The Swiss National Bank left monetary policy unchanged at its latest meeting and forecast that the Swiss economy would grow 1.5% in 2017.At its latest policy meeting on 16 March, the Swiss National Bank (SNB) left the interest rate on sight deposits at a record low of -0.75% and the central bank reiterated its willingness to intervene in the foreign exchange market if needed, “taking the overall currency situation into consideration”, as it had mentioned in its previous press release. The SNB revised slightly up its inflation forecast for 2017 from 0.1% to 0.3% and foresees inflation of 0.4% and 1.1% for 2018 and 2019, respectively. The central bank remains “cautiously optimistic” for 2017 growth outlook, maintaining its forecast for the Swiss economy to grow by 1.5% in 2017.Our baseline scenario is for the interest rate on sight deposits with the SNB to stay at -0.75% in 2017, with a first rate hike coming in March 2018. FX interventions are likely to remain the policy tool of choice to counter any appreciation of the Swiss franc.Our main argument for this forecast is that the SNB is unlikely to pre-empt the ECB in normalising monetary policy. The ECB will most likely announce a tapering of asset purchases starting in Q1 2018. Moreover, the SNB might be keen to keep the current interest rate differential or even let the differential widen more.

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB monetary policy, Swiss economy, Swiss GDP forecast, Switzerland growth

This could be interesting, too:

Investec writes Swiss economy stalls in second quarter of 2023

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

The Swiss National Bank left monetary policy unchanged at its latest meeting and forecast that the Swiss economy would grow 1.5% in 2017.

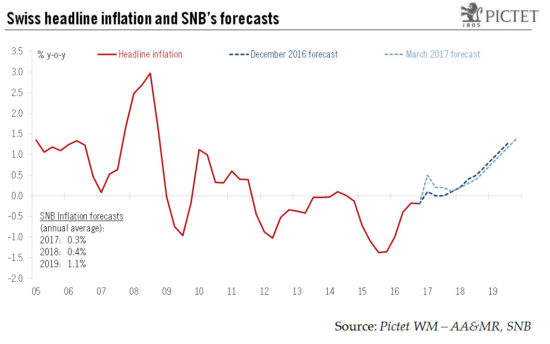

At its latest policy meeting on 16 March, the Swiss National Bank (SNB) left the interest rate on sight deposits at a record low of -0.75% and the central bank reiterated its willingness to intervene in the foreign exchange market if needed, “taking the overall currency situation into consideration”, as it had mentioned in its previous press release. The SNB revised slightly up its inflation forecast for 2017 from 0.1% to 0.3% and foresees inflation of 0.4% and 1.1% for 2018 and 2019, respectively. The central bank remains “cautiously optimistic” for 2017 growth outlook, maintaining its forecast for the Swiss economy to grow by 1.5% in 2017.

Our baseline scenario is for the interest rate on sight deposits with the SNB to stay at -0.75% in 2017, with a first rate hike coming in March 2018. FX interventions are likely to remain the policy tool of choice to counter any appreciation of the Swiss franc.

Our main argument for this forecast is that the SNB is unlikely to pre-empt the ECB in normalising monetary policy. The ECB will most likely announce a tapering of asset purchases starting in Q1 2018. Moreover, the SNB might be keen to keep the current interest rate differential or even let the differential widen more. Domestic developments also suggest that the SNB might be cautious before hiking. In particular, the SNB may want to wait for more sustained inflation and a stronger and more broad-based economic recovery.

Finally, we see three main external risks to our baseline scenario for SNB policy:

- A hawkish communication or/and a rate hike from the ECB in the coming months might lead the SNB to tighten policy.

- A rise in global growth might take pressure off the Swiss franc, allowing a Swiss hike in 2017.

- A significant deterioration in the European political landscape could put renewed upward pressure on the franc, forcing the SNB to cut rates.