growth numbers, but external factors are expected to weigh on growth in the near future.Indian GDP came in strongly in Q2, expanding 1.9% quarter-over-quarter and 8.2% year-over-year (y-o-y), beating both the consensus and our own forecast. These numbers put India easily at the top of G20 countries in terms of GDP growth. As a result, we are revising our Indian GDP forecast for fiscal year 25018-2019 slightly upwards to 7.6% from 7.5%.The acceleration...

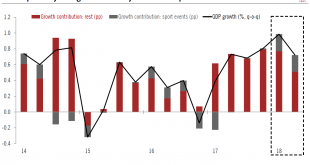

Read More »Switzerland Q2 growth numbers are impressive, but details are mixed

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010. Nevertheless, GDP was again boosted by special factors, namely sports events, which added 0.2...

Read More » Perspectives Pictet

Perspectives Pictet