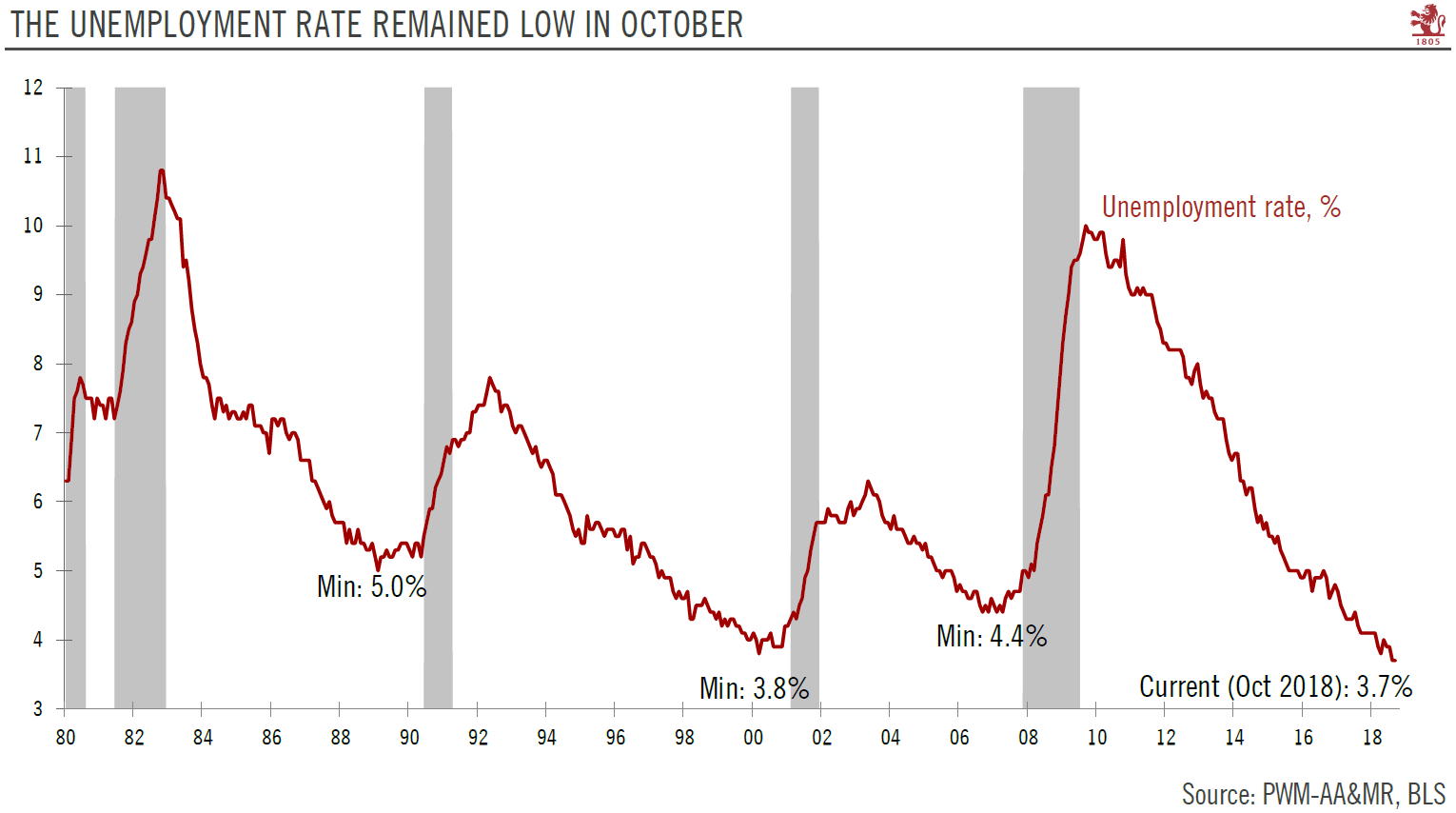

Latest data indicates the US business cycle is in good shape and sets the stage for rate hike next month.US employment grew by 250,000 in October (+1.7% y-o-y); the 3-month average is now a solid 218,000/month, and strong October payroll results were strong, which bodes well for US GDP growth in Q4. It appears therefore that the US’ heated rhetoric towards China is having little effect so far on the US economy.The mere fact that the US economy continues to generate such job growth is an indication that the US business cycle is in good shape, with a low risk of recession in the near term. Furthermore, despite signs that the business cycle is maturing, our optimism about the latter’s continued strength is supported by strong employment gains in cyclically-sensitive sectors such as

Topics:

Thomas Costerg considers the following as important: Macroview, US business cycles, us job creation, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest data indicates the US business cycle is in good shape and sets the stage for rate hike next month.

US employment grew by 250,000 in October (+1.7% y-o-y); the 3-month average is now a solid 218,000/month, and strong October payroll results were strong, which bodes well for US GDP growth in Q4. It appears therefore that the US’ heated rhetoric towards China is having little effect so far on the US economy.

The mere fact that the US economy continues to generate such job growth is an indication that the US business cycle is in good shape, with a low risk of recession in the near term. Furthermore, despite signs that the business cycle is maturing, our optimism about the latter’s continued strength is supported by strong employment gains in cyclically-sensitive sectors such as manufacturing and construction, as well as temporary employment. In other words, sign point to underlying fundamentals in the US economy being healthy.

Wage growth continued to creep higher in October (+3.1% y-o-y), but the pace of wage gains remains gradual and wage growth is still lower than the pre-2008 growth rates. The risk of a corporate margin squeeze is increasing but should not be exaggerated at this stage.

The Federal Reserve looks set to increase rates again at its December meeting, continuing its routine of one rate increase per quarter – unless there are important financial-market jitters between now and then. While October wage growth numbers were strong, we do not expect the Fed to accelerate its current routine of rate increase per quarter. This could change however, if wage growth exceeds 3.5% in the near term, in which case the Fed could increase the frequency of its rate hikes, provided GDP growth exceeds expectations as well.