A generally more optimistic ECB looks set to announce its roadmap for QE tapering in September. QE tapering itself may start in Q1 2018.The ECB delivered a fairly balanced, albeit more optimistic message at today’s press conference, echoing upward revisions to the staff projections for 2017-18 euro area GDP growth and inflation. Crucially, however, the 2019 projection for inflation was left unchanged at 1.7%.Looking ahead, the ECB’s four inflation criteria are unlikely to be fully met before year’s end. We still expect the ECB to wait until September before announcing a tapering of asset purchases starting in Q1 2018. As regards policy rates, our baseline remains for a first hike in the deposit facility rate in Q4 2018.The ECB’s governing council statement was adjusted at the margin. It was still consistent with a dovish bias, although the press conference signalled a gradual shift in the ECB’s forward guidance toward a more neutral stance, in our view.Although the balance of risks on economic activity remained “tilted to the downside”, according to the statement, it said risks had become “less pronounced”.

Topics:

Frederik Ducrozet considers the following as important: core euro inflation, ECB forecasts, ECB policy outlook, Macroview, QE tapering

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A generally more optimistic ECB looks set to announce its roadmap for QE tapering in September. QE tapering itself may start in Q1 2018.

The ECB delivered a fairly balanced, albeit more optimistic message at today’s press conference, echoing upward revisions to the staff projections for 2017-18 euro area GDP growth and inflation. Crucially, however, the 2019 projection for inflation was left unchanged at 1.7%.

Looking ahead, the ECB’s four inflation criteria are unlikely to be fully met before year’s end. We still expect the ECB to wait until September before announcing a tapering of asset purchases starting in Q1 2018. As regards policy rates, our baseline remains for a first hike in the deposit facility rate in Q4 2018.

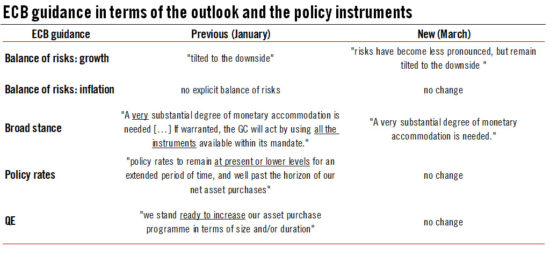

The ECB’s governing council statement was adjusted at the margin. It was still consistent with a dovish bias, although the press conference signalled a gradual shift in the ECB’s forward guidance toward a more neutral stance, in our view.

Although the balance of risks on economic activity remained “tilted to the downside”, according to the statement, it said risks had become “less pronounced”. Importantly, the bias for lower rates was kept in the statement, with policy rates expected to remain “at present or lower levels for an extended period of time, and well past the horizon of net asset purchases”, but the reference to rate cuts as a policy instrument was removed. The ECB also reiterated its commitment to implement QE until at least December 2017, and to increase the pace of asset purchases if needed.

To be sure, the bigger picture remains unchanged – the ECB’s mission is not yet complete. Beyond political risks, the ECB’s main concern continues to be the lack of “upward adjustment” in core prices. Core inflation remains too low, below 1% in February, and wage growth is subdued. We do not expect the ECB’s inflation criteria to be fully met until Q4 2017, providing ample justification for a cautious approach to policy normalisation.

Notwithstanding the improvement in the economic outlook, the ECB’s bias for rate cuts and QE extension was maintained at this stage. Still, a proper debate on the sequencing of policy normalisation could start at the ECB’s June meeting, including on the timing of tapering and rate hikes.