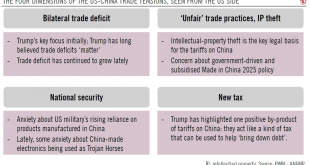

Although highly uncertain, any truce between the US and China at the G20 meeting could delay new tariffs.A new low point in trade tensions between the US and China was reached in September 2018 when the US placed an additional 10% duty on roughly USD200 billion of Chinese imports. However, since then, hints at a potential ‘détente’ have focused on the G20 summit in Buenos Aires at the end of November, with hopes that progress there could delay the setting of tariffs on all Chinese imports...

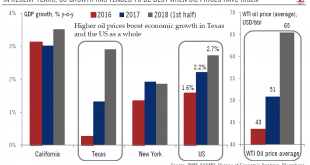

Read More »By threatening growth in Texas, collapsing oil prices could hurt the US at large

Historical data suggest that, instead of boosting consumer spending, lower oil prices can harm the US economy’s growth prospects and persuade the Fed to stall its tightening plans.The link between oil prices and the health of the US economy has changed considerably this decade, especially as a result of the domestic energy sector boom. The US produced a record high of 11.7 million barrels per day last week, versus only around 5 million in 2008.The epicentre of this oil boom, linked to...

Read More »Weekly View – SHIFTING SCALES

The CIO office’s view of the week ahead.Oil is on a losing streak. 12 consecutive days of falling prices led to a rise in high yield spreads. Because this decline has been largely supply-, rather than demand-driven and on the front-end of the forward curve, we are not overly alarmed about the long-term prospects of the oil price at this point. However, as a result of these recent moves, US high yield has suffered in particular, putting pressure on financial conditions. This was followed by...

Read More »In Conversation with Cesar Perez Ruiz

[embedded content] After a decade of protection from central banks, the markets are changing. But Cesar Perez Ruiz, Pictet’s chief investment officer, says this needn’t be cause for concern. During the Investment Summit, at Pictet’s headquarters in Geneva, he made the case for active management and strategic asset allocation as important contributors to healthy returns.

Read More »Pictet – In Conversation with Cesar Perez Ruiz

After a decade of protection from central banks, the markets are changing. But Cesar Perez Ruiz, Pictet’s chief investment officer, says this needn’t be cause for concern. During the Investment Summit, at Pictet’s headquarters in Geneva, he made the case for active management and strategic asset allocation as important contributors to healthy returns.

Read More »Pictet – In Conversation with Cesar Perez Ruiz

After a decade of protection from central banks, the markets are changing. But Cesar Perez Ruiz, Pictet’s chief investment officer, says this needn’t be cause for concern. During the Investment Summit, at Pictet’s headquarters in Geneva, he made the case for active management and strategic asset allocation as important contributors to healthy returns.

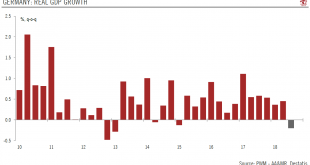

Read More »German Q3 contraction: more than a blip?

German economy should rebound this quarter, but external demand poses a downside risk.Real GDP in Germany fell 0.2% q-o-q in Q3, compared with a 0.5% rise in Q2. This was below consensus and marks the first quarterly contraction in GDP since Q1 2015. The headline number looks horrible, but the market was prepared, as high-frequency data were already pointing in that direction.As usual, the Federal Statistical Office will release more detailed information on the GDP expenditure components on...

Read More »US retail prices show limited signs of tariff effect

Tariffs on Chinese goods would seem to be having little impact on some retail prices so far.US core inflation (excluding energy and food prices) remains relatively muted, slowing slightly to 2.1% y-o-y in October, from 2.2% in September. The average over the past year is 2.1%.To some degree, the surprise was that prices did not increase more, especially given fresh tariffs on Chinese imports. In late September the Trump administration imposed a 10% tariff on roughly USD200 billion of Chinese...

Read More »In conversation with Edward Luce

[embedded content] With geopolitical currents challenging the west’s long-standing liberal status quo, we live in an age of global uncertainty. But even as the world enters what has been described as a “democratic recession”, there’s cause for optimism. Edward Luce is The Financial Times’ US national editor; at Pictet’s 2018 Investment Summit he outlined how beneficial a truly global perspective can be in the face of change.

Read More »Pictet – In Conversation with Edward Luce

With geopolitical currents challenging the west’s long-standing liberal status quo, we live in an age of global uncertainty. But even as the world enters what has been described as a “democratic recession”, there’s cause for optimism. Edward Luce is The Financial Times’ US national editor; at Pictet’s 2018 Investment Summit he outlined how beneficial a truly global perspective can be in the face of change. https://www.group.pictet/wealth-management

Read More » Perspectives Pictet

Perspectives Pictet