Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by 5%, as fears rose that international trade disputes will dent global demand for commodities.But we believe that these concerns are exaggerated. For one, tariffs implemented so far are expected to have a mere 0.1 % impact on world GDP growth. Instead, we are sticking to the view that the oil market is

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil price equilibrium, oil prices, oil prices forecast

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Cesar Perez Ruiz writes Weekly View – Big Splits

Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.

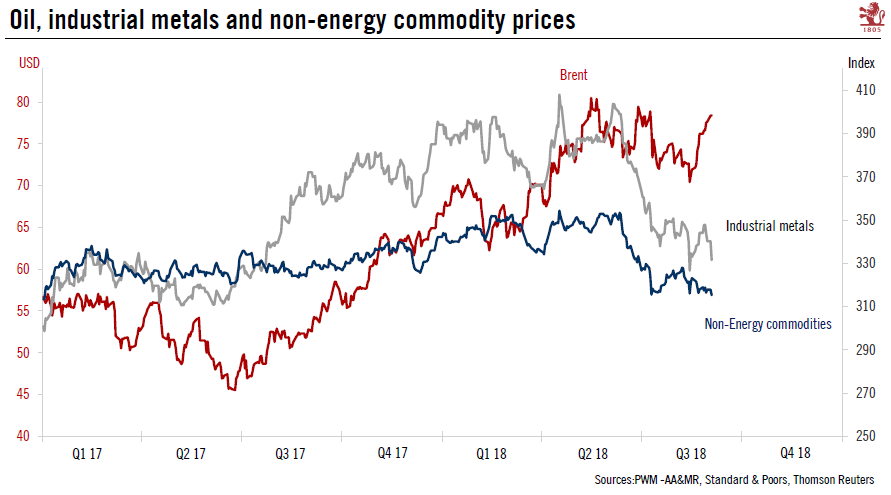

In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by 5%, as fears rose that international trade disputes will dent global demand for commodities.

But we believe that these concerns are exaggerated. For one, tariffs implemented so far are expected to have a mere 0.1 % impact on world GDP growth. Instead, we are sticking to the view that the oil market is facing a supply shortage. In the US, infrastructure bottlenecks have put a break on oil production, and the largest projects aimed at increasing production are unlikely to be operational before the second half of 2019. In fact, there has been a sharp inflection in US shale oil production. The latest figures show that early year output expectations of 1.5mbd will not be reached.

OPEC producers continue to face their own difficulties, with Venezuela, Angola, and Iran having seen their production decline. With US production being capped until mid-2019, the oil supply/demand balance is reliant on other producers, namely Saudi Arabia and Russia, which have a clear incentive to let oil prices rise to the top of their targeted range.

Since mid-August, our bullish view on prices has been vindicated, and oil prices are now very close to our end-of-year forecasts. Indeed, events have tended to confirm our scenario of a price premium above the long-term oil price equilibrium due to the risk of an oil shortage. Brent now stands at USD78 per barrel, close to our estimated current fair value and forecasted year-end price of USD77.

We continue to believe that oil prices will continue to be shaped by the opposing forces of risks to oil supply and the risk that trade disputes pose to global oil demand. Taking these factors into account, we maintain our end-of-year oil price forecasts of USD77 for Brent and USD70 for WTI.