The latest edition of Horizon is out, presenting Pictet Wealth Management’s expected returns for the main asset classes over the next 10 years. We believe that the returns that can be expected from developed-market equities over the next 10 years will be over a third lower than average of the past 46 years. Growth potential and inflation trends suggest that expected annual returns for US equities could decline to just over 5% over the next 10 years, compared with a historic 10-year average of about 7%, for example.Our main conclusion is that there is no such thing as a free lunch. Better returns require taking more risk. According to our calculations, private equity will provide the highest annual returns, but with the greatest volatility risk, while cash (especially Japanese cash) will provide little or no return in spite of low historical volatility.Some of our expectations for the main asset classes are presented in the bullet points below. In general, our conclusions are based on proprietary risk-return models combined with our internal economic forecasts. Our calculations and methodology are detailed asset class by asset class in Horizon.According to our expectations, global equities can be expected to post a 6% return in US dollars annually for the next 10 years, which is lower than the 8.6% average long-term annual return of the S&P 500.

Topics:

Perspectives Pictet considers the following as important: 10 year expected returns, bond returns, cash returns, equity returns, Government Bonds, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

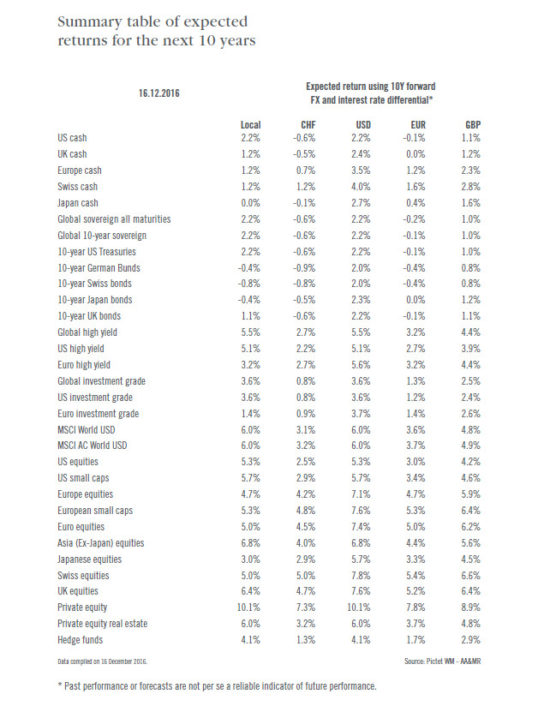

The latest edition of Horizon is out, presenting Pictet Wealth Management’s expected returns for the main asset classes over the next 10 years.

We believe that the returns that can be expected from developed-market equities over the next 10 years will be over a third lower than average of the past 46 years. Growth potential and inflation trends suggest that expected annual returns for US equities could decline to just over 5% over the next 10 years, compared with a historic 10-year average of about 7%, for example.

Our main conclusion is that there is no such thing as a free lunch. Better returns require taking more risk. According to our calculations, private equity will provide the highest annual returns, but with the greatest volatility risk, while cash (especially Japanese cash) will provide little or no return in spite of low historical volatility.

Some of our expectations for the main asset classes are presented in the bullet points below. In general, our conclusions are based on proprietary risk-return models combined with our internal economic forecasts. Our calculations and methodology are detailed asset class by asset class in Horizon.

- According to our expectations, global equities can be expected to post a 6% return in US dollars annually for the next 10 years, which is lower than the 8.6% average long-term annual return of the S&P 500. US Treasuries could end up providing less than half the 4.8% annual return they have delivered over the past 10 years. 10-year government bonds in the euro area, Switzerland and Japan will deliver negative returns.

- Euro investment-grade (IG) corporate bonds can be expected to post positive returns of the order of 1.3% annually over the next 10 years, while US dollar IG returns will average 3.2%. USD high yield (HY) can be expected to post equity-like returns of 5.5% annually, compared with 3.5% for euro HY.

- In the meantime, alternatives should harvest the liquidity premium that comes attached, with an average annual return for hedge funds of 4% (in USD).

- Finally, the gradual increase in short-term rates should lead to a slightly positive return for cash, of the order of 2% annually.