Latest data suggests continued growth moderation in Q3. Our 2018 Chinese GDP forecast remains unchanged, but we see potential downside risk.In August, Purchasing Manager Indices (PMIs) sent mixed messages about the Chinese economy. Official PMIs compiled by the national bureau of Statistics and the China Federation of Logistics and Purchasing showed the market picking up slightly in August, while the Markit PMIs (also known as the Caixin PMIs) indicated further growth deceleration. Taking this and other factors into account, evidence points to moderation in Chinese growth in Q3.The weaker readings of the Caixin PMIs may suggest underperformance of exporters compared to more domestically focused SOEs. After a strong rise in 2016, the end of 2017 saw a broad-based slowdown in global

Topics:

Dong Chen considers the following as important: Chinese exports, Chinese GDP forecast, Chinese PMIs, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest data suggests continued growth moderation in Q3. Our 2018 Chinese GDP forecast remains unchanged, but we see potential downside risk.

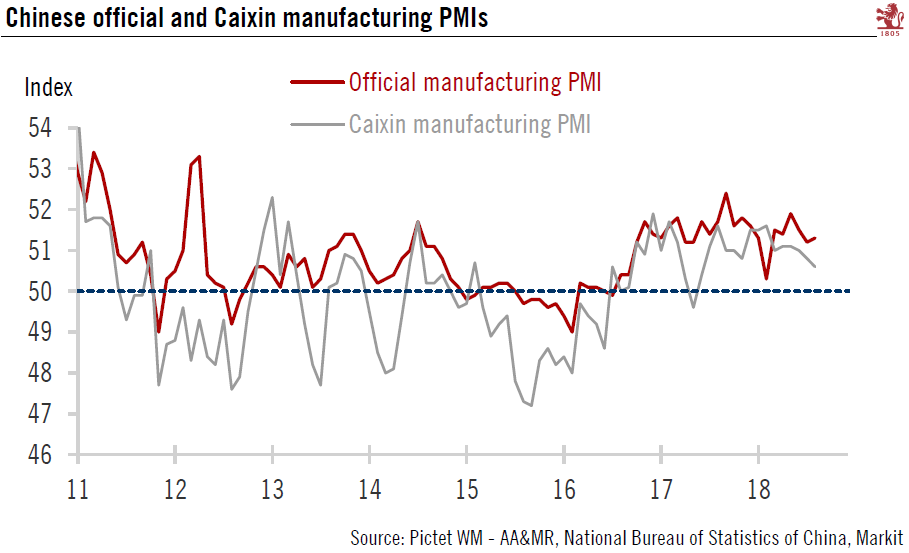

In August, Purchasing Manager Indices (PMIs) sent mixed messages about the Chinese economy. Official PMIs compiled by the national bureau of Statistics and the China Federation of Logistics and Purchasing showed the market picking up slightly in August, while the Markit PMIs (also known as the Caixin PMIs) indicated further growth deceleration. Taking this and other factors into account, evidence points to moderation in Chinese growth in Q3.

The weaker readings of the Caixin PMIs may suggest underperformance of exporters compared to more domestically focused SOEs. After a strong rise in 2016, the end of 2017 saw a broad-based slowdown in global exports. Chinese exports held up well, but recent data suggests upcoming headwinds.

Moderating global growth as well as trade tensions with the US will likely weigh on Chinese exports over the coming months. It looks likely that a second wave of USD 200 billion of Chinese goods will be implemented.

Domestically, it also appears the economy is decelerating, especially regarding fixed-investment and consumption. Infrastructure continues to be a drag, due to the government’s policies of deleveraging and tighter regulations on local government debt. Investment in property and manufacturing has been fairly stable.

Regarding consumption, retail sales have been disappointing, due to slower growth in disposable income and reduced consumer confidence. Auto sales were especially weak as tax incentives introduced in 2016 to encourage the purchase of smaller-engine cars were gradually rolled back. We believe that China will continue its transition to a consumption-driven economy over the course of the coming decade. However, the Chinese consumer sector could be affected by upcoming headwinds, on both domestic and external fronts.

We expect some policy adjustment on the part of the Chinese central government, with moves to come in the rest of the year, such as additional cuts in banks’ reserve ratios and more fiscal support on infrastructure investment. Overall, we are keeping our 2018 Chinese GDP forecast at 6.6%, but we recognize that the risk is tilted slightly downwards.