The domestic economy is retaining its momentum, but external headwinds are building.The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September. The rise in services PMI suggests domestic demand remains solid. On the one hand, household consumption is recovering. Retail sales have undergoing an expansion over the last few months, after being soft in the first half of of the year. Income growth finally started to gain momentum in 2018. We therefore the Japanese consumer sector to continue recovering over the coming months.On the other hand, Japan’s export sector is a source of concern. Overseas demand

Topics:

Dong Chen considers the following as important: Japan economy, Japan GDP, Japan household consumption, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The domestic economy is retaining its momentum, but external headwinds are building.

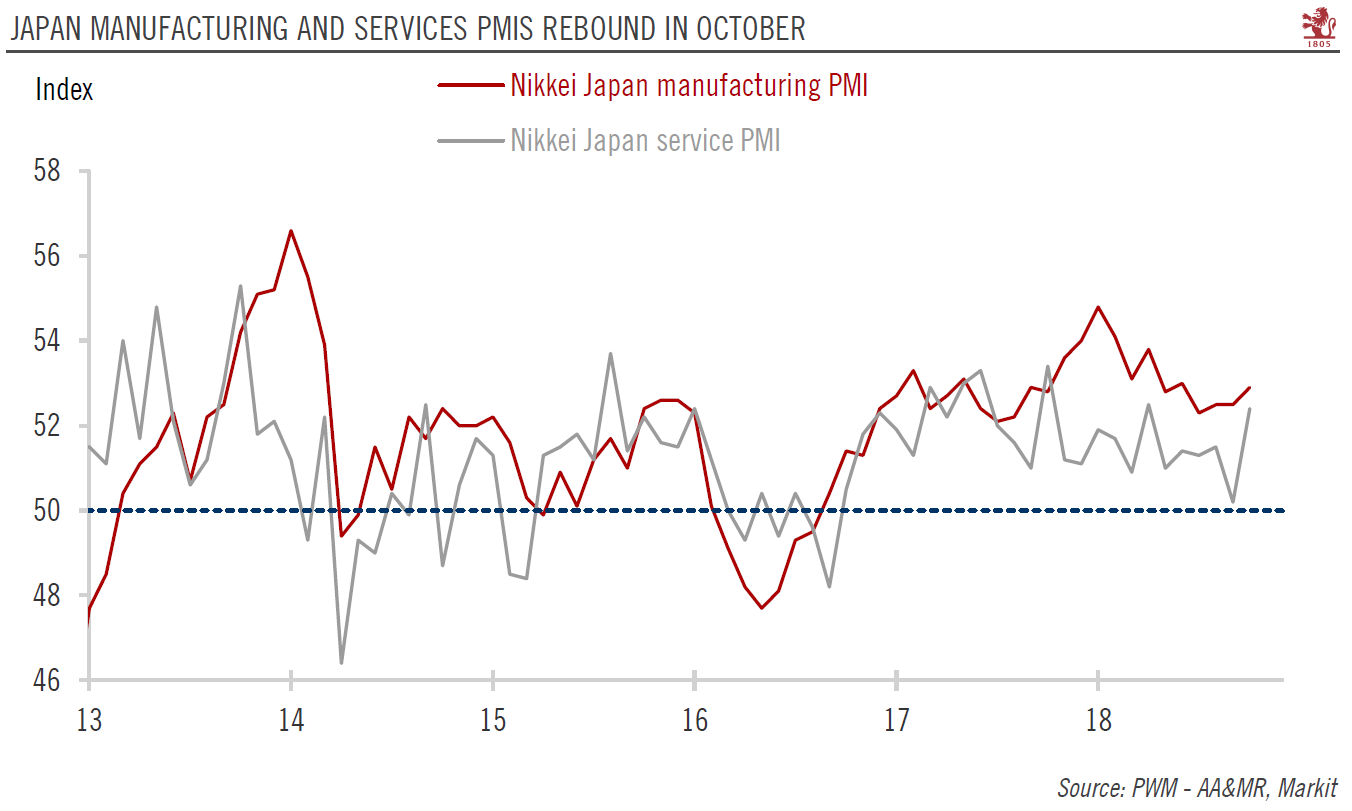

The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September. The rise in services PMI suggests domestic demand remains solid. On the one hand, household consumption is recovering. Retail sales have undergoing an expansion over the last few months, after being soft in the first half of of the year. Income growth finally started to gain momentum in 2018. We therefore the Japanese consumer sector to continue recovering over the coming months.

On the other hand, Japan’s export sector is a source of concern. Overseas demand for Japanese machinery has declined on a year-on-year basis since July, with the latest data available for August showing a decline of -2.4%. In our view this likely reflects a deterioration in corporate sentiment in the face of rising uncertainties about the global economic outlook. Japan is not directly involved in any trade disputes with the US, but it is vulnerable to any trade disruptions due to its role as a major supplier of capital goods and an important link in the global supply chain. Elevated tensions could therefore continue to weight on Japanese growth in the near future.