Dong Chen, Sales Manager, Afore New Energy

Read More »Dong Chen, Sales Manager, Afore New Energy

Dong Chen, Sales Manager, Afore New Energy

Read More »Weekly View – deal or no deal

The CIO office’s view of the week ahead.Last week, the US concluded a trade ‘deal’ with Mexico, although the extent of changes is limited, mostly targeting the car industry. While this is a step in the right direction, the picture is not clear-cut and could ultimately be a story of several deals. Meanwhile, this week we expect Trump’s confirmation regarding the potential for further tariffs on USD 200bn of Chinese imports, fuelling uncertainty around global trade. China’s economy is already...

Read More »Assuaging yield curve anxiety

Unlike some Fed policy makers, Fed economic staff have been downplaying the significance of recent yield curve flattening.The ongoing yield curve compression (the narrowing difference between short-term and long-term Treasury yields) has become a key focus for Federal Reserve (Fed) policymakers. Several Fed researchers have released notes dismissing some policymakers’ anxiety about a flattening yield curve, the latest coming from economic staff at the San Francisco Fed.Some of them,...

Read More »Peak headline inflation for the euro area?

Latest inflation report came in on the softer side of expectations, but changes in headline inflation are likely to gain importance as we move closer to policy normalisation.Although the European Central Bank’s (ECB) mandate is defined in terms of headline inflation (targeting an annual rate of “below, but close to 2%” over the medium-term), over the past few years, the central bank has been mainly focused on underlying consumer price dynamics, including core inflation. Looking forward,...

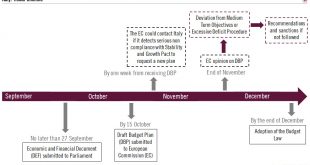

Read More »Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found.September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures.In this contract, the governing coalition, made up of the Five Star Movement (M5S) and the League, committed to a...

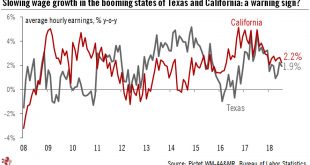

Read More »State data’s sobering message for future US wage gains

US wage growth has remained puzzlingly weak lately, possibly held back by structural factors.Perennially slow wage growth partly explains why the Federal Reserve’s monetary tightening has been so slow despite the strong US labour market and core inflation that is now at or about the Fed’s target of 2%. Hence the close market attention to wage growth, which could influence Fed policy considerably. Recent wage data has remained tame, with average hourly earnings in July growing an uninspiring...

Read More »Powell maintains his middle-of-the-road approach to tightening

Jerome Powell’s speech at Jackson Hole brought limited news, reinforcing our Fed scenario of one quarter-point rate hike per quarter.At the Jackson Hole conference last week, Fed chairman Jerome Powell once again showed his pragmatic and cautious approach to monetary tightening: US rate hikes should continue at a gradual pace, even though the US economy is in strong shape.Powell took a well-trodden path in his Jackson Hole speech, discussing once again the numerous uncertainties around the...

Read More »Weekly View – the show must go on

The CIO office’s view of the week ahead.Jerome Powell’s speech at the Jackson Hole summit of central bankers on Friday helped support emerging markets (EM) after a nervous few weeks, especially in Turkey. While the Fed chairman reiterated plans for the gradual normalisation of monetary policy, he also said that the economy is not at risk of overheating, meaning the Fed is unlikely to accelerate rate rises. This, in combination with Trump’s vocal aversion to a strong dollar (he said last week...

Read More »Men’s Taijijian 男子太极剑 第2名 广东队 陈伟杰 9.67分 guang dong chen wei jie 2017年全国武术套路锦标赛

2017年全国武术套路锦标赛 2017 National Wushu Routine Championship 时间:2017年5月26日至29日 地点:中国江苏无锡体育中心体育馆 My website:https://www.facebook.com/keitai.yamamoto

Read More » Perspectives Pictet

Perspectives Pictet