The CIO office’s view of the week ahead.One-time Remain advocate, Jo Johnson (brother of leading Leave campaigner Boris), resigned from his position as minister of transport in protest at Theresa May’s handling of Brexit negotiations. Johnson’s departure signals an increased risk of no deal or a second referendum in our view, with a high level of uncertainty around the outcome persisting. Sterling’s subsequent fall reinforces our play on GBP volatility, which we maintain as the best strategy...

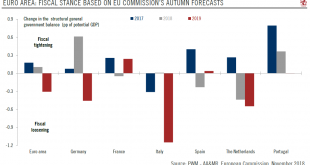

Read More »Euro area’s fiscal policy to turn supportive of growth next year

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.Germany, Italy and the Netherlands are planning fiscal expansions, but Spain,...

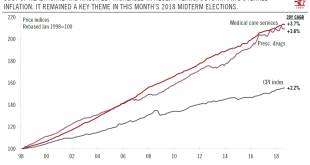

Read More »Rising healthcare costs continue to be a hot-button issue in US politics

More political scrutiny of drug and treatment prices is likely following the midterm elections.Healthcare policy was a key theme in the midterm elections and it seems that Democrats capitalised on this popular anxiety better than Republicans (they gained enough seats in the House of Representatives to secure a majority). Indeed, one of President Trump’s key failures over the past two years has been around healthcare policy. The Congressional vote to partly repeal Obama’s healthcare reform...

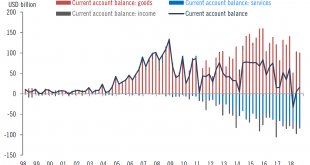

Read More »China’s days of current account surplus may be behind it

Structural changes may lead to the first current account deficit in over two decades this year.Over the first three quarters of this year, China ran a current account deficit of USD12.8 billion. It looks likely that China will see its first full-year current account deficit in over two decades in 2018.We believe that China’s current account position is going through structural change, driven by two trends. The first is the decline in China’s merchandise trade surplus. Indeed, since reaching...

Read More »US outlook after the 2018 midterms

[embedded content] Following the US midterm elections, Senior US Economist Thomas Costerg and Senior Cross-Asset Strategist Jacques Henry discuss the outlook for the US economy and markets.

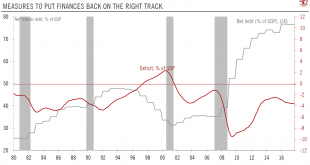

Read More »Trump fails to upset the law of (midterm) gravity

The gridlock produced the midterm elections complicates legislation, but our central scenario for the US economy remains unchanged.As predicted, Democrats gained enough seats in the House to form a majority (their first since Barack Obama’s first term). As also expected by polls, they lost seats in the Senate, where they remain a minority. With a Congress that will likely be gridlocked, legislation, including tax legislation, is likely to be meagre, leaving the US economy to continue to...

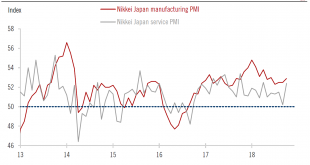

Read More »Japan services PMI rebounds strongly in October

The domestic economy is retaining its momentum, but external headwinds are building.The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September. The rise in services PMI suggests domestic demand remains solid. On the one hand, household consumption is recovering. Retail sales have undergoing an expansion...

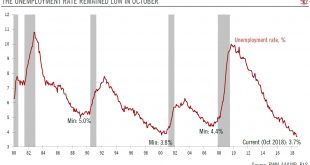

Read More »US employment and wage growth continue to shine

Latest data indicates the US business cycle is in good shape and sets the stage for rate hike next month.US employment grew by 250,000 in October (+1.7% y-o-y); the 3-month average is now a solid 218,000/month, and strong October payroll results were strong, which bodes well for US GDP growth in Q4. It appears therefore that the US’ heated rhetoric towards China is having little effect so far on the US economy.The mere fact that the US economy continues to generate such job growth is an...

Read More »Weekly View – Temporary relief

The CIO office’s view of the week ahead.Several factors halted the equity sell-off last week. Investors continued to take a jaundiced eye of some corporate guidance, but Q3 earnings growth has finally turned out as good as in previous quarters (around 25% year on year for the S&P 500). The sky has seemed to brighten on other fronts too. Most conspicuously, oil prices have fallen and president Trump has floated the idea that tensions with China might be easing. Investors should probably...

Read More »Su Dong Chen

Kross method

Read More » Perspectives Pictet

Perspectives Pictet