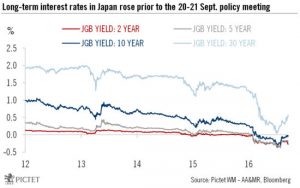

While possibly helping to alleviate margin pressure on banks, raising inflation expectations remains a difficult task The Bank of Japan (BoJ) today shifted its monetary stimulus framework towards yield-curve control and away from rigid targeting of asset purchases. In essence, the BoJ will purchase sufficient Japanese government bonds (JGBs) to ensure that 10-year JGB yields are capped at about zero. The BOJ also announced that it aims to overshoot its 2% inflation target, committing itself to monetary stimulus until the consumer price index stabilises above that target.At the same time, the shift in the BoJ’s focus from asset purchases to yield-curve control will help alleviate concerns about the sustainability of its monetary-easing programme. By explicitly controlling the yield curve, the BoJ is aiming to push the real interest rate down below real GDP growth to boost economic activity. To the extent that this helps to restore people’s confidence in the broad financial system in spite of negative interest rates, this initiative is to be welcomed.However, the BoJ still faces an uphill battle to lift inflation expectations and boost activity. Monetary policies alone may not be enough to get the job done and fiscal policies need to play a greater role in boosting growth.

Read More »