While possibly helping to alleviate margin pressure on banks, raising inflation expectations remains a difficult task The Bank of Japan (BoJ) today shifted its monetary stimulus framework towards yield-curve control and away from rigid targeting of asset purchases. In essence, the BoJ will purchase sufficient Japanese government bonds (JGBs) to ensure that 10-year JGB yields are capped at about zero. The BOJ also announced that it aims to overshoot its 2% inflation target, committing itself to monetary stimulus until the consumer price index stabilises above that target.At the same time, the shift in the BoJ's focus from asset purchases to yield-curve control will help alleviate concerns about the sustainability of its monetary-easing programme. By explicitly controlling the yield curve, the BoJ is aiming to push the real interest rate down below real GDP growth to boost economic activity. To the extent that this helps to restore people's confidence in the broad financial system in spite of negative interest rates, this initiative is to be welcomed.However, the BoJ still faces an uphill battle to lift inflation expectations and boost activity. Monetary policies alone may not be enough to get the job done and fiscal policies need to play a greater role in boosting growth.

Topics:

Dong Chen and Luc Luyet and Jacques Henry considers the following as important: Bank of Japan, Japanese monetary policy, Macroview, quantative easing, yield curve controls

This could be interesting, too:

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Higher Yields Help Extend the Dollar’s Gains

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

While possibly helping to alleviate margin pressure on banks, raising inflation expectations remains a difficult task

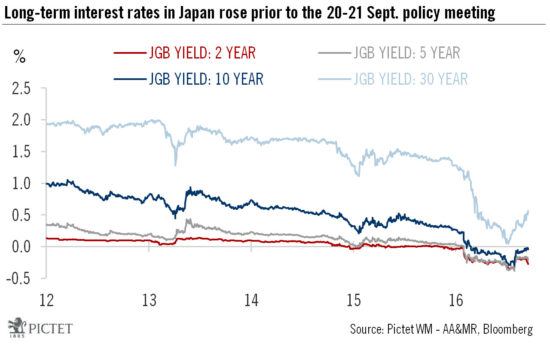

The Bank of Japan (BoJ) today shifted its monetary stimulus framework towards yield-curve control and away from rigid targeting of asset purchases. In essence, the BoJ will purchase sufficient Japanese government bonds (JGBs) to ensure that 10-year JGB yields are capped at about zero. The BOJ also announced that it aims to overshoot its 2% inflation target, committing itself to monetary stimulus until the consumer price index stabilises above that target.

At the same time, the shift in the BoJ's focus from asset purchases to yield-curve control will help alleviate concerns about the sustainability of its monetary-easing programme. By explicitly controlling the yield curve, the BoJ is aiming to push the real interest rate down below real GDP growth to boost economic activity. To the extent that this helps to restore people's confidence in the broad financial system in spite of negative interest rates, this initiative is to be welcomed.

However, the BoJ still faces an uphill battle to lift inflation expectations and boost activity. Monetary policies alone may not be enough to get the job done and fiscal policies need to play a greater role in boosting growth. Given the Japanese government’s constrained fiscal capacity, any significant expansion of its budget probably isn’t feasible without the co-operation of the BoJ. In our view, this means so-called 'helicopter money' (or some variant of it) cannot be totally excluded in the future, although BoJ governor Haruhiko Kuroda rejected such an idea in a speech earlier this month. Ultimately, the solutions to Japan's economic problems lie in structural reforms that enhance potential growth. Otherwise, it's hard to be convinced that Japan can leave behind its current economic woes once and for all.

The renewed focus on real interest rates, and concern about the health of the banking sector, should favour a weaker yen. However, although the BoJ’s new framework seems, in theory, well suited to boost inflation expectations and curb upward pressures on the Japanese yen, much of the actual impact remains highly uncertain. Lifting expectations is a hard and long process and many of the factors that go into expectations are outside the BoJ’s reach. All in all, the Japanese yen can be expected to remain strong in the months ahead, especially as observed inflation will continue to weigh on inflation expectations. Consequently, the upside potential for the US dollar against the JPY would seem to be limited.