Summary:

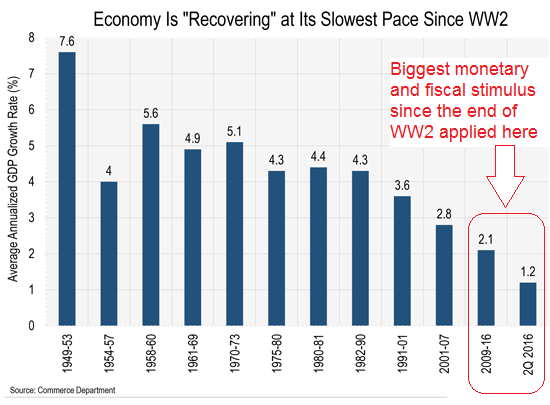

Lies and Distortions Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites. Economy is “Recovering” at its Slowest Pace Since WW2 A comparison of average annual GDP growth in different time periods since 1949. The last bar shows Q2 2016, the one before it the time period 2009 – 2016. In this time period, the by far biggest fiscal and monetary stimulus of the entire post WW2 era was applied. Obviously, it hasn’t worked as advertised. Growth wasn’t so weak in spite of, but because of these policies (keep in mind that “measuring” aggregate growth in an inflationary system is even more flawed than it would otherwise be). Yet, despite the utter failure of the current money and banking paradigm to resolve the situation, the chance of a return to a commodity based monetary order is highly unlikely especially when one looks at the anti-gold bias found in typical college economics textbooks. Macroeconomics: Principles, Problems and Policies by McConnell, Brue and Flynn is a leading introductory level college text which has been through, to date, some 20 editions.

Topics:

Antonius Aquinas considers the following as important: Central Banks, Featured, Gold Standard, newslettersent

This could be interesting, too:

Lies and Distortions Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites. Economy is “Recovering” at its Slowest Pace Since WW2 A comparison of average annual GDP growth in different time periods since 1949. The last bar shows Q2 2016, the one before it the time period 2009 – 2016. In this time period, the by far biggest fiscal and monetary stimulus of the entire post WW2 era was applied. Obviously, it hasn’t worked as advertised. Growth wasn’t so weak in spite of, but because of these policies (keep in mind that “measuring” aggregate growth in an inflationary system is even more flawed than it would otherwise be). Yet, despite the utter failure of the current money and banking paradigm to resolve the situation, the chance of a return to a commodity based monetary order is highly unlikely especially when one looks at the anti-gold bias found in typical college economics textbooks. Macroeconomics: Principles, Problems and Policies by McConnell, Brue and Flynn is a leading introductory level college text which has been through, to date, some 20 editions.

Topics:

Antonius Aquinas considers the following as important: Central Banks, Featured, Gold Standard, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Chart by: Casey Research

Chart and image captions by PT