With geopolitical currents challenging the west’s long-standing liberal status quo, we live in an age of global uncertainty. But even as the world enters what has been described as a “democratic recession”, there’s cause for optimism. Edward Luce is The Financial Times’ US national editor; at Pictet’s 2018 Investment Summit he outlined how beneficial a truly global perspective can be in the face of change. https://www.group.pictet/wealth-management

Read More »After May’s divorce deal: the road ahead for Brexit

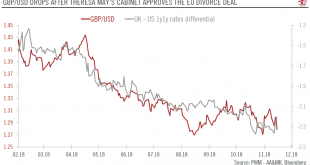

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months.Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give the EU too much influence on UK affairs.The next step is formal approval of...

Read More »China hard data for October reveals mixed picture

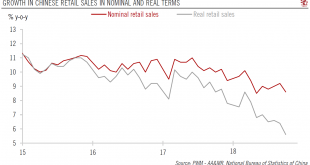

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.Growth in fixed asset investment rebounded strongly in October, to 8.1%...

Read More »Pictet Investment Summit

[embedded content] The world is at a crossroads: while geopolitical tensions threaten to upend the established order, developments in areas such as healthcare and technology offer new vistas of possibility for humanity. Uncertainty may seem to be the order of the day but Pictet’s Investment Summit offered a more reassuring message. With more than 200 years of experience, the bank has negotiated the currents of change before; at Pictet’s headquarters in the heart of Geneva, a dynamic line-up...

Read More »Pictet – Investment Summit

The world is at a crossroads: while geopolitical tensions threaten to upend the established order, developments in areas such as healthcare and technology offer new vistas of possibility for humanity. Uncertainty may seem to be the order of the day but Pictet’s Investment Summit offered a more reassuring message. With more than 200 years of experience, the bank has negotiated the currents of change before; at Pictet’s headquarters in the heart of Geneva, a dynamic line-up of...

Read More »Pictet – Investment Summit

The world is at a crossroads: while geopolitical tensions threaten to upend the established order, developments in areas such as healthcare and technology offer new vistas of possibility for humanity. Uncertainty may seem to be the order of the day but Pictet’s Investment Summit offered a more reassuring message. With more than 200 years of experience, the bank has negotiated the currents of change before; at Pictet’s headquarters in the heart of Geneva, a dynamic line-up of speakers...

Read More »Key trends shaping the future of consumption

Giant digital companies are increasingly competing in the physical world by personalising their offerings, and offering products that create a ‘better me’ or a better world. But some retailers are fighting back by creating real world experiences that cannot be rivalled online.Understanding the consumer of the future is critical to success in a fast-changing world where the old rules no longer apply. Brands need to react to the evolving needs of consumers who are prepared to change their...

Read More »Italian government sticks to its 2019 deficit plan

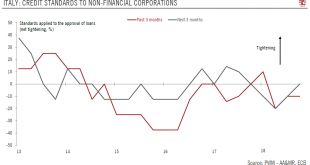

The minor concessions continued in the revised plan presented to the European Commission are unlikely to dissuade Brussels from launching sanctions.In a letter to the European Commission on 13 November, the Italian government confirmed that it would aim for a budget deficit at 2.4% of GDP in 2019 and reasserted its real growth forecast of 1.5% for next year. Rome made only minor concessions to Brussels’ demand that it revise its fiscal plan. It committed to raising its privatisation efforts...

Read More »Su Dong Chen

Striking power

Read More »Su Dong Chen

Striking power

Read More » Perspectives Pictet

Perspectives Pictet