Political gridlock has been good news for US stocks in the past, but Tuesday’s midterm elections come at a time of rising doubts about market prospects.The US midterm elections take place on Tuesday 6 November. Based on recent polls, the most likely outcome is that the Democrats will regain a small majority in the House of Representatives, while the Republicans keep a small majority in the Senate.Should the Democrats take control of the House, Washington D.C. could be back to ‘gridlock as usual’, with little new major legislation being passed over the next two years. But while Democrats may not want to work with Trump, there could be ‘passive compromise’ on trade policy, particularly with regard to China.The main alternative to this scenario is failure by the Democrats to mobilise

Topics:

Team Asset Allocation and Macro Research considers the following as important: Macroview, US equities outlook, us midterm elections, US politics

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Political gridlock has been good news for US stocks in the past, but Tuesday’s midterm elections come at a time of rising doubts about market prospects.

The US midterm elections take place on Tuesday 6 November. Based on recent polls, the most likely outcome is that the Democrats will regain a small majority in the House of Representatives, while the Republicans keep a small majority in the Senate.

Should the Democrats take control of the House, Washington D.C. could be back to ‘gridlock as usual’, with little new major legislation being passed over the next two years. But while Democrats may not want to work with Trump, there could be ‘passive compromise’ on trade policy, particularly with regard to China.

The main alternative to this scenario is failure by the Democrats to mobilise sufficiently, leaving the House in Republican hands. This is likelier than a ‘blue wave’ scenario in which the Democrats take both the House and the Senate by a wide margin.

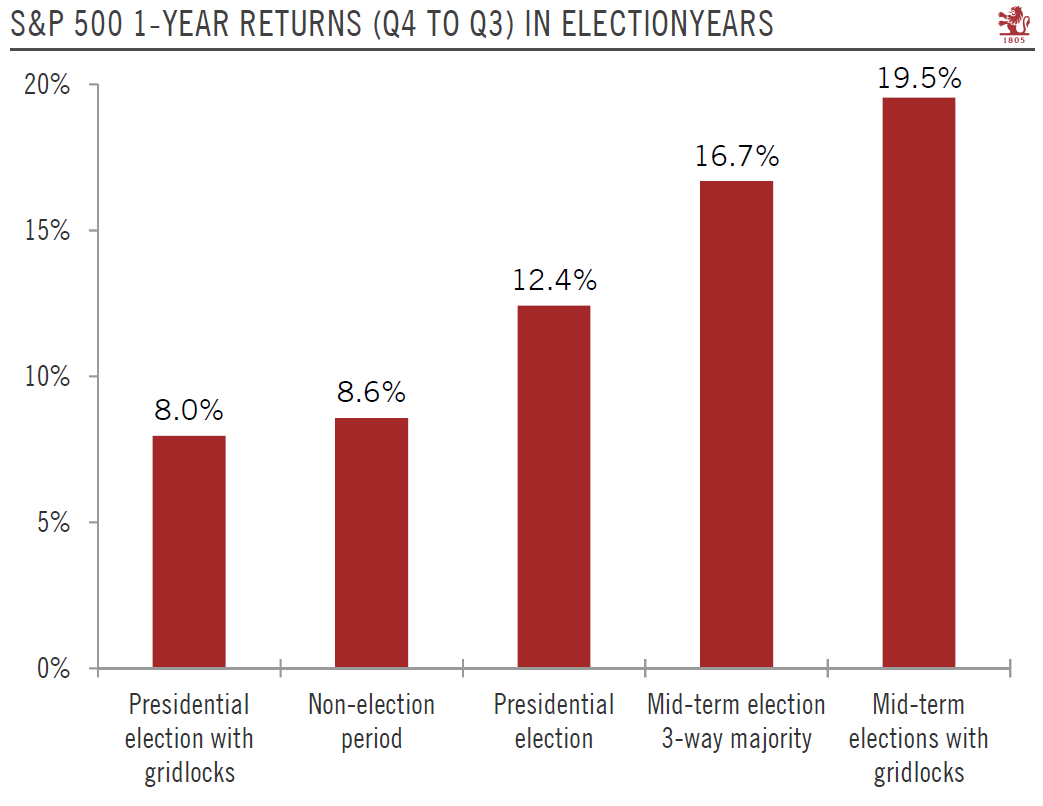

Historically, the outcome of midterm US elections has been supportive of equity markets, and even more if it produces political gridlock, which is our core scenario. The Q3 reporting season, which was a major contributor to the October sell-off, has shown some improvements in recent days.

But this year, the midterm elections come at a time of rising concerns about the prospects for risk assets. This can be seen by looking at the VIX index. Others remain, including, to name but three, Fed rate hikes, serious trade tensions and Italian political risk. Any sign that trade tensions are abating would likely have a more material impact on risk assets than the outcome of the midterm elections. But this is not in our core scenario for the moment, as a tough stance on trade talks with China still has wide support from Republicans and Democrats alike. In short, the trade tensions that have weighed on equity valuations may not cool down significantly. This could cap an equity rebound.