With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US and euro area. However, we expect US and euro sovereign yields to rise this year. This should in theory translate into upwards pressure on yields in US and euro investment grade (IG) and high yield (HY). But with other factors also at play, there may be places in credit for fixed-income investors to hide in an environment of rising sovereign yields.Leverage ratios are declining among IG and HY companies, helped by recovering profits and a stabilisation of debt issuance. Potential US tax cuts and changes in rules on capital repatriation could benefit US IG spreads. Meanwhile, the recovery in oil prices and looser lending conditions should help default rates in US HY, which surged in 2016, to fall back again.Credit spreads are tight according to different valuation metrics, especially in HY, which has strongly outperformed IG in terms of spread ratios.

Topics:

Laureline Chatelain considers the following as important: Corporate bonds, credit spreads, fixed income forecasts, high-yield bonds, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Happy Days Are Here Again!

Joseph Y. Calhoun writes Weekly Market Pulse: The Real Reason The Fed Should Pause

Joseph Y. Calhoun writes Weekly Market Pulse: No News Is…

Joseph Y. Calhoun writes Weekly Market Pulse: Opposite George

With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.

Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US and euro area. However, we expect US and euro sovereign yields to rise this year. This should in theory translate into upwards pressure on yields in US and euro investment grade (IG) and high yield (HY). But with other factors also at play, there may be places in credit for fixed-income investors to hide in an environment of rising sovereign yields.

Leverage ratios are declining among IG and HY companies, helped by recovering profits and a stabilisation of debt issuance. Potential US tax cuts and changes in rules on capital repatriation could benefit US IG spreads. Meanwhile, the recovery in oil prices and looser lending conditions should help default rates in US HY, which surged in 2016, to fall back again.

Credit spreads are tight according to different valuation metrics, especially in HY, which has strongly outperformed IG in terms of spread ratios. We expect credit spreads to tighten slightly this year, except in euro IG (which is likely to suffer as markets start to factor in the prospect of ECB tapering) and possibly US HY (which, with lower default rates and higher commodity prices already priced in, would likely require a major US fiscal stimulus to justify another leg of spread tightening).

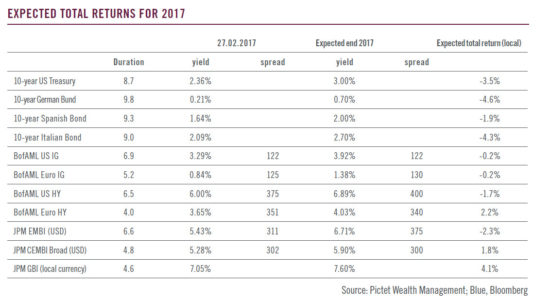

Due to the expected rise in sovereign yields and a lack of significant spread tightening, total returns from IG are likely to be low in 2017. Returns should be higher in HY, making HY a better place to hide than IG for fixed-income investors at a time of rising sovereign yields. However, with valuations particularly expensive at present, and political uncertainty likely to see periodic spikes in yields this year, we think investors should wait for a rise in spreads before adding exposure to HY, especially US HY.