Declining manufacturing and services PMIs suggest negative GDP prospects.In addition to ongoing discussions around the 2019 Italian budget, GDP growth is one of the key variables to watch given its importance to debt dynamics. Recent surveys point to quite worrying signals. The Italian manufacturing PMI slipped to 50.1 in August from 51.5 in July, posting its second consecutive fall. The main driver of this decrease was new orders (-1.4 points to 48.7) and output (-0.9 points to 49.4). Both indicators moved back into contraction territory. Firms cited weakness in the domestic economy as one of the reasons for the slowdown. “Concerns over future global trading conditions, particularly in relation to the US, also undermined confidence in August, with expectations amongst manufacturers for

Topics:

Nadia Gharbi considers the following as important: Italian GDP growth, Italian PMIs, Italian surveys, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Declining manufacturing and services PMIs suggest negative GDP prospects.

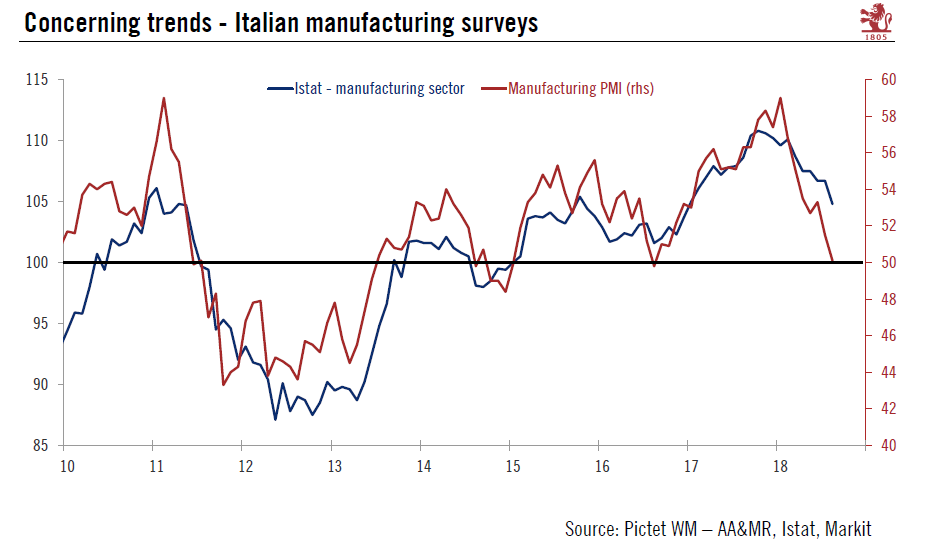

In addition to ongoing discussions around the 2019 Italian budget, GDP growth is one of the key variables to watch given its importance to debt dynamics. Recent surveys point to quite worrying signals. The Italian manufacturing PMI slipped to 50.1 in August from 51.5 in July, posting its second consecutive fall. The main driver of this decrease was new orders (-1.4 points to 48.7) and output (-0.9 points to 49.4). Both indicators moved back into contraction territory. Firms cited weakness in the domestic economy as one of the reasons for the slowdown. “Concerns over future global trading conditions, particularly in relation to the US, also undermined confidence in August, with expectations amongst manufacturers for output in the next year weakening to the lowest level recorded since May 2013”, according to Markit press release. The ISTAT industrial confidence also fell significantly in August, but still remained above its long term trend average (see Chart).

News from the services sector was not much more upbeat. Services PMI dropped by 1.4 points to 52.6 in August, bringing the index to its lowest level since October 2017.

At an average of 52.4, composite PMI is now consistent with a slower pace of GDP growth in Q3 compared to Q2. This is less than our GDP growth forecasts of 0.25% q-o-q on average for the second half of the year. Nevertheless, Q3 hard data have not been published yet. This will give us a better picture of how Italian economy is doing in Q3 so far.