Strong Flash PMI surveys for April indicate that output growth is accelerating in the euro area.Euro area PMI surveys surprised to the upside in April. The composite flash PMI surged to 56.7 in April from 56.4 in March, above consensus expectations (56.4). Overall, April’s composite PMI is consistent with euro area GDP growth of 0.7% quarter over quarter (q-o-q) in Q2, up from 0.6% in Q1 and higher than our forecasts. Other national surveys and hard data have been more mixed, suggesting that...

Read More »French elections: a Le Pen win would hit euro area periphery

While our central scenario discounts the possibility of Marine Le Pen becoming president, her presence in the second round of the presidential election is likely to create considerable nervousness for investors.Our main scenario, a win for a Europhile politician in the second round of the French presidential elections in May, could result in a small relief rally on markets. However, the National Front’s Marine Le Pen is seen as being one of the two candidates to go through from the first...

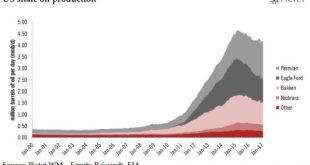

Read More »Oil industry successfully reinvents itself again

Shale oil has forced the conventional oil industry to reinvent itself. Companies have nevertheless demonstrated terrific powers of adaptation, helped by the high-tech nature of the oil industry.In a ‘lower-for-longer price’ environment, there are still attractive themes and equity stories to play, assuming prices remain broadly above USD45-50 per barrel. Valuations generally remain reasonable, especially on the back of the correction since the start of the year. The growth theme is clearly...

Read More »Monthly Investment Strategy Highlights, April 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset allocationThe first quarter was exceptionally strong for risk assets, and the outlook remains good for developed market (DM) equities.We remain comfortable with our overweight in developed market equities, but it would be wise not to take too much risk in the coming quarter.EM assets may offer attractive opportunities on a tactical basis.CurrenciesThe US dollar probably has only limited further upside, absent a...

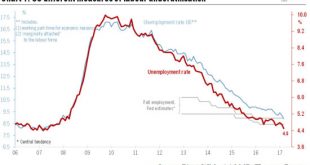

Read More »U.S. job creation slows but unemployment drops to a new record low

Job growth was strong in the first quarter as a whole, however, and latest numbers may not lead Fed to change its overall assessment of the economic outlook.Non-farm payrolls increased by 98,000 m-o-m in March, well below consensus expectations (180,000). Adverse weather conditions likely weighed on the aggregate numbers. Moreover, job creation averaged 177,000 in Q1 2017, above the Q4 average of 147,000.Importantly, the US unemployment rate fell to a new cycle low of 4.5% in March, from...

Read More »New tech city could help China’s economic transition

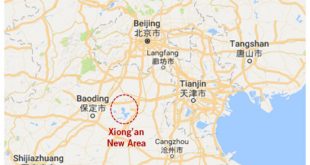

A new development zone south of Beijing could turn out to be the most important domestic infrastructure project in China in the decade to come and lead to large-scale economic change.At the beginning of April, the Chinese government caught people by surprise by unveiling plans to create the Xiong’an New Area, a new development zone about 130 kilometres south of Beijing. According to the announcement, the first phase of development will cover an area of 100 square kilometres, with long-term...

Read More »Reality check means markets face a pause

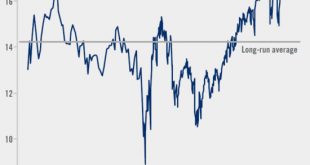

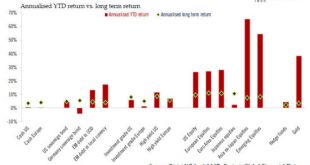

Risk assets had an exceptionally strong first quarter, but a repeat performance will require overcoming numerous obstacles.The first quarter was an exceptional one for risk assets—so exceptional that it is difficult to see how their performance can be repeated in the present quarter without some strong catalysts. According to our analysis, annualised returns on equities in the first quarter were up to three times higher than their historic average in the case of developed-market equities,...

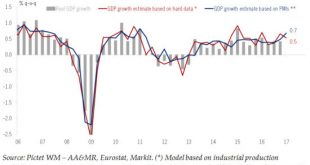

Read More »Euro area: reconciling soft and hard data

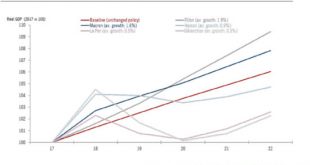

The latest confidence surveys in the euro area have been remarkably strong, adding upside risks to our GDP forecasts, but meaning that the ECB will have to tread carefully.Recent composite purchasing manager surveys for the euro area are consistent with a growth rate of about 0.7% q-o-q in Q1, above our projection of 0.4%, and are pointing to similar levels of growth in Q2. More generally, ‘soft’ survey data and ‘hard’ activity data have been diverging significantly of late, with large...

Read More »Momentum remains strong in China, but headwinds ahead

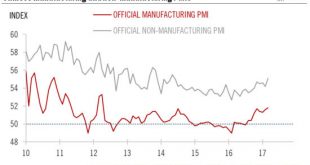

PMI data in China has continued to move higher, meaning the near-term outlook is strong, but tighter controls on the property sector and on monetary policy point to a slowdown in the second half.The official PMI figures for manufacturing and nonmanufacturing rose again in March, extending a rebound that has been evident since early 2016. Sub-indices also remain on a solid upward trend, with the production and new order sub-indices reaching their highest levels since mid-2014 and the new...

Read More »Drop in euro area inflation amplified by statistical distortions

Euro area headline inflation declined by a larger margin than expected. Our main explanation is related to statistical effects.Euro area headline inflation declined for the first time in almost a year, by a larger margin than expected by the consensus. Headline HICP eased to 1.5% in March, from 2.0% in February, while core HICP inflation (excluding energy, food, alcohol and tobacco) dropped to a two-year low of 0.67% y-o-y, from 0.86% in February. The harmonised inflation rate dropped by...

Read More » Perspectives Pictet

Perspectives Pictet