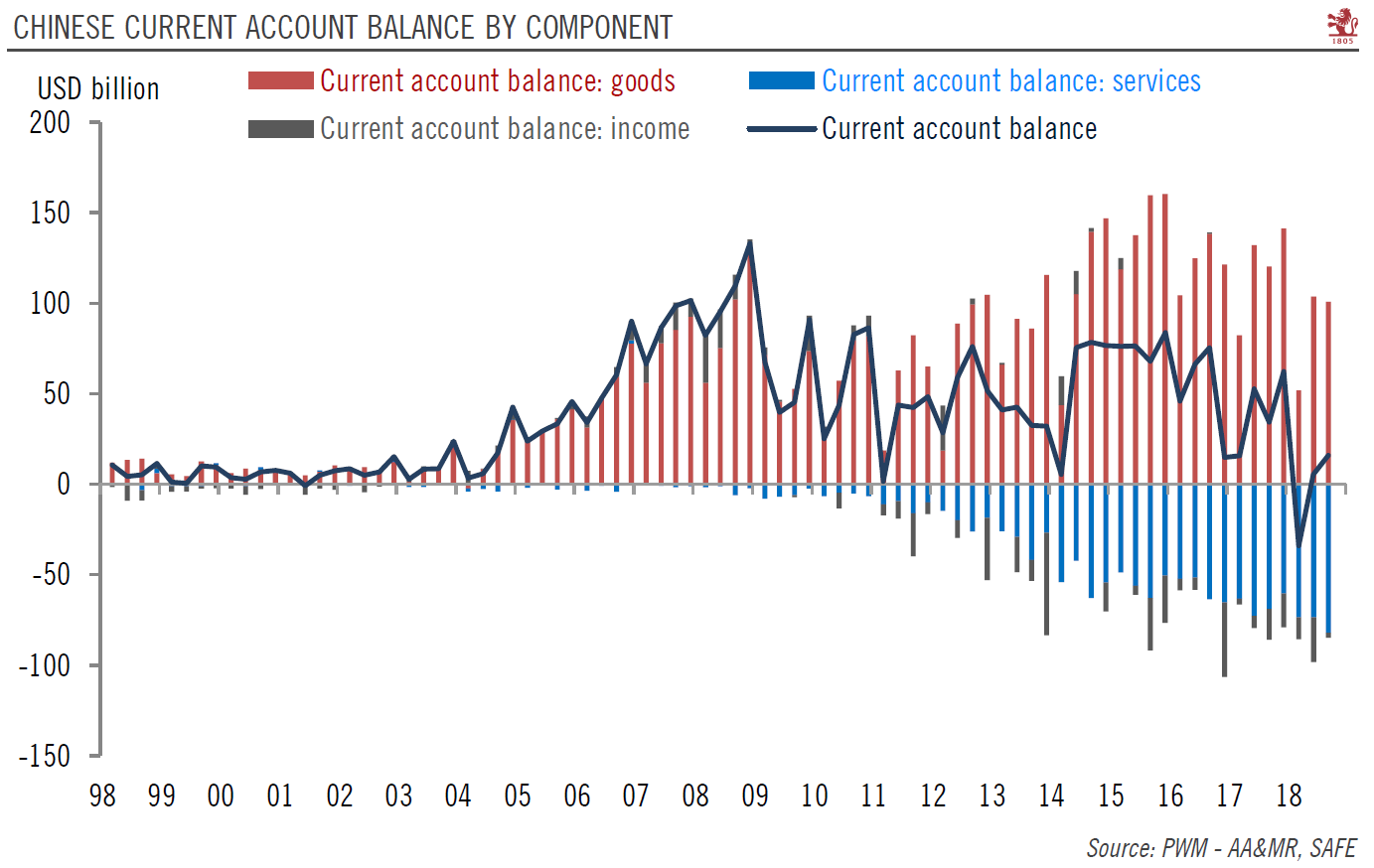

Structural changes may lead to the first current account deficit in over two decades this year.Over the first three quarters of this year, China ran a current account deficit of USD12.8 billion. It looks likely that China will see its first full-year current account deficit in over two decades in 2018.We believe that China’s current account position is going through structural change, driven by two trends. The first is the decline in China’s merchandise trade surplus. Indeed, since reaching a peak in late 2016 at nearly 38% of GDP, exports as a share of GDP has been falling, to below 20% in Q3 2018. The second change is China’s growing trade deficit in services, particularly as a result of outbound tourism and education abroad. There is little sign of either trend abating any time soon.

Topics:

Dong Chen considers the following as important: China currency forecast, China trade war, Macroview, US China trade tension

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Structural changes may lead to the first current account deficit in over two decades this year.

Over the first three quarters of this year, China ran a current account deficit of USD12.8 billion. It looks likely that China will see its first full-year current account deficit in over two decades in 2018.

We believe that China’s current account position is going through structural change, driven by two trends. The first is the decline in China’s merchandise trade surplus. Indeed, since reaching a peak in late 2016 at nearly 38% of GDP, exports as a share of GDP has been falling, to below 20% in Q3 2018. The second change is China’s growing trade deficit in services, particularly as a result of outbound tourism and education abroad. There is little sign of either trend abating any time soon. Indeed, should ongoing trade tensions continue to weight on China’s outbound trade and erode its trade surplus, the trend could accelerate.

There is little sign that these two trends are going to reverse anytime soon. Given elevated trade tensions with the US, the migration of supply chains out of China may accelerate in the medium to long term. This could lead to further erosion of China’s merchandise trade surplus. Meanwhile, the growth in outbound tourism and demand for foreign education is bound up with China’s transition towards household consumption

Over the long term, it looks likely that the Chinese government will have to allow the renminbi to depreciate more against the currencies of its major trading partners, although for the moment it remains subject to the central bank’s intervention. It is also likely that China will need more foreign direct investment to compensate for the current account deficit. It is to this effect that Chinese authorities have reduced entry barriers to foreign investment in various industries, and could decide to continue to open up China’s domestic financial markets.