Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived dovishness of the Fed. Broad positive macro data in the euro area and increasing signs that US fiscal stimulus might be delayed have also been helping the euro against the US dollar.From a tactical point of view, we believe downward pressure on the EUR/USD rate is likely before May as inflation in the euro area disappoints again and uncertainties about the French election linger. But looking ahead over the next few months, we do not expect any political accident during the French presidential election and it is very likely that the ECB will adopt a more hawkish stance at its monetary policy meeting on 8 June. These two events are expected to be supportive of the euro. Consequently, the EUR/USD rate is likely to move in a relatively broad range between 1.05 and 1.10 in the next few months and not towards parity as previously expected.

Topics:

Luc Luyet considers the following as important: Dollar strength, ECB hawkishness, euro currency forecast, Macroview, USD/EUR rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.

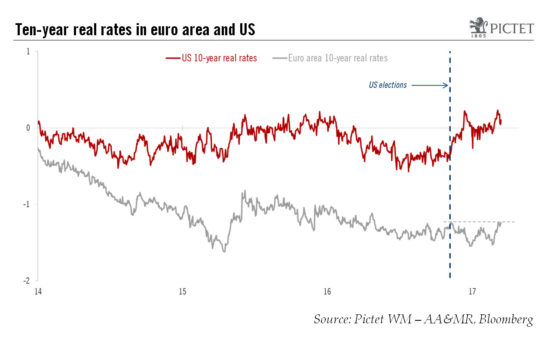

The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived dovishness of the Fed. Broad positive macro data in the euro area and increasing signs that US fiscal stimulus might be delayed have also been helping the euro against the US dollar.

From a tactical point of view, we believe downward pressure on the EUR/USD rate is likely before May as inflation in the euro area disappoints again and uncertainties about the French election linger. But looking ahead over the next few months, we do not expect any political accident during the French presidential election and it is very likely that the ECB will adopt a more hawkish stance at its monetary policy meeting on 8 June. These two events are expected to be supportive of the euro. Consequently, the EUR/USD rate is likely to move in a relatively broad range between 1.05 and 1.10 in the next few months and not towards parity as previously expected.

But in our opinion, it is too soon to call for the end of the depreciating trend in the EUR/USD rate. However, the expectation of looser fiscal policy in the US should lift the USD again, on the back of a higher growth outlook. Furthermore, given reduced slack in the economy, the US is prone to generate inflationary pressure at some stage down the road. In the euro area, notwithstanding the rebound in oil prices, inflationary pressure remains subdued. Consequently, any normalisation of the ECB’s monetary policy is likely to be very gradual.

In the longer term, there is no denying that the USD’s current long-term upward cycle is maturing. The two previous long-term USD appreciating trends have lasted between 77 and 80 months. The current one started in July 2011. Furthermore, in terms of valuation, the US dollar index is near extreme overvalued territory.