2017年全国武术套路锦标赛 2017 National Wushu Routine Championship 时间:2017年5月26日至29日 地点:中国江苏无锡体育中心体育馆 My website:https://www.facebook.com/keitai.yamamoto

Read More »Euro area PMIs: still little good news below the surface

We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast.Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q...

Read More »Japanese exports soften further in July

Following July’s deceleration in export growth, we may revise downward our 2018 GDP growth forecast for Japan if trade tensions escalate further.Japanese exports softened further in July, rising by 3.9% year-over-year (y-o-y), compared with 6.7% in June, in JPY terms. Growth in imports strengthened in July to 14.6% y-o-y, compared with 2.6% in the previous month. As a result, Japan’s trade balance fell into deficit territory in July.Transportation equipment (mainly passenger cars) saw its...

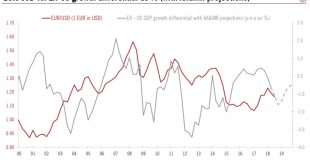

Read More »A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the euro.As a consequence, we have lowered our...

Read More »Weekly View – Turkish spillovers

The CIO office’s view of the week ahead.Last week market volatility was driven by news headlines, rather than fundamentals. This was particularly evident in emerging markets (EM), which continued to underperform despite the stabilisation of the Turkish lira. Chinese internet company Tencent piqued investor nervousness after reporting disappointing Q2 results, against a broader backdrop of concern around slowing Chinese economic growth and technology stocks’ growth prospects. While the...

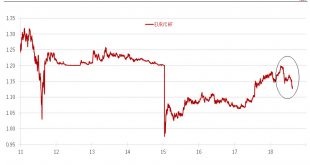

Read More »Europe chart of the week – Swiss franc

Recent foreign exchange movements pave the way for a cautious SNB monetary policy.In April, the EUR/CHF rate (1 euro in Swiss franc) hit its highest level since the Swiss National Bank (SNB) decided to lift its exchange rate floor in January 2015. Since then, the Swiss franc has appreciated by 5.8% against the euro, mainly driven by political uncertainty in Italy and concerns that Turkey’s economic troubles could impact European banks.Movements in the foreign exchange (FX) markets are...

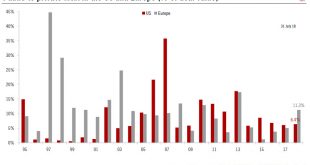

Read More »The global M&A value is running close to its 2015 peak

Despite a disappointing equity market performance this year, M&A activity remains buoyant.Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.Since...

Read More »Weekly View – “We have our people”

The CIO office’s view of the week ahead.Last week, markets were troubled by the dramatic decline of the Turkish lira and the potential for the spread of contagion elsewhere in markets. The lira fell by 12% on Friday and 35% since the start of 2018 against the dollar. Emerging Market (EM) equities fell but overall losses for the week were limited. Elsewhere, the European Central Bank voiced its concern over EU banks’ exposure to Turkish borrowers, sending European banks’ shares and the euro...

Read More »Europe chart of the week – Turkey

European banks’ exposure to Turkey looks non-systemic and manageable overall, although a number of indirect effects could amplify the eventual losses.The rapid depreciation of the Turkish Lira is raising concerns at the European Central Bank over European banks’ exposure to Turkey, according to recent press reports. Data from the Bank of International Settlements (BIS) show that the total exposure of foreign banks to Turkish assets was USD223 bn in Q1 2018, on an ultimate risk basis (net of...

Read More »US CPI inflation still moderate

Underlying inflation in the US remains moderate in July, confirming there is still limited impact of the trade tariffs.July’s US CPI data showed that underlying inflation remains moderate despite the strong economy, the tight labour market and the higher customs duties recently put in place by the Trump administration. The headline CPI print rose 0.2% m-o-m in July, keeping the y-o-y reading at 2.9%. This y-o-y print was still mostly driven by energy prices (up 25% y-o-y), but this boost...

Read More » Perspectives Pictet

Perspectives Pictet