Today’s topic is the millennial generation and how financial repression has resulted in asset bubbles that ultimately have affected the millennials in terms of their values and how they view the economy and life. As well as what they’re facing in terms of the housing market and the job situation. Click here for the full summary with all the supporting graphs/charts: http://financialrepressionauthority.com/2017/05/13/charles-hugh-smith-millennial-housing-summary/

Read More »FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

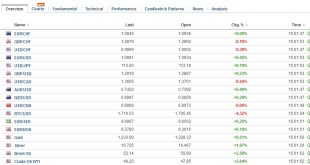

Swiss Franc EUR/CHF - Euro Swiss Franc, May 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday’s activity. It appeared to have been trying to stabilize yesterday in the North American session. News that President Trump may have shared...

Read More »Swiss awarded stolen tax CD payment

Switzerland will receive most of the money paid by the German state of North Rhine-Westphalia (NRW) to a man who provided the state with stolen Credit Suisse client data, it has been confirmed. The CDs of stolen data and now the spy affair have tested German-Swiss relations - Click to enlarge NRW’s finance ministry paid €2.5 million (CHF2.7 million) in February 2010 for the CD, which contained tax details of Credit...

Read More »Weekly SNB Interventions and Speculative Positions: SNB interventions are rising again

Headlines Week May 15, 2017 The pro-European politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, more investment, more jobs. As opposed to Hollande, he also advocates limitations on salaries and less social protection for workers, to restore France’s competitiveness. Mostly probably he will fail – similar to his predecessor...

Read More »Inflation Is Oil, But Inflation Is Much More Than Consumer Prices

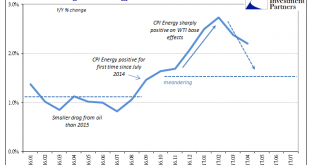

The average annual change in the WTI benchmark price was in April about 25%. That was still a sizable increase year-over-year, and just marginally less than March’s average of 33%. For calculated inflation rates, it represents the last of the base effects that have to this point made it appear as if economic improvement was possibly serious. CPI Changes On Energy, January 2016 - May 2017 - Click to enlarge Combined...

Read More »A Bumper Under that Silver Elevator – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Problem with Mining If you can believe the screaming headline, one of the gurus behind one of the gold newsletters is going all-in to gold, buying a million dollars of mining shares. If (1) gold is set to explode to the upside, and (2) mining shares are geared to the gold price, then he stands to get seriously...

Read More »Earnings Update – The Proof of the Pudding is in the Eating

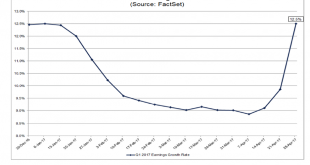

The first quarter just seemed to zoom by this year, bringing continued optimism (or, animal spirits if you prefer) to the stock market and leaving even higher valuations in its wake. The Standard & Poor’s 500 Index returned an impressive 6.07% for the quarter, on the tail of the previous five consecutive quarters of positive performance. The second quarter is now a third of the way through and, we are still...

Read More »Charles Hugh Smith: Millennials Will Change The Economy Forever

Get Immediate Access to our Exclsuive Crypto Report At: http://www.wealthresearchgroup.com/bi... Get Immediate Access To Wealth Research Group's Complete Junior Stocks Manual AT: http://www.wealthresearchgroup.com/go... Get Immediate Access to Our Exclusive Report On The New Cryptocurrency Following Bitcoin Footsteps AT: http://www.wealthresearchgroup.com/bi... Get our Full Analysis on Gold, Silver & Mining here: http://WealthResearchGroup.com/Resour... Become a Wealth Machine by...

Read More »Swiss Producer and Import Price Index in April 2017: +0.8 YoY, -0.2 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »FX Daily, May 15: Softer Dollar and Yen to Start the Week

Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in...

Read More » SNB & CHF

SNB & CHF