The gridlock produced the midterm elections complicates legislation, but our central scenario for the US economy remains unchanged.As predicted, Democrats gained enough seats in the House to form a majority (their first since Barack Obama’s first term). As also expected by polls, they lost seats in the Senate, where they remain a minority. With a Congress that will likely be gridlocked, legislation, including tax legislation, is likely to be meagre, leaving the US economy to continue to digest the December 2017 tax cuts.The potential new Democratic House Speaker Nancy Pelosi hinted at a pragmatic approach to relations with President Trump, playing down the risk of launching an impeachment procedure. Her key focus seems to be healthcare policy, where she voiced the hope of working with

Topics:

Thomas Costerg considers the following as important: Macroview, us midterm elections, US politics

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The gridlock produced the midterm elections complicates legislation, but our central scenario for the US economy remains unchanged.

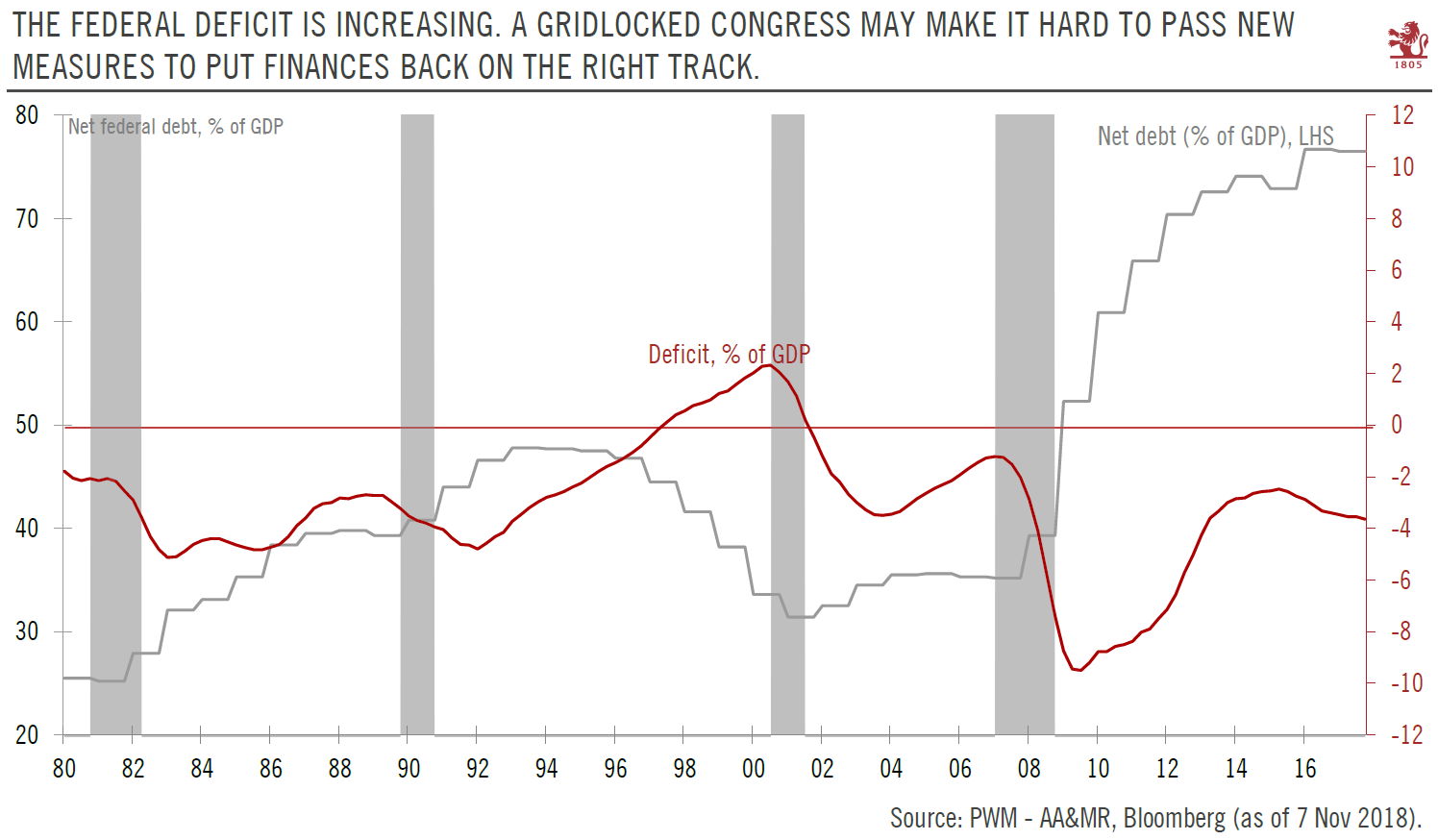

As predicted, Democrats gained enough seats in the House to form a majority (their first since Barack Obama’s first term). As also expected by polls, they lost seats in the Senate, where they remain a minority. With a Congress that will likely be gridlocked, legislation, including tax legislation, is likely to be meagre, leaving the US economy to continue to digest the December 2017 tax cuts.

The potential new Democratic House Speaker Nancy Pelosi hinted at a pragmatic approach to relations with President Trump, playing down the risk of launching an impeachment procedure. Her key focus seems to be healthcare policy, where she voiced the hope of working with Republicans on lowering drug prices.

But the prospect for large-scale infrastructure spending, while an area of possible political convergence, remains uncertain, as there could be disagreement over federal funding. Likewise, the road ahead for tech regulation remains uncertain, in spite of the enthusiasm of some newly elected Democrats for controlling big tech.

The Democrats could give tacit agreement to Trump’s tough trade negotiation tactics, in particular towards China. We still believe there will be further tariffs on Chinese imports, even though bilateral dialogue should continue. Of particular note in the near term will be the G20 meeting in Buenos Aires at the end of this month.

Overall, we remain constructive on the US economic outlook as domestic drivers, particularly business investment, do not look like they’re losing steam. We still see GDP growth of 3% in 2018 as a whole, and north of 3% in 4Q. As a result, we are also maintaining our scenario of one additional Federal Reserve rate increase by December and three further ones next year.