Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27. The DEF will tell us to what extent the populist ruling coalition is willing to challenge the European Union’s fiscal rules.One of the key questions is how the government will manage to find a compromise between the contradictory views expressed by Giovanni Tria, the finance minister and the government

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Euro periphery bonds, Italian sovereign debt, Italy budget plan, Italy government, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.

Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27. The DEF will tell us to what extent the populist ruling coalition is willing to challenge the European Union’s fiscal rules.

One of the key questions is how the government will manage to find a compromise between the contradictory views expressed by Giovanni Tria, the finance minister and the government coalition leaders, Matteo Salvini and Luigi Di Maio. While Tria has tried to reassure investors, the coalition leaders have been quite confrontational with the EU on budget issues.

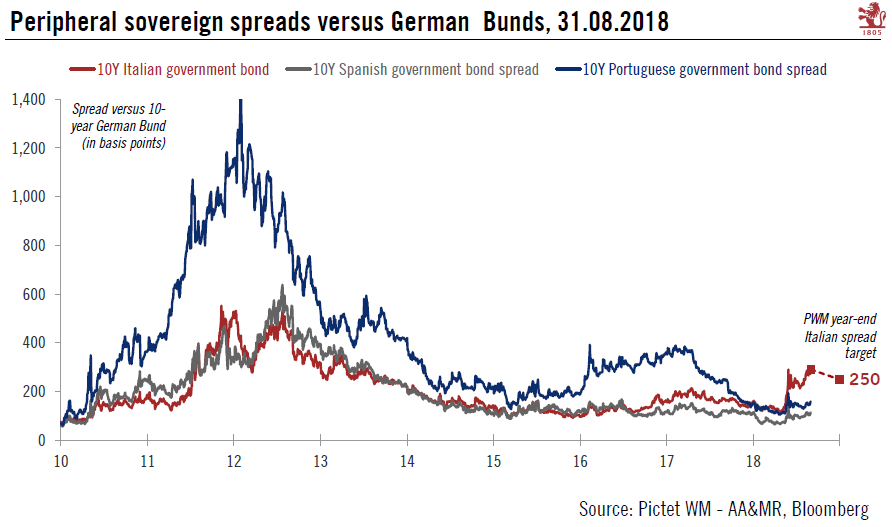

Our central scenario is that the Italian will adopt an ‘in-between’ fiscal stance, aiming for a target deficit above but close to 2%. In this scenario, we would expect the 10-year Italian sovereign bond spread to retreat to 250 bps by year-end. However, given the confrontational behaviour of the current government, a more aggressive fiscal stance should not be underestimated. This could lead us to change our target for Italian spreads to 350 bps by year’s end.

So far, contagion to other countries has been relatively limited. Nevertheless, given the uncertainty surrounding Italian budget discussions and the lack of visibility on the composition and size of the budget, we remain bearish on peripheral euro area bonds in general, expecting further market volatility.